FOREX

During early Tuesday trading, the US dollar edged lower compared to other major currencies. Notably, the greenback reached a three-month peak in mid-February, coinciding with market sentiments anticipating the first rate cut now coming in June instead of the previously assumed March and May. However, following this peak, the dollar displayed some softness, a trend somewhat perplexing given the Federal Reserve's hawkish stance and the robust economic indicators showcasing the resilience of the US economy. Against this backdrop, and with significant data, such as personal expenditure, the Fed's preferred inflation gauge, slated for release this week, the dollar's risk continues to lean towards the upside.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN STOCKS

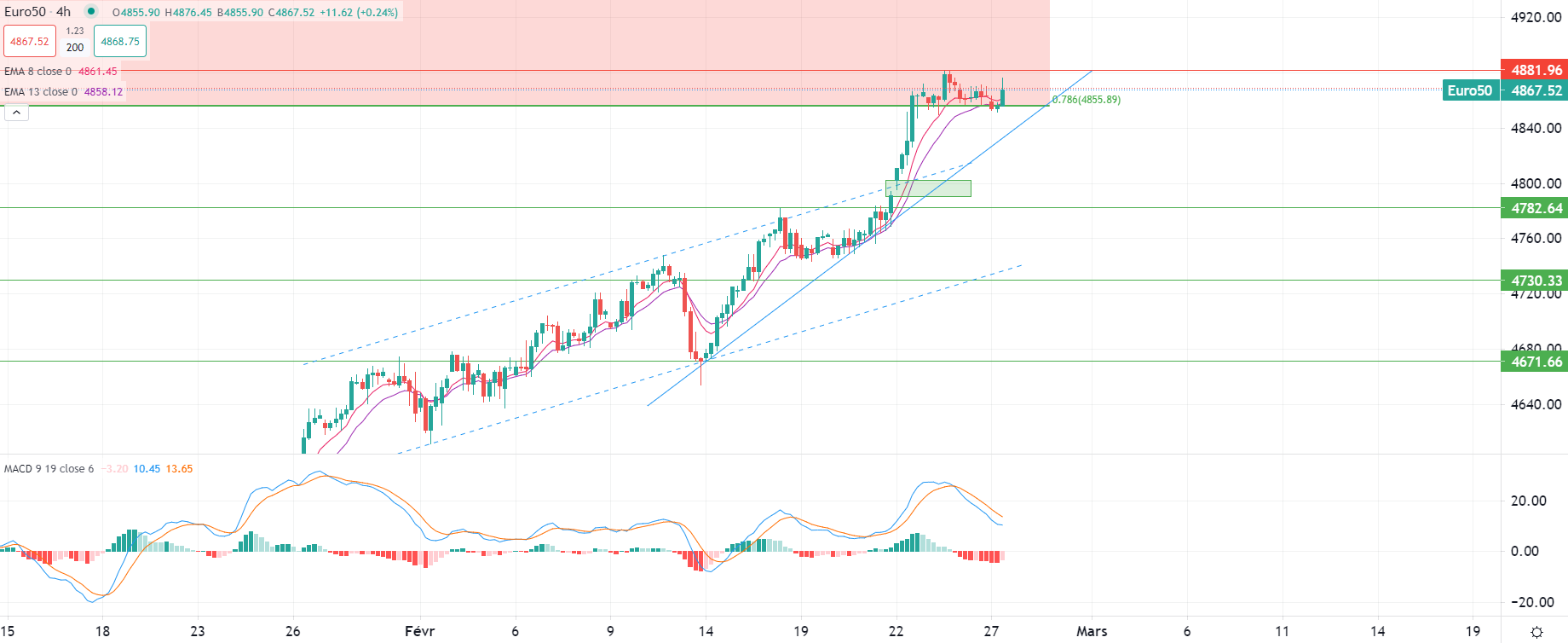

European markets opened mostly higher on Tuesday, following the overnight trend in Asia, as investors remain optimistic ahead of this week’s data.

Bull traders managed to defend support levels and keep most benchmarks inside their narrow ranges despite lacking a bullish catalyst in the short term, highlighting the lingering positive mood surrounding markets.

More market volatility will likely be on its way later today with the first batch of US data brought by the US Conference Board Consumer Confidence Index and Durable Goods orders report, alongside the Republican and Democratic primaries.

No significant data is expected from the old continent, but a speech from BoE Governor Andrew Bailey may bring increased price action on GBP pairs as well as equities listed in the FTSE-100 index.

The STOXX-50 index currently trades in the middle of its 25-point wide range, following a rebound over the lower bound, led mainly by basic materials and tech shares.

Even if a deeper correction may still be possible, the market remains above its short-term bullish trendline so far, and we won’t expect more directionality prior to this week’s macro developments.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.