Weekly Outlook

What Happened This Week?

- In June, the US saw roughly 7.4 million job openings, a figure that showed little change compared to May.

- After a sharp fall in April and a steady May, the Conference Board Consumer Confidence Index improved in June. Despite this recent gain, it hasn't reached the strong levels seen last year.

- According to the ADP National Employment Report, the US private sector added 104,000 jobs in July, with workers seeing an average annual pay increase of 4.4%.

- US economic growth hit 3% in the second quarter, mainly due to a big jump in trade. However, consumers are worried, construction is down, and business investment has slowed, all while tariffs continue to cause instability in US economic figures.

- US pending home sales dropped in June, decreasing by 0.8% from May and 2.8% compared to last year.

- Despite two FOMC members voting for a 25 basis point rate cut—openly agreeing with the President that lower borrowing costs are warranted—the Federal Reserve held its monetary policy steady. The Fed funds target rate range remains at 4.25-4.5%.

- The euro zone economy grew by a modest 0.1% in the second quarter of 2025, according to flash data. This suggests the region has largely withstood changes in US trade policy so far. However, Germany's economy, the largest in the zone, contracted by 0.1% during the same period.

- President Trump signed an executive order Thursday to increase tariffs on numerous countries, effective August 7th at 12:01 a.m.

- China's manufacturing activity shrank in July, with its PMI hitting 49.5, S&P Global reported. The sector faced multiple headwinds: new business growth slowed, companies lowered prices due to competition and high costs, and jobs were cut as export orders dropped. Although domestic demand offered some resilience, overall sales were limited by weak international demand and uncertain global trade conditions.

- South Korea's exports jumped 5.9% in July, exceeding forecasts thanks to strong demand for advanced AI computing chips. This positive news comes after a new trade deal with the U.S. eased worries about tariffs, a deal that includes tariffs on goods and substantial South Korean investments in the U.S.

This Week’s Market Movers

Forex

- The Dollar Index jumped 2.45%, trading not far from the 100 key level.

- The EUR/USD is down 2.75% below 1.15.

- The EUR/GBP is down more than 1%.

