As a trader you can often spend a good deal of time looking for, or trying to work out, what the current market regime is, and what narratives that drive it are.

Some times however, the market does the thinking for you and when it does it can be joined up thinking too.

November- Fireworks and Thanks Giving

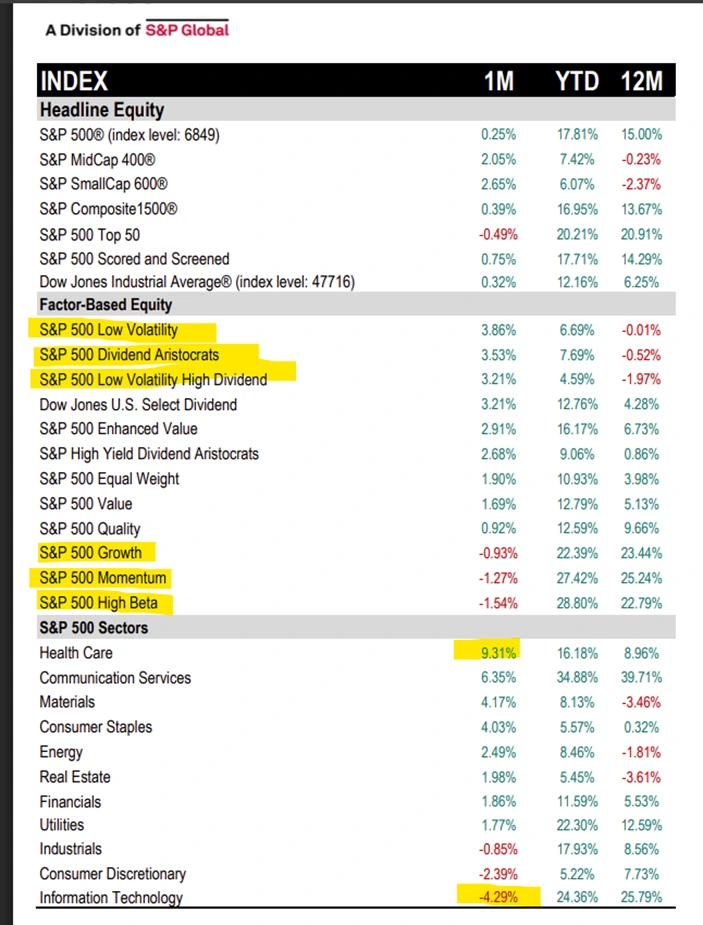

During November there was a distinct undertone of Risk-off, as we can see in this table from S&P DJI.

Healthcare stocks were the best performer in November up by +9.31%, while the Information Technology sector fell by -4.29% in the same period.

Though it's worth noting that Communication Services added +6.35%, largely thanks to the performance of Alphabet, the parent company of Google.

Source: S&P DJI

Defensive styles or factors were also back in favour last month, with the top 3 performers in the US being Low Volatility, the Dividend Aristocrats, alongside the hybrid, Low Volatility/High Dividend factor.

All of which returned more than +3.0% a piece, in the 11th month of the year .

Perhaps the biggest risk off indicator however, was bitcoin, which underwent a dramatic price slump, falling by as much as -25.0% peak to trough before staging a bounce.

Source: Trading Economics

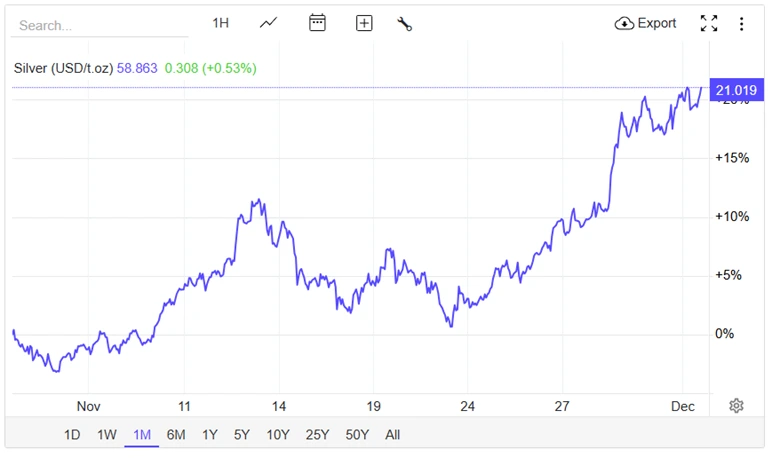

Whilst silver moved in the opposite direction to Bitcoin, breaking through resistance at $50.0 per ounce and trading significantly higher thereafter.

