One of my former bosses was fond of saying that the difference between perception and reality was the reason that many people lost money trading in stocks and shares, and to be fair to him he was often right.

Thinking that something is true, and, or expecting a narrative to play out, based solely on those beliefs can be an expensive mistake.

Weight of numbers ,or the flow of funds tends to drive stock prices (not fervent beliefs)

Those are forces that can be boiled down to supply and demand, and when one exceeds the other, we come to a tipping point in the price of an instrument.

And it's then that prices move significantly.

Balancing act

Imagine a See-saw in a children's playground, at one end sits supply at the other demand.

If, as in the image below, demand (buyers) outweigh supply then the price of an instrument will rise.

If the opposite is true and supply (sellers) dominates demand, then the price will fall.

In both cases the price will move until it finds a new equilibrium, which simply means the point at which buyers and sellers, or supply and demand, are in balance once more.

Sometimes the narrative can be very compelling and in these circumstances it can be easy to get caught up in it.

For example the idea that US consumers are struggling.

Something that the ever readable Bespoke Research have recently looked at.

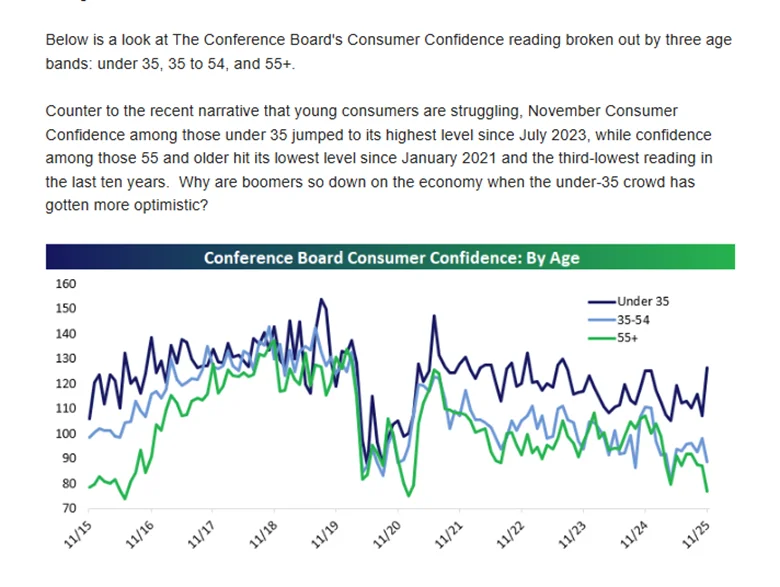

Starting with this chart, that tracks US Consumer Confidence by demographic cohorts.

Source: Bespoke Research

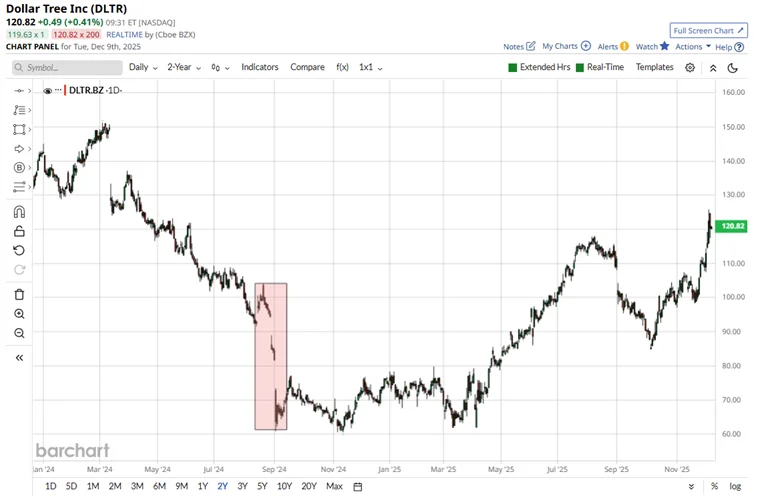

The idea that consumers, or certain cohorts of US consumers, were struggling may have taken hold in September last year. When the share price of discount stores, Dollar General DG US and Dollar Tree, slumped see below.

