Weekly Outlook

What Happened This Week?

United States

- Trump threatens Iran

- Cattle herd at lowest level in 75 years; ranchers hesitant to rebuild despite record beef prices and strong demand

- Ground beef prices up 17% year-on-year in January vs +2.1% for other groceries

- Administration exploring higher imports from South America to ease beef prices

- Federal debt projected to exceed 100% of GDP later this year; publicly held debt expected to surpass $56tn by 2036

- Fed minutes show little appetite for near-term rate cuts; most officials want more inflation progress before easing

- Two officials dissented in January, favoring a rate cut instead of holding steady

- Governor Miran now sees rates below 2.75% by year-end, less aggressive than his prior <2.25% view

- Fed’s Daly says policy is “in a good place” while assessing AI’s economic impact

- Fed’s Barr wants clearer evidence that goods inflation is retreating before further cuts; warns labor market (low hiring, low firing) is vulnerable to shocks

- Fed’s Goolsbee says future cuts depend on inflation progress; core inflation running around 3.6% annualized, with sticky services prices

- Leading Economic Index fell 0.2% in December, fifth straight monthly decline, pointing to continued softness into early 2026

- Industrial production rose 0.7% in January after +0.2% in December, third consecutive monthly gain

- Durable-goods orders fell 1.4% in December after +5.4% in November

- Initial jobless claims declined to 206k (week to Feb. 14) from 229k prior week

- Homebuilder confidence fell to 36 in February from 37; future sales index at 46, buyer traffic at 22

- Housing starts rose 6.2% in December; building permits up 4.3%

- Pending home sales fell 0.8% in January to 70.9, as affordability improvements have yet to lift demand

Eurozone

- ECB President Christine Lagarde has not decided whether to complete her term ending October 2027

- Reports suggested potential early departure, but spokesperson said focus remains on mandate

- Vice President’s term ends May 2026; Chief Economist’s term ends May 2027

- Senior ECB appointments decided by eurozone governments through negotiated process, with France and Germany playing key roles

United Kingdom

- CPI inflation slowed to 3.0% y/y in January from 3.4% in December

- Bank of England expects inflation to average 2.5% in 2026, falling to 2% by April

- Policy rate held at 3.75% in early February; vote split 5–4 in favor of holding

- Jobless rate rose to 5.2% (three months to December), near five-year high; wage growth also moderating

Canada

- Inflation eased to 2.3% y/y in January

- Core inflation averaged 2.45%, slowest pace since late 2024

- Market expectations leaning toward policy rates staying on hold this year, though softer core data fuels some easing bets

Philippines

- Bangko Sentral ng Pilipinas cut its overnight reverse repo rate by 25bps to 4.25% (from 4.50%)

- Benchmark lending rate reduced to 4.75% from 5.00%

- Sixth consecutive rate cut amid slowing growth

Indonesia

- Bank Indonesia kept its 7-day reverse repo rate unchanged at 4.75%

- Ongoing pause aimed at supporting rupiah stability following September rate cut

New Zealand

- Reserve Bank of New Zealand held official cash rate at 2.25%

- Inflation, currently above the 1%–3% target band, expected to return within range this quarter

- Economy described as in early recovery phase, with elevated unemployment and cautious household spending

This Week’s Market Movers

Forex

- The USD/SEK is up more than 1.70%.

- The USD/JPY is up more than 1.65%.

- The EUR/RUB is down more than 1.75%.

- The NZD/USD is down more than 1.30%.

- The JPY/CAD is down more than 1%.

