Weekly Outlook

What Happened This Week?

United States

- The official January jobs report is delayed by the Bureau of Labor Statistics, pushing analysts to rely more on private and unofficial labor data.

- Private-sector hiring slowed sharply, with ADP reporting only 22,000 new jobs in January, well below expectations.

- Initial unemployment claims rose to 231,000, above forecasts of 212,000, while continuing claims increased to 1.84 million, signaling softer labor conditions.

- Job openings fell by 386,000 in December, reaching their lowest level since September 2020.

- Services-sector activity continued to expand in January, although businesses flagged concerns about tariffs and geopolitical tensions.

- Fed policymaker Thomas Barkin said rate cuts totaling 175 basis points over the past 18 months have helped support employment, while warning demographic changes could weaken future labor supply.

- Fed Governor Lisa Cook emphasized that inflation remains the biggest economic risk, suggesting resistance to further rate cuts in the near term.

- A senior Republican senator said there is no evidence that Fed Chair Jerome Powell committed a crime, attempting to ease tensions surrounding the ongoing investigation.

- Temporary Fed governor Stephen Miran resigned from his White House role, with expectations President Trump may fill the vacancy alongside his Fed chair nomination.

- The U.S. is working with Japan, Mexico and the European Union to secure critical mineral supplies and reduce reliance on China, with trade agreements expected within 30 to 60 days.

- Home builders proposed federal support measures, including a rent-to-own program, to reduce the largest surplus of unsold homes in 15 years caused by high borrowing costs and elevated prices.

Mexico

- The Bank of Mexico paused its rate-cutting cycle after 12 consecutive reductions, leaving the benchmark rate at 7.0% while assessing inflation risks tied to tariffs and tax increases.

- Mexico is also part of new U.S.-led agreements aimed at strengthening supply chains for critical minerals.

Canada

- Canada’s services sector contracted for the third consecutive month in January, with new business volumes falling for the fourteenth straight month.

- Input price inflation slowed to a 16-month low due to intense price competition despite rising costs.

- Bank of Canada Governor Tiff Macklem warned that lowering rates too aggressively could misinterpret structural economic changes linked to trade tensions and technological shifts.

Eurozone

- Annual inflation fell to 1.7% in January from 2.0%, dropping below the ECB’s target.

- Cheaper Chinese imports and currency effects could further lower inflation and increase pressure for potential rate cuts.

- Despite weaker inflation, strong growth and low unemployment continue to support wage pressure risks.

- ECB policymakers signaled little urgency to cut rates, with investors now pricing only a 20% probability of a rate reduction this year.

- Retail sales dropped 0.5% in December, mainly driven by weaker nonfood purchases, although annual sales still rose 1.3%.

- The European Union is participating in new trade initiatives with the U.S. and Japan to secure mineral supply chains.

United Kingdom

- The Bank of England held its key interest rate at 3.75% and suggested borrowing costs could decline later this year.

- The central bank cut its 2026 growth forecast to 0.9% from 1.2%, signaling a sharper slowdown from 2025 growth of 1.4%.

- Inflation is expected to fall closer to the 2% target from April and remain near that level through early 2029.

- Spare economic capacity is expected to increase, with unemployment projected to peak around 5.3% mid-year.

Australia

- The Reserve Bank of Australia raised its cash rate by 25 basis points to 3.85% due to rising inflation and stronger economic momentum.

- Core inflation risks climbing above 4.0% in 2026, and policymakers signaled the possibility of additional rate hikes.

New Zealand

- Unemployment rose to 5.4% in the fourth quarter of 2025, the highest level since 2015.

- Consumer inflation increased 3.1% year over year, exceeding the central bank’s target range.

- Both employment and unemployment increased, with 165,000 people unemployed, up 5,000 from the previous quarter.

India

- The Reserve Bank of India held its policy rate at 5.25% following a rate cut in December.

- Policymakers maintained a neutral stance as improved trade relations with the U.S. supported economic stability.

Argentina

- Investor confidence weakened after the resignation of the country’s statistics chief amid delays in updating the inflation index.

- Argentina’s benchmark S&P Merval stock index fell about 8% during the week, reflecting concerns about President Milei’s economic reforms.

