In recent articles, I have commented on the health of the US consumer and the differing fortunes of some of the retailers who service them.

In some senses, retailing is the front line of the US economy, after all, as I recently highlighted personal consumption and expenditure accounts for close to 70.0% of US GDP.

It’s probably no surprise to learn that the company which services the most US consumers, Walmart WMT US, is also the world's biggest retailer, with a market cap of more than $620.0 billion.

Walmart's annual sales are over $648.0 billion and it employs 2.10 million people, in more than 10,600 stores.

Outperforming in many senses

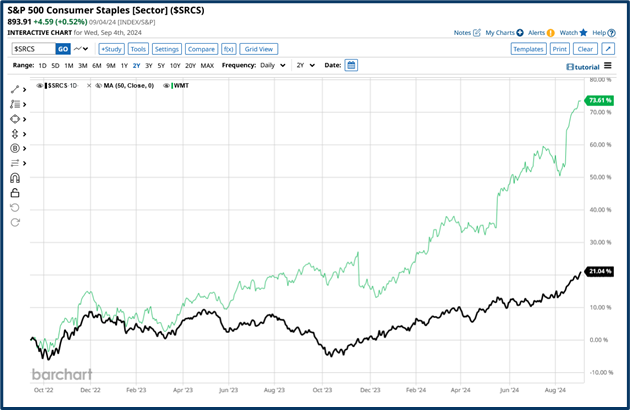

Walmart stock performance has trounced its peers in the Consumer Staples sector over the last two years, rallying by more than +73.60%, compared to the +21.04% return generated by the sector index.

Source: Barchart.com

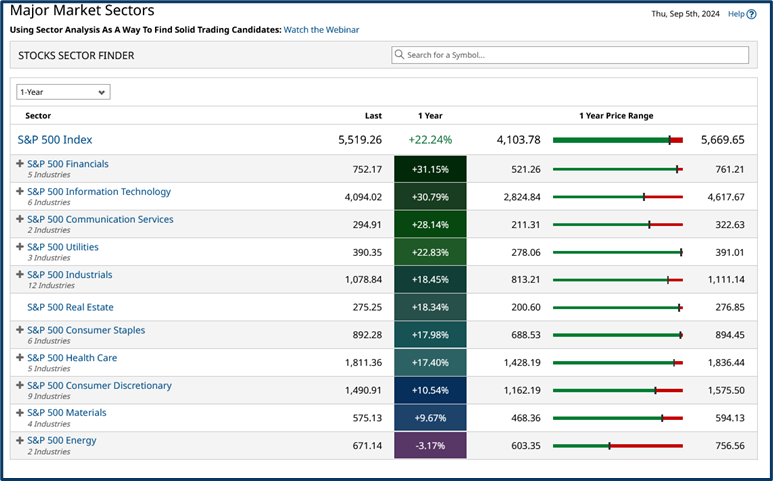

In fact, Walmart hasn’t just outperformed other retailers it’s outperformed pretty much any other sector as well.

Over the last 12 months, Walmart stock has risen by +41.0%.

Compare that figure to those in the table below, which tracks the performance of all S&P 500 sectors over the last 12 months.

'

'

Source: Barchart.com

In recent weeks, Walmart’s defensive properties have also come into play as the wider equity market underwent a series of what we might politely call “wobbles”.

The percentage change in Walmart over the last three weeks is drawn in red, and is overlaid on the chart of the S&P 500 - During this time frame the grocer outperformed the index by almost +8.00%.

Source: Barchart.com

Category Killer

There is no doubt that Walmart is the “ category killer” among US retailers and that it’s extremely efficient at what it does, The question of course is can the business continue to grow? And increase its revenues and earnings it does so.

This article isn’t meant to be a love-letter to Walmart, though you have to admire what’s been achieved by the company in the last 50 years, and the wealth that it has generated, and continues to generate to this day. Wealth that seems far more tangible to me the paper gains of Elon Musk and co.

Rather, in this piece I wanted to look at how even a business of Walmart’s size can continue to innovate and what the future looks like.

Future Opportunities

Walmart recently hosted a summit and a series of meetings with brokers and banks at which it highlighted its marketplace logistics and fulfilment capabilities.

Walmart's marketplace operates as a market for third-party sellers and Walmart’s own product lines.

E-commerce at the business already turns over more than $100 billion per annum.

And in the US this business has experienced 6 straight quarters of double-digit growth according to research from Goldman Sachs.

In the last financial year, there was a +20% increase in the number of sellers listing items on the Walmart website, there is also a growing interest in selling pre-owned, vintage and collectable items on the site.

The uptick in third-party sellers has the potential to create additional revenue streams from “marketplace fees, advertising income, fulfilment services, and data monetization”.

Interesting but not revolutionary I hear you say.

The role of AI

However, the story gets much more interesting when you consider the potential impact of AI on Walmart.

Investment bank Jefferies believes that the technology can be applied in three main areas:

- Ways of working (labour efficiencies in store and at HQ)

- Supply chain automation/efficiency

- Customer-facing initiatives such as hyper-personalised offers and AI-driven search

Jefferies thinks that AI could help to generate an additional $20 billion in income by 2029 alongside another $7.0bln in savings.

Advertising revenue from marketplace could generate a further $10.30 billion revenues by 2029.

Walmart has set itself a target of adding $130.0 billion in turnover over the next 5-years, without growing its headcount.

Whilst upskilling its workforce and their job roles, at the same time. AI will play a crucial role in these initiatives.

This is where the real promise of AI lies, not in image generation, ghost-written content and other spurious uses.

The numbers mentioned above are not earth-shattering, especially by Walmart’s standards.

However, they are likely to be incremental and ongoing.

Nor are these changes going to happen overnight the five-year time scale is realistic even conservative.

Above all, Walmart is a volume business, one in which small cost savings and efficiencies can be quickly magnified to meaningful sums.

And, as the group deploys AI, it seems likely it will identify other areas, within its operations that can benefit from it.

It will be a fascinating test case and one that will be closely watched by investors and businesses alike.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.