Weekly Outlook

What Happened This Week?

United States

● On January 3, the U.S. carried out military strikes in Venezuela and captured President Nicolás Maduro and his wife, triggering heavy trading in defense and energy stocks.

● Several U.S. equity benchmarks continued to rally, with the Dow Jones and S&P 500 reaching fresh record highs.

● Job openings fell to 7.1 million in November from nearly 7.5 million in October, according to JOLTS, pointing to a gradual cooling in the labor market.

● Private-sector hiring turned positive in December, with 41,000 jobs added after a loss of 29,000 in November. However, average monthly job creation slowed to about 22,000 in recent months, down sharply from earlier in 2025.

● Weekly initial jobless claims remained low at 208,000 in the week through January 3, suggesting layoffs are still limited.

● Wholesale inventories rose by 0.2% in October, slowing from a 0.5% increase in September, indicating softer momentum in goods demand.

Europe and Eurozone

● Major European indices, including the DAX, IBEX and FTSE MIB, hit new highs, supported by global risk appetite.

● Eurozone business confidence slipped after four months of improvement, reflecting weaker momentum in services and manufacturing.

● The eurozone unemployment rate edged down to 6.3% in November from 6.4%, its first decline since April, showing the labor market remains resilient despite weak growth.

● National inflation eased across key economies, reinforcing the ECB’s view that policy is in a “good place.” German inflation slowed to 2.0% in December from 2.6%, while French inflation eased to 0.7%.

● The ECB kept its deposit rate at 2% in December and expects eurozone inflation to slow to around 1.9% this year.

Germany

● The unemployment rate held steady at 6.3% in December, unchanged since March, even as economic momentum weakens.

● The Bundesbank expects unemployment to gradually decline from 2026 onward, reaching 5.4% by 2028.

● Factory orders jumped 5.6% in November, far above expectations, as easing tariff pressures lifted demand for metal products and transport equipment.

Switzerland

● Inflation ticked up to 0.1% in December from 0.0% in November, the first increase in five months.

● The modest rise in prices eased pressure on the Swiss National Bank to cut rates below zero, after it held its policy rate at 0% in December.

China

● Consumer inflation rose to 0.8% year over year in December, the highest since March 2023, mainly driven by food prices.

● Producer prices fell 1.9% from a year earlier, extending more than three years of deflation at the factory gate.

● Economists warn that without stronger demand-side support, overcapacity and deflationary pressures are likely to persist.

Asia-Pacific

● Several Asian equity benchmarks, including Japan’s Nikkei 225, South Korea’s Kospi and Singapore’s STI, reached new highs.

● In Australia, inflation continued to cool, with CPI rising 3.4% year over year in November, down from 3.8% in October, easing some pressure on policymakers.

This Week’s Market Movers

Forex

● The USD/RUB is up more than 2.45%.

● The USD/CZK is up more than 1.50%.

● The AUD/CAD and the AUD/CHF are up more than 1.30%.

● The USD/CAD is up more than 1.10%.

● The USD/BRL is down more than 1.60%.

● The CHF/NOK is down more than 1.14%.

