Weekly Outlook

What Happened This Week?

- China maintained its benchmark lending rates, holding the 1-year loan prime rate (LPR) at 3.0% and the 5-year LPR at 3.5%. This decision comes as the country continues to face weak consumer sentiment and softening economic growth.

- The European Central Bank (ECB) has opted to keep its key deposit rate steady at 2%. This decision comes after a series of eight rate cuts since last June, with the central bank holding off on further easing as U.S. tariff negotiations cloud the economic outlook.

- Turkey's Central Bank has resumed its strategy of cutting interest rates, a move coming after an earlier hike forced by civil unrest. This policy shift occurs as the nation's annual inflation, which soared above 75% last year, has now cooled to approximately half that level as of June.

- Japan's exports to the U.S. will now be subject to a 15% tariff, a decrease from the current 25%.

- HSBC anticipates the Bank of Japan will implement a 25-basis-point interest rate hike in October, pushing the policy rate to 0.75%. This move is largely influenced by the recent U.S.-Japan trade deal, which has provided a timely boost to Japan's economic growth prospects.

- Tokyo's inflation rate eased to 2.9% in July, down from 3.1% in June. Similarly, core inflation also decreased to 2.9% in July from 3.1% the previous month.

- German consumer confidence has been shaken by economic uncertainty, with a monthly German consumer-climate index revealing that consumers are prioritizing saving over making major purchases.

- Eurozone consumers are feeling slightly less pessimistic as inflation stabilizes, even amidst ongoing global economic uncertainty.

- US home prices reached a record high in June, contributing to a decline in sales and making a housing market recovery unlikely this year. Existing home sales dropped by 2.7% in June, marking the slowest pace since September, indicating a weak spring selling season. The primary culprits are high home prices and mortgage rates exceeding 6.5%, which continue to make homeownership unaffordable for many, despite some regional price decreases.

- US business activity significantly accelerated in July, according to preliminary 'flash' PMI data, signaling a strong beginning to the third quarter.

- Canada's economy began summer with clear signs of strengthening, as estimated retail sales saw their largest growth since last year. Retail sales are estimated to have risen 1.6% month-over-month in June, marking a significant rebound from May's sharp drop, according to Statistics Canada.

- U.K. consumer confidence slipped to minus 19 in July, undoing the small gain from June. This decline in economic outlook is being impacted by global uncertainty, trade disputes, and the potential for tax increases. Domestically, high inflation, a weakening job market, and a contracting economy are significantly weighing on consumer sentiment.

This Week’s Market Movers

Forex

- The USD/MXN is slightly up after 4 weeks down.

- The AUD/USD is up more than 1.10%.

- The USD/BRL is down more than 1.05%.

