Weekly Outlook

What Happened This Week?

United States

● Existing home sales dropped 8.4% in January, the biggest monthly fall since February 2022, as freezing weather, high prices and low confidence weighed on demand. Economists had expected a smaller 4.6% decline.

● Revised labor data showed the economy added 1.5 million jobs in 2024, down from a previous estimate of 2 million. For 2025, job gains were revised to 181,000 from 584,000, signaling a much weaker hiring trend than first reported.

● In contrast, January payrolls rose by 130,000 and the unemployment rate fell to 4.3%, marking the strongest monthly gain in over a year and complicating expectations for rate cuts.

● Weekly jobless claims fell to 227,000 from 232,000, pointing to continued labor-market resilience.

● Retail sales were flat in December, missing expectations. For 2025 overall, sales rose 3.7%, but weakness in autos, furniture and electronics highlighted fragile consumer momentum.

● Small-business confidence declined in January, with seven out of ten components falling. Inflation, labor quality and insurance costs were key concerns, though sales expectations improved.

● Several Fed officials signaled little urgency to cut rates. Cleveland Fed President Beth Hammack said policy could stay on hold for some time. Dallas Fed President Lorie Logan described the current rate range as appropriate. Kansas City Fed President Jeffrey Schmid pushed back on easing, citing inflation risks.

● Fed Governor Stephen Miran argued there is still a case for rate cuts and said the dollar would need a “really big move” to materially affect inflation. He also emphasized the importance of central bank independence.

● The Trump administration completed a reciprocal trade agreement with Taiwan, setting a 15% U.S. tariff on Taiwanese imports while Taiwan agreed to lower or eliminate duties on nearly all American products.

Eurozone

● Inflation fell to 1.7% in January, its lowest level since April 2021 and below the ECB’s 2% target.

● ECB projections show inflation at 1.9% in 2026, 1.8% in 2027 and returning to 2.0% in 2028, suggesting only a temporary dip below target.

● Bundesbank President Joachim Nagel said a short-lived drop below target would not automatically trigger rate cuts.

France

● François Villeroy de Galhau will leave his role as Governor of the Bank of France in June, departing over a year before his mandate was due to expire in October 2027.

● His departure comes amid broader leadership changes at the ECB, including the upcoming end of Vice President Luis de Guindos’s term and President Christine Lagarde’s mandate in 2027.

Canada

● Bank of Canada minutes highlighted rising risks from a U.S.-led review of the North American trade agreement.

● The central bank kept its benchmark rate unchanged at 2.25% on January 28, with policymakers agreeing that holding rates depends on the economy evolving as expected.

Australia

● Deputy Governor signaled the Reserve Bank of Australia will “do whatever it takes” to bring inflation back within its 2%–3% target band.

● The central bank expects inflation may not fall below target until mid-2027.

● Treasurer Jim Chalmers appointed economist Bruce Preston to the RBA board for a five-year term starting March 1, as inflation pressures re-emerge.

Japan

● Bank of Japan board member Naoki Tamura said the 2% inflation target could be declared achieved as early as this spring.

● He warned inflation is becoming more persistent, driven by stronger wage-price dynamics.

This Week’s Market Movers

Forex

● The USD/NOK is down more than 2.50%.

● The USD/JPY is down more than 2.25%.

● The USD/THB is down more than 2.%.

● The EUR/JPY and the USD/ZAR are down more than 1.70%.

● The JPY/GBP is up more than 1.90%.

● The AUD/USD is up more than 1.85%.

● The JPY/CAD is up more than 1.80%.

● The AUD/HKD is up more than 1.75%.

● The CHF/TRY is up more than 1.30%.