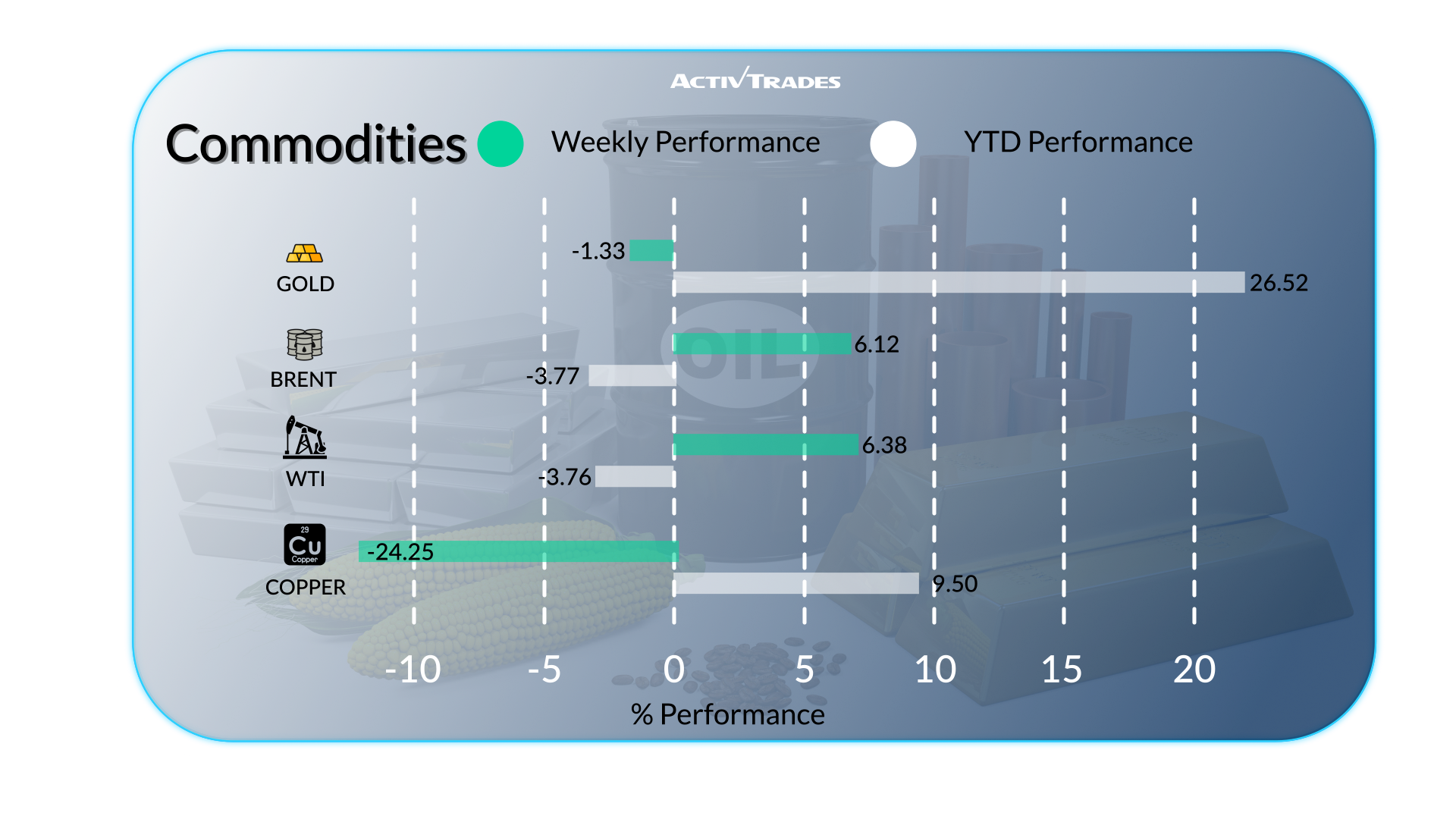

Commodities

- Copper prices saw their steepest single-day decline this week since records began in 1968, outstripping the 12% plunge that occurred on October 20, 1987, in the wake of "Black Monday" when market panic caused widespread crashes. Copper prices are down more than 23%.

- Silver prices are down more than 4%.

- Platinum prices are down more than 9.5%.

- Orange juice prices are down more than 11.40%.

Indices

- The S&P 500 and Nasdaq hit new record highs, but are trading slightly down these all-time high closes.

- The Swi20 is down more than 1.90%.

- The ChinaA50 is down more than 1.85% after 6 bullish weeks.

- The Ger40 is down after 3 weeks up.

- The Eur50 is down more than 1.30%.

Shares

Tops

- Direcional ON: +196.88%

- Generac Holdings: +27.43%

- Embraer: +18.46%

- Teradyne: +16.42%

- C.H Robinson Worldwide: +14.63%

- Super Micro Computer: +13.81%

- Western Digital: +13.71%

- Corning Incorporated: +13.64%

- Globe Life: +12.55%

- Cadence Design Systems: +11.98%

- eBay: +11.59%

- Airtel Africa: +10.98%

Flops

- Align Technology: -36.48%

- Charter Communications: -32.30%

- Baxter International: -23.24%

- Albemarie: -17.76%

- United Parcel Service: -16.45%

- Intel: -15.71%

- Moderna: -15.42%

- Adidas: -15.21%

- London Stock Exchange: -10.79%

- Stellantis: -10.71%

- Accor: -10.14%

This Week’s News to Follow

Tuesday 05 August

- 12:30 PM - Canadian Balance of Trade (June)

- Previous: C$-5.9B

- Forecast: C$ -1.6B

- 02:00 PM - American ISM Services PMI (July)

- Previous: 50.8

- Forecast: 51

Thursday 07 August

- 01:30 AM - Australian Balance of Trade (June)

- Previous: A$2.238B

- Forecast: A$ 6.8B

- 03:00 AM - Chinese Balance of Trade (July)

- Previous: $114.77B

- Forecast: $111.0B

- 03:00 AM - Chinese Exports YoY (July)

- Previous: 5.8%

- Forecast: 5.1%

- 03:00 AM - Chinese Imports YoY (July)

- Previous: 1.1%

- Forecast: 1.3%

- 06:00 AM - German Balance of Trade (June)

- Previous: €18.4B

- Forecast: €14.5B

- 11:00 AM - UK BoE Interest Rate Decision

- Previous: 4.25%

- Forecast: 4.0%

- 02:00 PM - Canadian Ivey PMI s.a (July)

- Previous: 53.3

- Forecast: 53.5

Friday 08 August

- 12:30 PM - Canadian Unemployment Rate (July)

- Previous: 6.9%

- Forecast: 6.9%

Major Earnings Reports to Watch

Monday 04 August

- Loews Corporation

- Beiersdorf

- Tyson Foods

- BioNTech

- Mitsubishi UFJ Financial

- Vertex Pharmaceuticals

Tuesday 05 August

- BP

- Hugo Boss

- Continental

- Infineon Technologies

- CATERPILLAR

- Amgen

- Marathon Petroleum

- Marathon Oil

- Kellogg Company

- PFIZER

- Mondelez

- AMD

- Fresenius Medical Care AG & Co

- Super Micro Computer Inc

Wednesday 06 August

- MCDONALDS

- Novo Nordisk

- Bayer

- Virgin Galactic

- WALT DISNEY

- Honda Motor ADR

- McKesson

- Aurora Cannabis

- Fortinet

- AIG

- Uber Technologies

- Novavax

Thursday 07 August

- Eli Lilly & Co

- Deutsche Telekom

- Expedia Group

- Gilead Sciences

- Sony

- ConocoPhillips

- Toyota Motor

Friday 08 August

- Canopy Growth

Source: Trading Economics, The Wall Street Journal, TradingView and ActivTrades’ Data as of 1 August 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.