This Week’s Market Movers

Forex

- The USD/ZAR is up more than 3%.

- The USD/SEK is up more than 2.60%.

- The USD/JPY is up more than 2.40%.

- The USD/CHF is up more than 1.60%.

- The AUD/JPY is up more than 1.10%.

- The GBP/USD is down more than 1.65%.

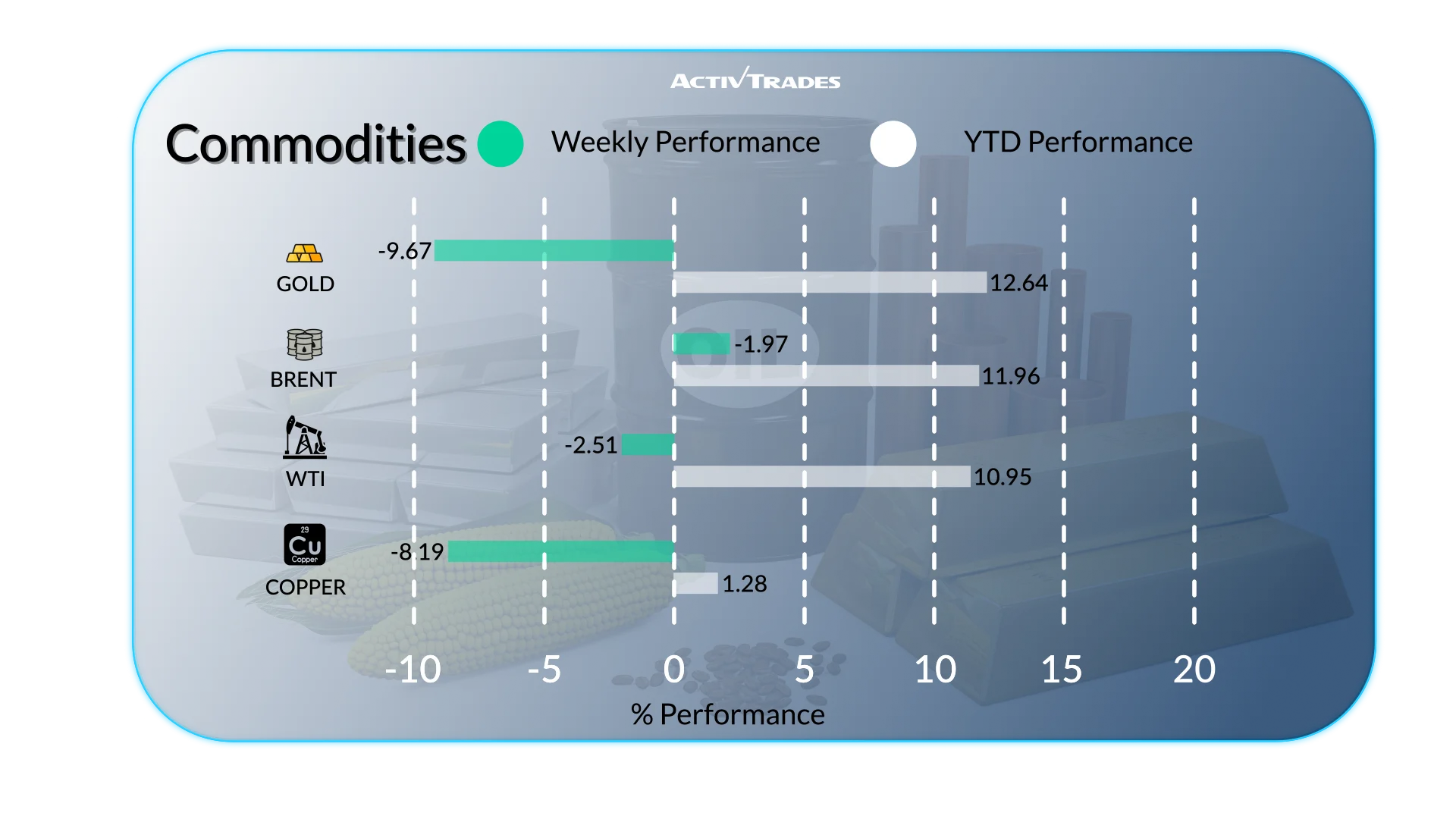

Commodities

- Orange Juices prices are down more than 24%.