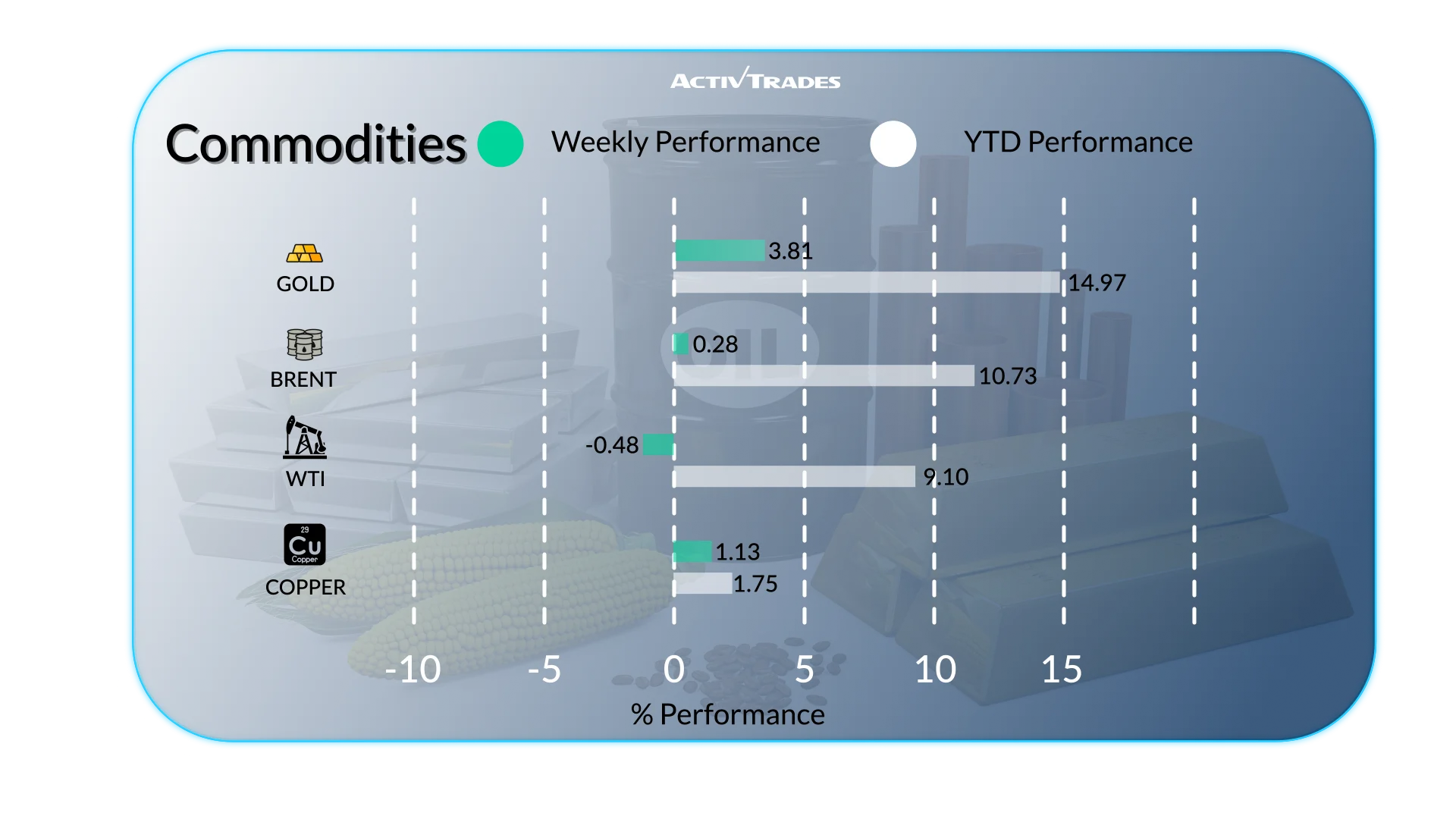

Commodities

● Orange Juices prices are down more than 24%.

● Natural gas prices are down more than 22%.

● Silver prices are down more than 11%.

● Platinum prices are down more than 8%.

● Coffee prices are down more than 6.80%.

Indices

● The KOSPI index is up more than 9.85%.

● The VIX index is up more than 8%.

● The Nikkei 225 index is up more than 6.55% to a new record high.

● The Bovespa index is up more than 3.30%.

● The CAC 40 index hit a new record high above 8,430.

● The Dow index hit another record high.

Shares

Tops

● Schroders: +27.55%

● Generac: +23.98%

● Corning: +22.27%

● Ciena: +20.74%

● MRV Engenharia e Participacoes: +20.42%

● Equinix: +19.18%

● Texas Pacific Land: +18.76%

● ARM: +16.95%

● Suzano: +16.55%

● STMicroelectronics: +14.46%

● KLA: +12.22%

● Coca-Cola: +12.00%

Flops

● Molina Healthcare: -28.26%

● Metlen Energy & Metals: -25.13%

● Stellantis: -22.99%

● Raizen: -22.09%

● Dassault Systemes: -21.63%

● Charles River Laboratories: -20.88%

● Arthur J.Gallagher & Co.: -18.79%

● CBRE: -17.46%

● St. James Place: -17.33%

● Atlassian: -17.24%

● Capgemini: -17.02%

● Doordash: -17.09%

Important Events to Follow

Tuesday 17 February

● 12:30 AM - Australian - RBA Meeting Minutes

● 07:00 AM - UK - Unemployment Rate (December)

○ Previous: 5.1%

○ Forecast: 5.1%

● 10:00 AM - German - ZEW Economic Sentiment Index (February)

○ Previous: 59.6

○ Forecast: 57

● 01:30 PM - Canadian - Inflation Rate YoY (January)

○ Previous: 2.4%

○ Forecast: 2.5%

● 11:50 PM - Japanese - Balance of Trade (January)

