What Happened Last Week?

- The U.S. services sector grew for the 10th straight month in April, with the ISM Services PMI at 51.6 - marking expansion in 56 of the past 59 months since the post-COVID recovery.

- Friedrich Merz became the new chancellor of Germany.

- Eurozone retail sales fell more than expected month-on-month in March 2025 with a 0.1% decrease.

- The U.S. trade deficit widened to a record level in March, as it increased by 14% to $140.5 billion.

- The Economic Policy Uncertainty Index for the United States from the FRED reached its highest level since at least 1985.

- Warren Buffet announced its retirement.

- The Federal Reserve kept interest rates steady at the 4.25-4.50% range, due to economic uncertainty caused by Trump's tariffs.

- The Bank of England lowered its main interest rate to 4.25% due to concerns about the potential negative impact that the Trump administration's tariff policies could have on global and local economic growth despite trade deals.

- Sweden's and Norway's central banks decided to maintain their current interest rates unchanged.

- The US has reached a trade agreement with Britain, according to Trump's announcement, with Chinese trade talks scheduled to follow.

- Bitcoin has once again hit the $100,000 level, a milestone it hasn't reached since February.

- In April 2025, China's exports saw a 8.1% year-over-year increase, reaching USD 315.7 billion. Despite this strong showing, the growth rate sharply declined from March's 12.4% increase.

- Chinese exports to the USA plunged 21% in April.

- April marked the third consecutive month of declining purchases in China, with imports contracting by 0.2% year-on-year to USD 219.5 billion (after a 4.3% drop in March).

- China decided to reduce the seven-day reverse repurchase rate from 1.5% to 1.4% and to lower the reserve requirement ratio by 50 basis points.

- The Chinese government also chose to implement measures to support financing for key sectors, including technology and real estate.

- These actions are part of China's efforts to boost economic growth amid rising trade concerns.

- India's military action against neighboring Pakistan has heightened tensions in the region.

Last Week’s Market Movers

Forex

- The Taiwanese dollar reached a three-year high against the USD at the beginning of the week with a record surge in two trading days. Over the last 5 days, the currency pair is up almost 6.5%.

- The Swiss National Bank may consider again a negative interest rates policy amid growing economic uncertainty and a significant rise in the Swiss Franc.

- EUR/USD down for the 3rd week in a row.

- EUR/GBP down for the 4th week in a row.

- GBP/JPY up for the 5th week in a row.