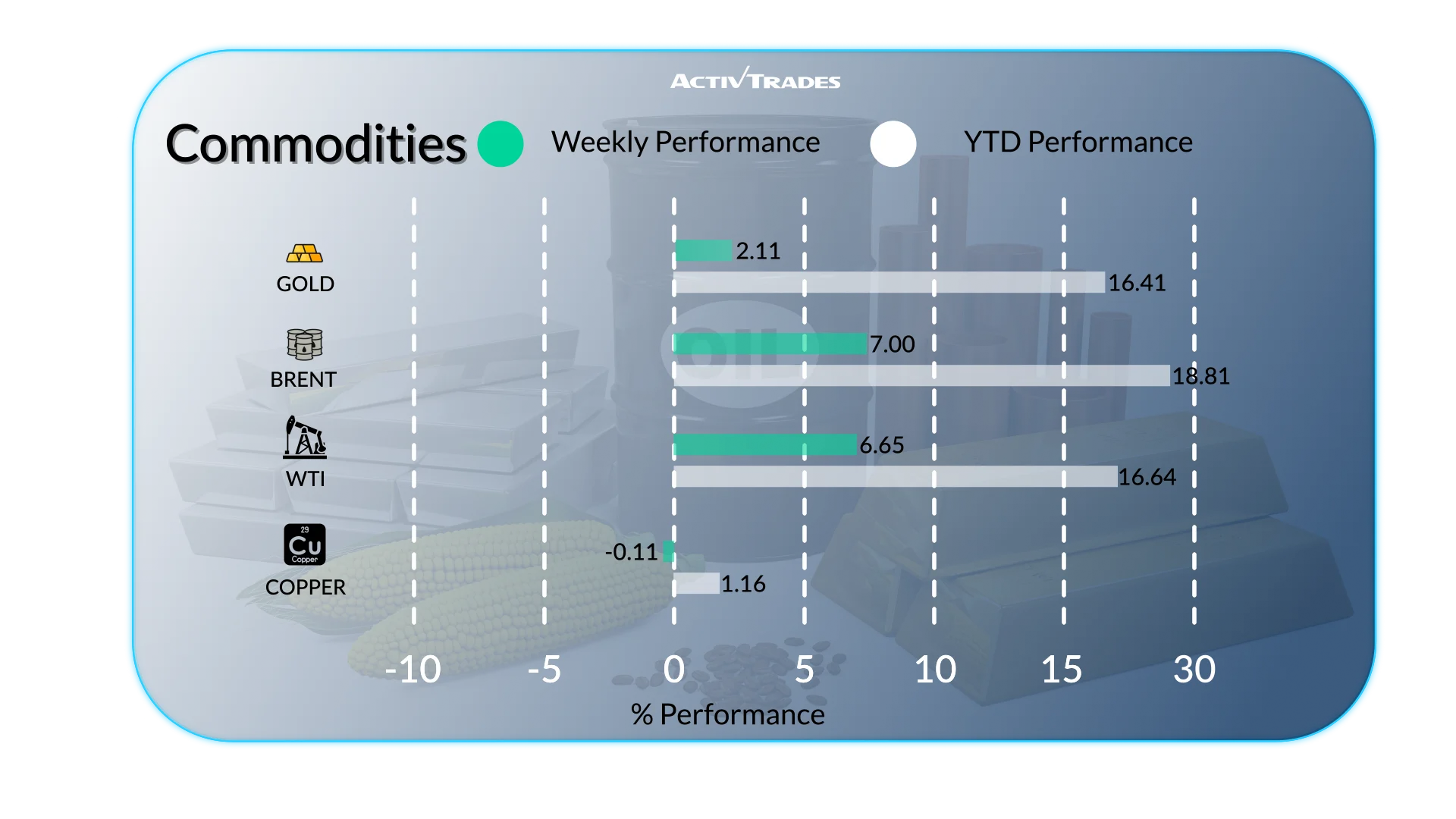

Commodities

- Diesel prices are up more than 9.80%.

- Brent prices are up more than 6.65%.

- Oats prices are up more than 5.85%.

- Soybeans Oil prices are up more than 4%.

- Cocoa prices are down more than 16%.

- Natural gas prices are down more than 5.40%.

Indices

- The VIX index is up more than 16%.

- The Neth25 index is up more than 1.40%.

- The SWI20 and the ESP25 indices are up more than 1.60%.

- The Bovespa index is up for the 7th week in a row.

- The CAC 40 index hit a new record high above 8,443.

- The UK100 is up more than 2% and reached a new all time high above 10,715.

- The Euro50 index hit a new record high above 6,112.

- The KOSPI index is up more than 5.25%.

Shares

Tops

- Moderna: +23.89%

- Molina Healthcare: +20.52%

- Texas Pacific Land: +17.41%

- Omnicom: +16.11%

- Garmin: +15.83%

- Paycom Software: +13.03%

- Safran: +11.22%

- Akamai Technologies: +10.98%

Flops

- EPAM Systems: -21.21%

- Genuine Parts: -20.42%

- Pool: -19.77%

- Raizen: -19.48%

- Expedia: -16.55%

- Companhia Brasileira de Distribuicao: -15.36%

- Essilor Lusottica: -15.58%

- Zebra Technologies: -14.27%

- Siemens Aktiengesellschaft: -11.43%

Important Events to Follow

Monday 23 February

- 09:00 AM - German - Ifo Business Climate (February)

- Previous: 87.6

- Forecast: 87

Wednesday 25 February

- 12:30 AM - Australia - CPI (January)

- Previous: 3.8%

- 07:00 AM - German - GfK Consumer Confidence (March)

- Previous: -24.1

- Forecast: -25

Friday 27 February

- 07:45 AM - French - Inflation Rate YoY Prel (February)

- Previous: 0.3%

- 01:00 PM - German - Inflation Rate YoY Prel (February)

- Previous: 2.1%

- 01:30 PM - Canadian - GDP Growth Rate Annualized (Q4)

- Previous: 2.6%

- Forecast: 0.0%

- 01:30 PM - Canadian - GDP Growth Rate QoQ (Q4)

- Previous: 0.6%

- Forecast: -0.1%

- 01:30 PM - American - PPI MoM (January)

- Previous: 0.5%

- Forecast: 0.3%

Major Earnings Reports to Watch

Monday 23 February

- Dominion Energy

Tuesday 24 February

- Alibaba

- AMC Holdings

- HOME DEPOT

- Solvay

- First Solar

- Fresenius Medical Care AG & Co

- Endesa

Wednesday 25 February

- Zoom

- Ageas

- Ferrovial

- HSBC HOLDINGS

- Beyond Meat

- Cellnex Telecom

- E.ON

- NVIDIA

- Salesforce

- Photronics

- Banco Comercial

- Lowe'S Cos

- TJX Companies

- EDP Renovaveis

- HeidelbergCement

- Universal Health Services

- Iberdrola

- AENA

- DIAGEO

- Fresenius SE & Co

- Telefonica

- ACS Actividades de Construccion y Servicios

Thursday 26 February

- Grifols

- Dell

- Stellantis

- COMPASS

- BAIDU

- Deutsche Telekom

- Prysmian

- Novavax

- Muenchener Rueckversicherungs

- Allianz

- Bouygues

- ENI

- Veolia Environnement

- ENGIE

- Valeo

- SCHNEIDER ELECTRIC

- LONDON STOCK EXCHANGE

- Saint-Gobain

- Teleperformance SE

- SBM OFFSHORE

- ROLLS-ROYCE

- Energias De Portugal

- Distribuidora Internacional de Alimentacion

Friday 27 February

- Semapa-Sociedade De Investim

- BASF

- Swiss Re

- BioMerieux

Source: The Wall Street Journal, Trading Economics, Reuters, TradingView and ActivTrades’ Data as of February 20, 2026

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.