- Natural gas prices are down more than 22%.

- Silver prices are down more than 11%.

- Platinum prices are down more than 8%.

- Coffee prices are down more than 6.80%.

Indices

- The Nikkei 225 index is up more than 11.40%.

- The VIX index is up more than 10%.

- The Swi20 index is up more than 1.80%.

- The CAC 40 index is up more than 1.30%.

- The USA500 index is down more than 2%.

- The USATEC index is down more than 3.90%.

- The Bovespa index is up for the 5th week in a row.

Shares

Tops

- DaVita: +40.77%

- Charter Communications: +23.52%

- Southwest Airlines Company: +21.06%

- GSK: +20.31%

- Verizon Communications: +19.00%

- Ball Corporation: +16.76%

- Old Dominion Freight Line: +16.60%

- Pepsico: +12.56%

- Comcast: +11.67%

- Deutsche Telekom: +11.64%

- Merck & Company: +11.58%

Flops

- Gartner: -32.37%

- Applovin: -31.79%

- Robinhood: -29.99%

- Coinbase Global: -29.35%

- Axon: -27.99%

- Raizen: -22.73%

- Fresnillo: -15.97%

- RELX: - 15.80%

- Rheinmetall: -14.27%

- Endeavour Mining: - 14.26%

- Capgemini: -10.23%

Important Events to Follow

Monday 09 February

- 11:30 PM - Australian - Westpac Consumer Confidence Change (February)

- Previous: -1.7%

- Forecast: -2.0%

Tuesday 10 February

- 12:30 AM - Australian - NAB Business Confidence (January)

- Previous: 3

- Forecast: 3

- 01:30 PM - American - Retail Sales MoM (December)

- Previous: 0.6%

- Forecast: 0.4%

Wednesday 11 February

- 01:30 AM - Chinese - Inflation Rate YoY (January)

- Previous: 0.8%

- Forecast: 0.7%

- 01:30 PM - American - Non Farm Payrolls (January)

- Previous: 50K

- Forecast: 68K

- 01:30 PM - American - Unemployment Rate (January)

- Previous: 4.4%

- Forecast: 4.4%

Thursday 12 February

- 07:00 AM - UK - GDP Growth Rate YoY Prel (Q4)

- Previous: 1.3%

- Forecast: 1.2%

- 07:00 AM - UK - GDP MoM (December)

- Previous: 0.3%

- Forecast: 0.1%

- 03:00 PM - Ameican - Existing Home Sales (January)

- Previous: 4.35M

- Forecast: 4.2M

Friday 13 February

- 01:30 PM - American - Core Inflation Rate YoY (January)

- Previous: 2.6%

- Forecast: 2.5%

- 01:30 PM - American - Inflation Rate YoY (January)

- Previous: 2.7%

- Forecast: 2.4%

Major Earnings Reports to Watch

Monday 09 February

- Loews Corporation

Tuesday 10 February

- KERING

- Mattel

- Ferrari

- Honda Motor

- Ford Motor

- ASTRAZENECA

- BP

- AIG

- Gilead Sciences

- Robinhood

- BARCLAYS PLC

- COCA-COLA

- CVS Health

Wednesday 11 February

- MCDONALDS

- Dassault Systemes

- Kraft Heinz

- CISCO

- ABN AMRO

- Commerzbank

- HEINEKEN

- Michelin

- T-Mobile US

- EssilorLuxottica

Thursday 12 February

- Vertex Pharmaceuticals

- Expedia Group

- Siemens

- LEGRAND

- KBC Group

- ThyssenKrupp

- Anheuser-Busch InBev

- RELX

- UNILEVER

- BRITISH AMERICAN TOBACCO

- Hermes

- L'Oreal

Friday 13 February

- Moderna

- NATWEST

- SAFRAN

Source: The Wall Street Journal, Trading Economics, Reuters, TradingView and ActivTrades’ Data as of February 6, 2026

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.