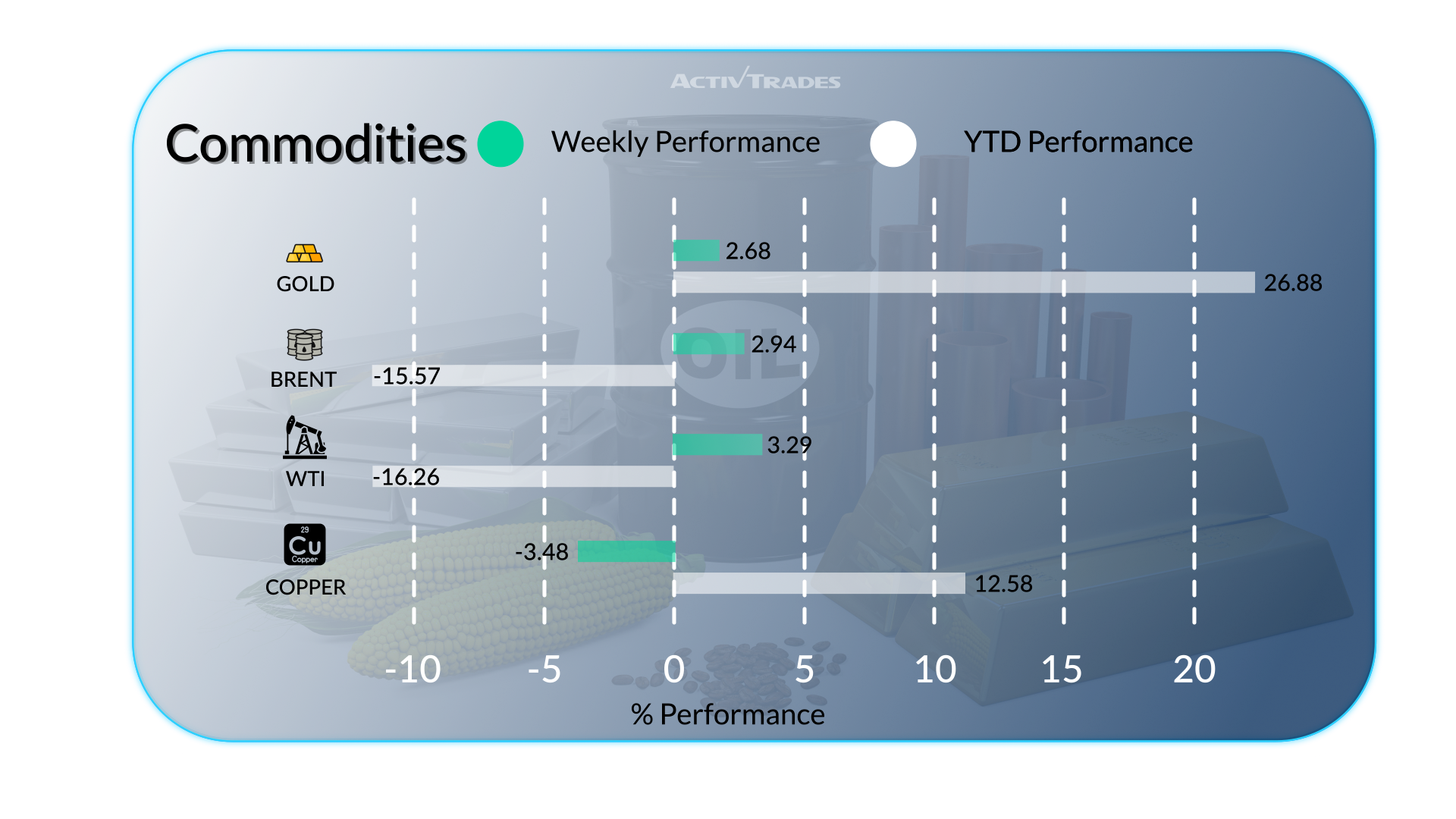

Commodities

- Second bullish week in a row for Palladium prices.

- Orange juice prices are losing around 2%, after being down more than 13% over the last two weeks.

- Oil prices are up more than 2% after reaching their lowest level since the beginning of 2021.

Indices

- Wall Street stock indexes ended a nine-day winning streak on Monday.

- The Italian FTSE Mib index reached its highest level in 6 weeks above the 38,900 level.

- DAX 40 is up almost 4%.

- Euro Stoxx 50 is up around 2.50%.

- Nikkei 225 is up about 2%.

- VIX is down around 7%.

Shares

Tops

- DexCom : +19.56%

- Rheinmetall : +16.57%

- Walt Disney Company: +15.18%

- Airbus : +10%

Flops

- Moderna: 11.92%

- Merck & Company: -8.11%

This Week’s News to Follow

Tuesday 13 May

- 12:30 AM - Australian Westpac Consumer Confidence Change

- Previous: -6

- 01:30 AM - Australian NAB Business Confidence (April)

- Previous: -3

- 06:00 AM - UK Unemployment Rate (March)

- Previous: 4.4%

- Forecast: 4.4%

- 09:00 AM - German ZEW Economic Sentiment Index (May)

- Previous: -14.0

- 12:30 PM - German Core Inflation Rate YoY (April)

- Previous: 2.8%

- Forecast: 2.8%

- 12:30 PM - American Inflation Rate YoY (April)

- Previous: 2.4%

- Forecast: 2.6%

Thursday 15 May

- 06:00 AM - UK GDP Growth Rate YoY Prel (Q1)

- Previous: 1.5%

- Forecast: 0.9%

- 06:00 AM - UK GDP MoM (March)

- Previous: 0.5%

- Forecast: 0.1%

- 12:30 PM - American PPI MoM (April)

- Previous: -0.4%

- Forecast: 0.2%

- 12:30 PM - American Retail Sales MoM (April)

- Previous: 1.4%

- Forecast: -0.8%

- 11:50 PM - Japanese GDP Growth Rate QoQ Prel (Q1)

- Previous: 0.6%

- Forecast: -0.1%

Friday 16 May

- 12:30 PM - American Building Permits Prel (April)

- Previous: 1.467M

- Forecast: 1.45M

- 12:30 PM - American Housing Starts (April)

- Previous: 1.324M

- Forecast: 1.31M

- 02:00 PM - American Michigan Consumer Sentiment Prel (May)

- Previous: 52.2

- Forecast: 52

Major Earnings Reports to Watch

Monday 12 May

- Grifols

- Sony ADR

- Phoenix ADR

- Alibaba ADR

Tuesday 13 May

- Hannover Rueck

- Bayer

- CISCO

- Muenchener Rueckversicherungs

Wednesday 14 May

- Bouygues

- Telefonica

- Porsche

- Sumitomo Mitsui Financial ADR

- EXPERIAN

- Alstom

- ABN AMRO

- E.ON

- JD.com ADR

- COMPASS

Thursday 15 May

- KBC Group

- ENGIE

- Allianz

- RWE

- Mizuho Financial ADR

- Deutsche Telekom

- Siemens

- Mitsubishi UFJ Financial ADR

- 3i Group

- ThyssenKrupp

- WALMART

Friday 16 May

- Swiss Re

- Compagnie Financiere Richemont

- Semapa-Sociedade De Investim

Source: Trading Economics, TradingView, and ActivTrades’ Data as of May 8 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.