○ Previous: ¥105.7B

○ Forecast: ¥-2500.0B

Wednesday 18 February

● 07:00 AM - UK - Inflation Rate YoY (January)

○ Previous: 3.4%

○ Forecast: 3.0%

● 01:30 PM - American - Building Permits Prel (November)

○ Previous: 1.411M

○ Forecast: 1.36M

● 01:30 PM - American - Building Permits Prel (December)

○ Forecast: 1.31M

● 01:30 PM - American - Durable Goods Orders MoM (December)

○ Previous: 5.3%

○ Forecast: -3.4%

● 01:30 PM - American - Housing Starts (November)

○ Previous: 1.246M

○ Forecast: 1.27M

● 01:30 PM - American - Housing Starts (December)

○ Forecast: 1.29M

● 07:00 PM - American - FOMC Minutes

Thursday 19 February

● 10:00 PM - Australian - S&P Global Manufacturing PMI Flash (February)

○ Previous: 52.3

○ Forecast: 52.6

● 10:00 PM - Australian - S&P Global Services PMI Flash (February)

○ Previous: 56.3

○ Forecast: 55.5

● 11:30 PM - Japanese - Inflation Rate YoY (January)

○ Previous: 2.1%

○ Forecast: 1.9%

Friday 20 February

● 12:30 AM - Japanese - S&P Global Manufacturing PMI Flash (February)

○ Previous: 51.5

○ Forecast: 52

● 12:30 AM - Japanese - S&P Global Services PMI Flash (February)

○ Previous: 53.7

○ Forecast: 53.3

● 07:00 AM - UK - Retail Sales MoM (January)

○ Previous: 0.4%

○ Forecast: 0.3%

● 08:15 AM - French - HCOB Composite PMI Flash (February)

○ Previous: 49.1

○ Forecast: 50

● 08:15 AM - French - HCOB Manufacturing PMI Flash (February)

○ Previous: 51.2

○ Forecast: 51.6

● 08:15 AM - French - HCOB Services PMI Flash (February)

○ Previous: 48.4

○ Forecast: 49.5

● 08:30 AM - German - HCOB Manufacturing PMI Flash (February)

○ Previous: 49.1

○ Forecast: 49.8

● 08:30 AM - German - HCOB Composite PMI Flash (February)

○ Previous: 52.1

○ Forecast: 52.5

● 08:30 AM - German - HCOB Services PMI Flash (February)

○ Previous: 52.4

○ Forecast: 52.9

● 09:00 AM - European - HCOB Composite PMI Flash (February)

○ Previous: 51.3

○ Forecast: 51.7

● 09:00 AM - European - HCOB Manufacturing PMI Flash (February)

○ Previous: 49.5

○ Forecast: 50.5

● 09:00 AM - European - HCOB Services PMI Flash (February)

○ Previous: 51.6

○ Forecast: 51.9

● 09:30 AM - UK - S&P Global Manufacturing PMI Flash (February)

○ Previous: 51.8

○ Forecast: 50.9

● 09:30 AM - UK - S&P Global Services PMI Flash (February)

○ Previous: 54.0

○ Forecast: 51.6

● 01:30 PM - American - Core PCE Price Index MoM (December)

○ Previous: 0.2%

○ Forecast: 0.2%

● 01:30 PM - American - GDP Growth Rate QoQ Adv (Q4)

○ Previous: 4.4%

○ Forecast: 3.5%

● 01:30 PM - American - Personal Income MoM (December)

○ Previous: 0.3%

○ Forecast: 0.1%

● 01:30 PM - American - Personal Spending MoM (December)

○ Previous: 0.5%

○ Forecast: 0.0%

● 02:45 PM - American - S&P Global Composite PMI Flash (February)

○ Previous: 53

○ Forecast: 52.6

● 02:45 PM - American - S&P Global Manufacturing PMI Flash (February)

○ Previous: 52.4

○ Forecast: 51.8

● 02:45 PM - American - S&P Global Services PMI Flash (February)

○ Previous: 52.7

○ Forecast: 52.5

Major Earnings Reports to Watch

Tuesday 17 February

● Medtronic

● Carrefour

Wednesday 18 February

● ORANGE

● Tenaris

● LLOYDS BANKING

● GLENCORE

● Renault

● BAE SYSTEMS

● Booking

● Moncler

Thursday 19 February

● Newmont Goldcorp

● Airbus

● Repsol

● WALMART

● TechnipFMC

● Air France-KLM

● AEGON

● Pernod-Ricard

● Lagardère

● RIO TINTO

● Accor

● Nestle

Friday 20 February

● Western Union

● ANGLO AMERICAN

● Danone

● Air Liquide

● Umicore

Source: The Wall Street Journal, Trading Economics, Reuters, TradingView and ActivTrades’ Data as of February 13, 2026

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.