Source: Barchart.com

Source: Barchart.com

Reuters had this to say about the situation:

“Sept 4 2024 (Reuters) - Dollar Tree (DLTR.O), opens new tab joined main rival Dollar General (DG.N), opens new tab in cutting annual forecasts after missing quarterly estimates on Wednesday as the discount store operator struggles to attract price-sensitive shoppers amid rising competition.

Shares of the company, which have lost nearly half of its value so far this year, were last down about 20% after touching an over four-year low of $64.04.”

And that:

“Customers are expanding their consumption (on low-margin essentials) while contracting their spending on discretionary items because of macro belt-tightening," said Davis on a post-earnings call.

Last week, rival Dollar General's shares also slumped nearly 30% as low-income households feel more pressure about spending on discretionary items.”

Hard to shift

Once a concept like this is embedded in traders' psyches, it’s hard to shift it, even if, later on the data is saying something different.

That's a point that Bespoke Research makes quite forcefully, using the share price performance of Walmart WMT US as a metaphor.

In the chart below, which plots the percentage change in the Walmart share price from mid-September 2024 to the current day, we can see that Walmart stock has rallied by more than +40.0% and a good chunk of those gains have been delivered in recent weeks.

Source: Barchart.com

Bespoke makes the very valid point that Walmart stock price is unlikely to be spiking if the US consumer is struggling, as we enter the key holiday shopping season in the USA.

Regular readers may recall that I wrote about Walmart, back on September 12th 2024 see this link the Future of retail analysis

The article was something of a love letter to Walmart, however, its conclusions were correct.

Walmart has out performed, in fact, over the period from mid-September 2024 it gained almost +50.0% more than the wider S&P 500 index.

WMT US +41.31% S&P 500 SPX +21.60%

Trade without the narrative

Now, there is a way that we can avoid falling into the trap of following false, or inaccurate narrative.

And that is to trade the price action, because the price action reflects the relationship between supply and demand, and the sentiment in the market, towards a stock, sector or index.

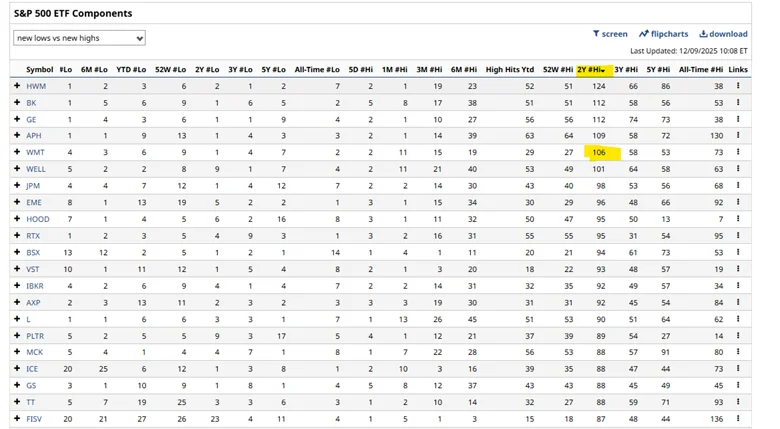

Here we see the table that tracks the number of new highs made by Walmart over specific time frames.

I have highlighted two year time frame during which time Walmart has posted 106 new highs

Source: Barchart.com

To put that into context here is a look at the S&P 500 components, ranked by the number of 2-year highs they have posted, shown in descending order.

You can see that Walmart was only beaten by four other stocks on this metric, and it was one of only six S&P 500 constituents, to post more than 100 new two year highs.

Source: Barchart.com

There is always room for nuance

If you can identify a persistent, and ongoing trend, like the one shown above in Walmart, then you are on to a winner.

You can ignore the narrative noise and focus solely on the price action.

The reality is you probably wouldn’t have stayed in Walmart for the whole 15 month period.

But then trading is about reading the room and the situation in front of you.

And when trend changes, as it did Walmart late in 2024/early 2025, then it's not wrong to change your stance.

However there is nothing to stop revisiting a postion if and when the price action tells you that the trend is being reinstated. See April 2025 in the Walmart price chart above.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.