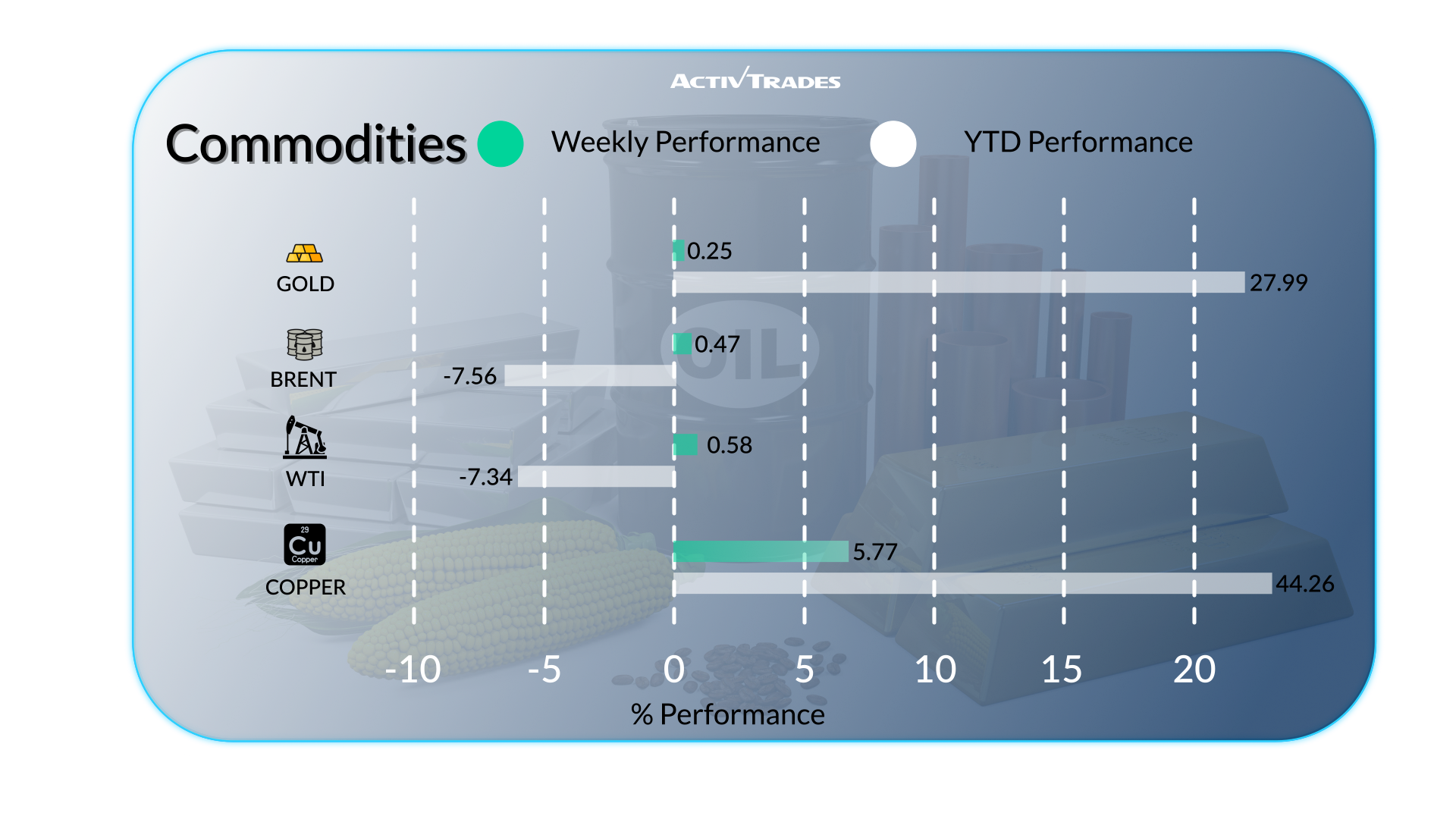

Commodities

- Copper prices are up more than 4%.

- Oats contracts are down for the 3rd week in a row.

- Orange juice prices are up for the 3rd week, gaining more than 45% over this period.

- Cocoa prices are up more than 6%.

Indices

- The S&P 500 and Nasdaq hit new records.

- The Esp35 is trading at its highest level around 14,240.

- The ChinaA50 is trading up for the 6th week in a row.

- The Ita40 is up for the 3rd consecutive week.

- The Jp225 is up more than 4.45% after the country reached a deal with the US.

- The UK100 is up for the 5th consecutive week.

Shares

Tops

- Invesco: +27.18%

- IQVIA Holdings: +26.84%

- West Pharmaceutical Services: +24.30%

- Baker Hughes Company: +18.60%

- TE Connectivity: +16.88%

- Lamb Weston Holdings: +16.85%

- Albemarie Corporation: +16.19%

- Thermo Fisher Scientific: +14.47%

- Charles River Laboratories: +14.31%

- Block: +14.25%

- Deutsche Bank: +11.38%

- Reckitt Benckiser: +10.75%

- Fleury ON: +10.37%

Flops

- Molina: -24.66%

- STMicroelctronics: -18.38%

- Elevance Health: -16.04%

- Fiserv: -15.74%

- LKQ: -15.21%

- Chiplote Mexican Grill: -14.70%

- Texas Instruments: -14.09%

- Philip Morris International: -11.99%

- Southwest Airlines: -11.60%

This Week’s News to Follow

Tuesday 29 July

- 07:00 AM - Spanish GDP Growth Rate YoY Flash (Q2)

- Previous: 2.8%

- Forecast: 2.6%

- 02:00 PM - American JOLTs Job Openings (June)

- Previous: 7.769M

- Forecast: 7.3M

Wednesday 30 July

- 05:30 AM - French GDP Growth Rate YoY Prel (Q2)

- Previous: 0.6%

- Forecast: 0.6%

- 08:00 AM - German GDP Growth Rate YoY Flash (Q2)