Source: Trading Economics

December looks to be a different month

No sooner had December started however, than some of those narratives started to come undone.

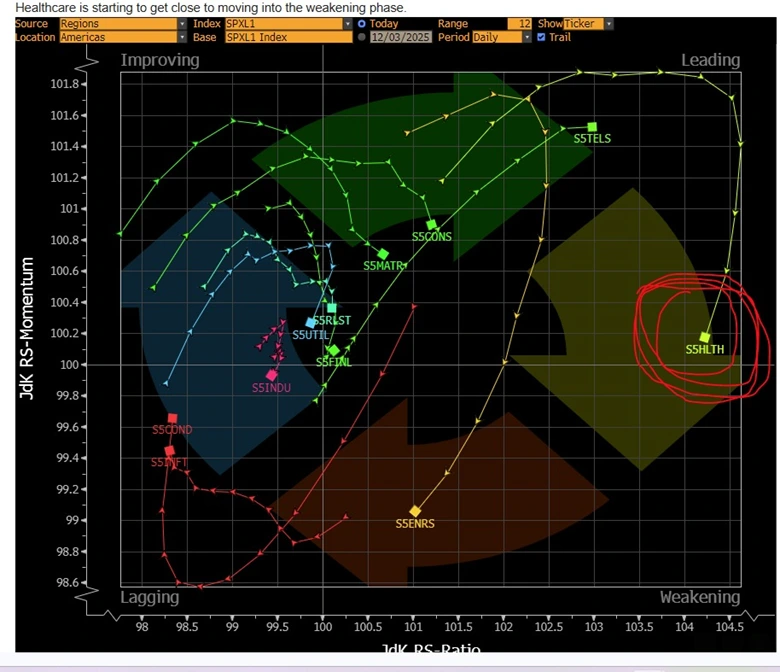

For example the S&P 500 Healthcare sector is moving towards, the bottom right hand quadrant, in the chart below. That’s the area that indicates price weakness.

Source: Wells Fargo Research

At the same time XLV, the S&P 500 Healthcare ETF, is close to posting a negative signal on the MACD indicator.

When it’s posted that signal in the recent past, it has been the precursor to a sell-off in the ETFs price.

Source: Wells Fargo Research

Christmas and New Year stories

If we are looking for themes and narratives to take us through December and into the New Year then the data centre story could be one to pay attention too.

However, in this instance, not necessarily through the chip stocks. But instead, through the effects that the unprecedented level of spending and construction in the sector could have, on associated markets such as copper and power.

The Financial Times featured a long form article on the copper market this week, in which it highlighted increasing demand for the orange metal, and contrasted that, with a lack of sizable new deposits, or at least very few that are in development.

The quotes below give a flavour of the article:

“BHP, the world’s biggest mining group by market value and a shareholder in Resolution, estimated in January that the amount of copper used in data centres worldwide will grow “sixfold by 2050”

“The International Energy Agency said this year that by 2035, production from existing and planned mines was on track to meet only 70 per cent of global demand.”

“Analysts are expecting shortfalls as soon as this year, with consultancy Wood Mackenzie forecasting a 304,000-tonne shortfall of refined copper in 2025, a gap it says will widen in 2026.”

Source: The FT- The hunt for copper to wire the AI boom

Other demands

What's more there are additional sources of demand for copper, other than data centres.

Increased defence spending for one; the world's militaries are significant consumers of copper it seems but that demand stays very much in the shadows.

At the same time, national power grids are being upgraded.

For example, here in the UK an investment of £28.0 billion for grid improvements has just been approved by regulators. The majority of which will be spent on improving electricity transmission.