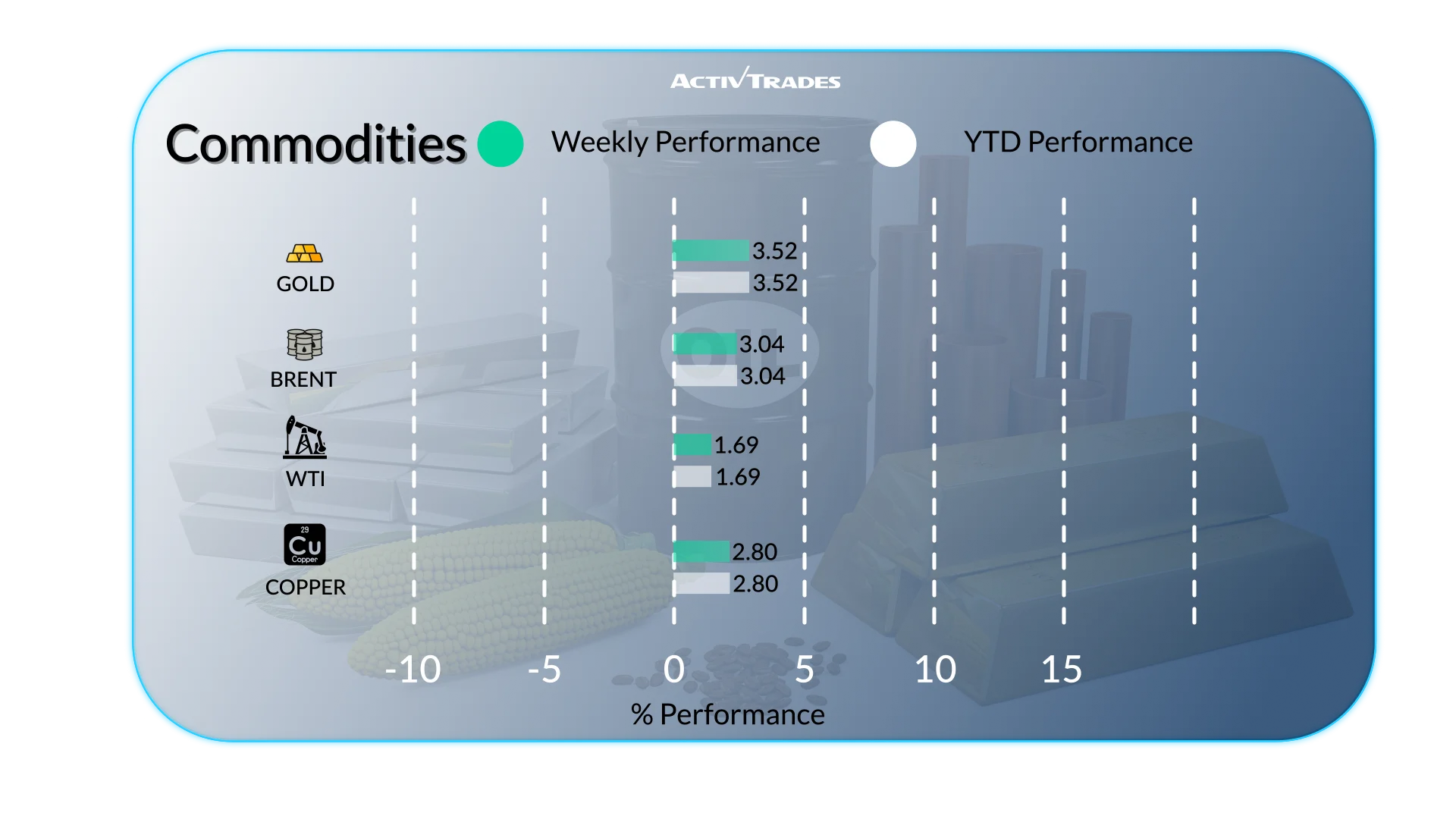

Commodities

● Orange Juice prices are up more than 10%.

● Silver prices reached new highs above $83.

● Copper prices reached new highs above $6 per pound.

● Platinum prices are up more than 7%.

● Brent prices are up more than 2.5%.

● Natural Gas prices are down more than 10%.

Indices

● The KOSPI index is up more than 8.50%.

● The BIST 100 index is up more than 7.70%.

● The VIX index is up more than 4%.

● The Nikkei 225 index is up more than 3.20%.

● The STOXX 50 index is up more than 2.70%.

● The DAX 40 index is up more than 2.55%.

● The CAC 40 index is up more than 2%.

Shares

Tops

● Sandisk: +38.57%

● Rheinmetall: +20.77%

● BAE Systems: +17.89%

● Badcock International: +16.56%

● Thales: +16.37%

● Valero Energy: +16.05%

● Lam Research: +15.17%

● Microchip Technology: +13.86%

● Cogna Educacao: +12.74%

● Infineon Technologies: +10.92%

● Rolls-Royce: +10.46%

Flops

● Versant Media: -25.42%

● Cyrela Brazil Realty: -15.81%

● Associated British Foods: -13.35%

● Applovin: -11.13%

● NRG Energy: -10.76%

Important Events to Follow

Monday 12 January

● 11:30 PM - Australian Westpac Consumer Confidence Change (January)

○ Previous: -9%

○ Forecast: 2.6%

Tuesday 13 January

● 01:30 AM - American Core Inflation Rate YoY (December)

○ Previous: 2.6%

○ Forecast: 2.6%

● 01:30 PM - American Inflation Rate YoY (December)

○ Previous: 2.7%

○ Forecast: 2.6%

Wednesday 14 January

● 03:00 AM - Chinese Balance of Trade (December)

○ Previous: $111.68B

○ Forecast: $ 105B

● 03:00 AM - Chinese Exports YoY (December)

○ Previous: 5.9%

● 03:00 AM - Chinese Imports YoY (December)

○ Previous: 1.9%

● 01:30 PM - American PPI MoM (October)

○ Previous: 0.3%

○ Forecast: 0.3%

● 01:30 PM - American PPI MoM (November)

○ Forecast: 0.2%

● 01:30 PM - American Retail Sales MoM (November)

○ Previous: 0%

○ Forecast: 0.3%

● 03:00 PM - American Existing Home Sales (December)

○ Previous: 4.13M

○ Forecast: 4.06M

Thursday 15 December

● 07:00 AM - UK GDP MoM (November)

○ Previous: -0.1%

○ Forecast: -0.1%

● 09:00 AM - German Full Year GDP Growth (2026)

○ Previous: -0.2%

○ Forecast: 0.2%

Major Earnings Reports to Watch

Tuesday 13 January

● Bank of New York Mellon

● JPMORGAN CHASE

● Delta Air Lines

Wednesday 14 January

● Citigroup

● Wells Fargo

● Bank of America

Thursday 15 December

● Blackrock

● GOLDMAN SACHS

● Morgan Stanley

Source: The Wall Street Journal, Trading Economics, Reuters, TradingView and ActivTrades’ Data as of 9 January 2026

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.