- Previous: 0%

- Forecast: 0.1%

- 09:00 AM - European GDP Growth Rate YoY Flash (Q2)

- Previous: 1.5%

- Forecast: 1.2%

- 12:30 PM - American GDP Growth Rate QoQ Adv (Q2)

- Previous: -0.5%

- Forecast: 2.5%

- 01:45 PM - Canadian BoC Interest Rate Decision

- Previous: 2.75%

- Forecast: 2.75%

- 01:45 PM - Canadian BoC Monetary Policy Report

- 06:00 PM - American Fed Interest Rate Decision

- Previous: 4.5%

- Forecast: 4.5%

- 06:30 PM - American Fed Press Conference

Thursday 31 July

- 01:30 AM - Chinese NBS Manufacturing PMI (July)

- Previous: 49.7

- Forecast: 50.2

- 03:00 AM - Japanese BoJ Interest Rate Decision

- Previous: 0.5%

- Forecast: 0.5%

- 05:00 AM - Japanese Consumer Confidence (July)

- Previous: 34.5

- Forecast: 35

- 06:45 AM - French Inflation Rate YoY Prel (July)

- Previous: 1%

- Forecast: 1.0%

- 12:00 PM - German Inflation Rate YoY Prel (July)

- Previous: 2%

- Forecast: 1.9%

- 12:30 PM - American Core PCE Price Index MoM (June)

- Previous: 0.2%

- Forecast: 0.3%

- 12:30 PM - American Personal Income MoM (June)

- Previous: -0.4%

- Forecast: 0.5%

- 12:30 PM - American Personal Spending MoM (June)

- Previous: -0.1%

- Forecast: 0.4%

Friday 01 August

- 01:45 AM - Chinese Caixin Manufacturing PMI (July)

- Previous: 50.4

- Forecast: 50.8

- 09:00 AM - European Inflation Rate YoY Flash (July)

- Previous: 2%

- Forecast: 1.8%

- 12:30 PM - American Non Farm Payrolls (July)

- Previous: 147K

- Forecast: 110K

- 12:30 PM - American Unemployment Rate (July)

- Previous: 4.1%

- Forecast: 4.2%

- 02:00 PM - American ISM Manufacturing PMI (July)

- Previous: 49

- Forecast: 49.4

Major Earnings Reports to Watch

Monday 28 July

- RECKITT BENCKISER

Tuesday 29 July

- Booking

- PROCTER & GAMBLE

- PayPal

- ASTRAZENECA

- BARCLAYS PLC

- BOEING

- Starbucks

- Unicredit

- Grifols

- Nomura

- Tilray

- Western Union

- Stellantis

- United Parcel Service

- VISA

- UNITEDHEALTH

- KONINKLIJKE

- Seagate Technology

Wednesday 30 July

- Robinhood

- MICROSOFT

- DHL Group

- CaixaBank

- HSBC HOLDINGS

- Adidas

- Altria

- UBS Group

- Airbus

- Tenaris

- Intesa Sanpaolo

- Solvay

- Banco Comercial

- Kraft Heinz

- Cognizant Technology Solutions

- META

- EBAY

- Qualcomm

- Telefonica

- Ford Motor

- Arm Holdings

- Banco Santander

- AENA

- COMPASS

Thursday 31 July

- CVS Health

- Deutsche Lufthansa

- Banco Bilbao Vizcaya Argentaria

- ING GROEP

- SHELL

- Ferrari

- BMW

- LEGRAND

- Prysmian

- PUMA

- Enel

- Sumitomo Mitsui Financial ADR

- Sanofi

- Sanofi ADR

- UNILEVER

- AAON Inc

- BIOGEN

- APPLE

- Mastercard

- Dominion Energy

- Anheuser-Busch InBev

- EDP Renovaveis

- Norwegian Cruise Line

- Mizuho Financial

- Abbvie

- CMS Energy

- Accor

- Energias De Portugal

- Advanced Semiconductor Engineering

- Amazon

- First Solar

Friday 01 August

- EXXON MOBIL

- CHEVRON

- Regeneron Pharmaceuticals

- Daimler

- WisdomTree Inc

- Colgate-Palmolive

- Moderna

Source: Trading Economics, TradingView, Yahoo Finance, and ActivTrades’ Data as of July 25 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.