It’s not impossible that a bidding war, for scarce copper supplies, could develop between these groups who are all keen to ensure their needs are met

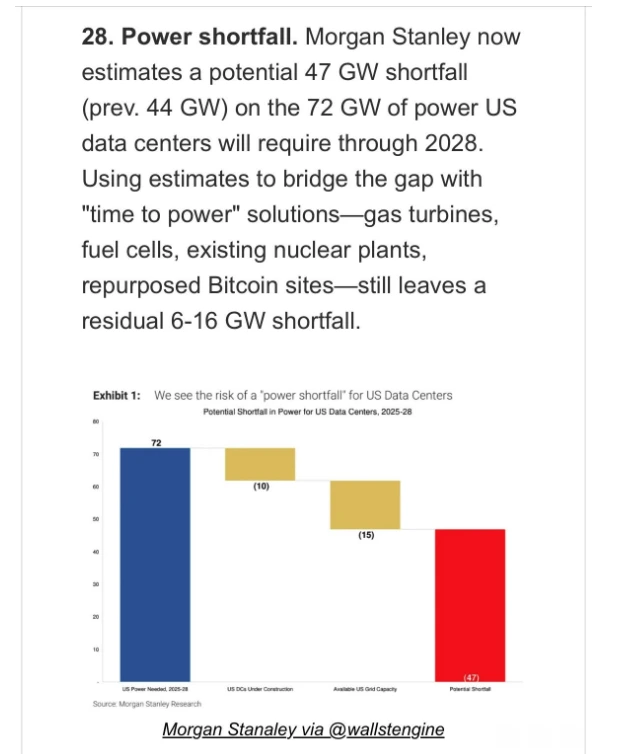

That leads the US onto the demand for power and potential shortfall therein.

As you can see below the shortfall could be significant.

With Morgan Stanley suggesting that more than half of the power/generating capacity required to operate US data centres out to 2028, does not exist right now.

And that means that data centre owners and operators will need to look at solutions other than US power grids for their electricity.

Source: Morgan Stanley

Turbine and engine manufacturers, fuel cell providers and re-conditioned nuclear plants, are all possible sources of power for the data centres.

However, there are likely to be tradeoffs in terms of scale, availability and lead times. across all of the alternatives.

Datacentre fit-out could also provide opportunities

Indeed JP Morgan upgraded Schneider Electric in France (ticker SU FP) today. The upgrade is driven largely by power generation, grid and data centre capex. The bank’s target price for the stock is €285.00 versus the €236.60 they are currently trading at.

It's interesting to note that Schneider Electric shares gapped higher on the open after the upgrade and have rallied by +3.0% so far today.

That suggests that the market is prepared to listen to and get behind the narratives in these sectors.

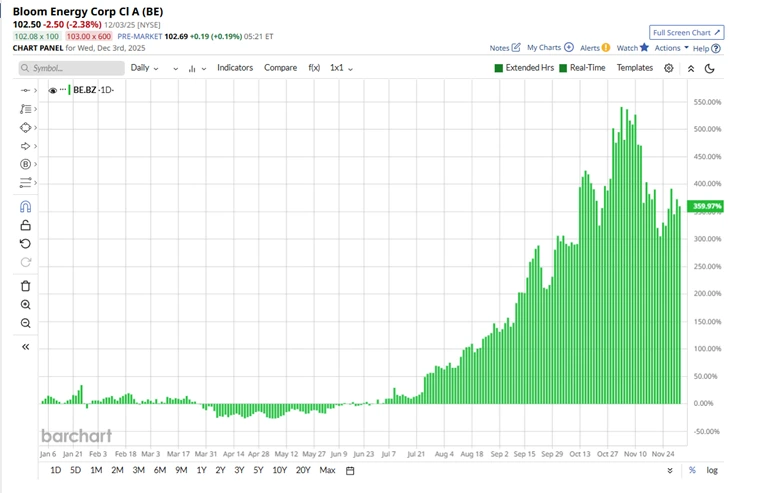

The chart of hydrogen fuel cell maker Bloom Energy BE US shows us what can happen in the right circumstances, when the market gets behind a narrative or story.

Source: Barchart.com

Bloom Energy’s stock is up by almost +360.0% year to date, at the time of writing.

Most of those gains have come since the summer, with the all time high in the stock, being hit in early November, when its year to date gains touched an eye popping +540.0%.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.