I recently wrote about September and its negative seasonality, as far as the S&P 500 is concerned.

A week into the month, and the S&P 500 is actually trading higher, up by +1.24% as I type.

That compares to the average decline over the last 15 years, of -0.85% for the month as a whole.

It's tempting to view the narrative of September 2025 as being Macro over Micro, not least because we have the Federal Reserve interest rate meeting next week, with the much-awaited decision due on Wednesday evening.

The odds, according to the Fed Funds Futures contracts, favour a -0.25% cut; the balance of probabilities is split 88.20% vs 11.80% in favour of a rate reduction, not quite a done deal, but close to it.

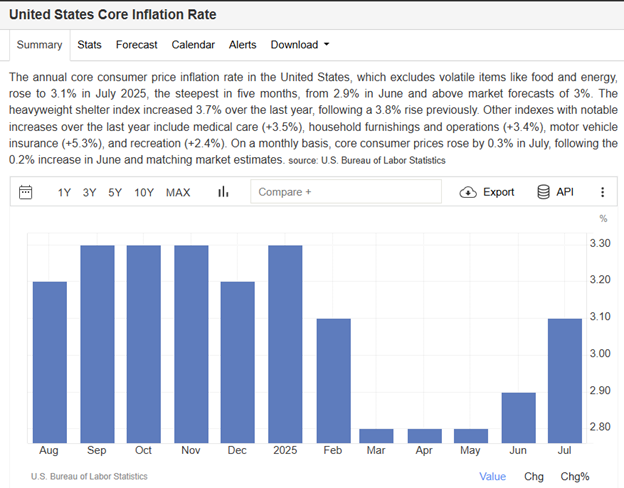

Of course, a spanner could still be thrown in the works. Inflation data in the US is due out on Thursday, the 12th, at 1:30 pm London time, and that could upset the status quo.

Though last time out, the market chose to focus on those data points that aligned with the rate cut narrative, and ignored the inconvenient truth about items like core inflation.

Which, as you can see in the chart below, has been moving in the “wrong “ direction.

Source: Trading Economics

FWIW, I think cutting interest rates at this point is the wrong thing to do, economically speaking

Not that the members of the FOMC are listening to me or any other market commentators, the only voices that they hear right now are likely to be the ones cajoling them from Washington, DC.

Even if rates do come down, I don't expect that will immediately mean cheaper borrowing costs for US consumers and businesses.

Although it's fair to say that US 10 and 30-year bond yields, which act as a proxy for government borrowing costs, have fallen from their recent highs.

See the chart below.

Source: Trading Economics

We also saw a further revision to US employment data this week, when the Bureau of Labour Statistics published its annual data review.

Analysts were expecting a downward adjustment in job creation numbers; however, the -911,000 jobs that were chalked off by the BLS surprised even the most bearish of them and raised questions about the underlying strength of the US economy and other assumptions based on that.

On top of this, geopolitics is back in the news, with tensions rising in both the Middle East and Eastern Europe, as Russia and Israel took their respective conflicts across international boundaries and into third-party states.

Added to which, a buildup of US Naval forces in the Caribbean, could be the precursor to an attempt at regime change in Venezuela, which analysts at RBC said was no longer “a tail risk event”

Macro data and events definitely have the potential to drive or change sentiment across the remainder of the month, but there is also a lot worth thinking about among the micro data.

Micro Heavyweights

The title micro doesn't really fit trillion, or near-trillion-dollar companies, which in some cases are larger than the market cap of many national stock exchanges.

Here is a perfect example of what I mean, and it's from a familiar source, Oracle Corp ORCL US. Which rallied by +28.0% in the after-market on Tuesday, following upbeat guidance about revenues from AI/data centre demand.

Bear in Mind that Oracle was a 660 billion dollar company, so a +30% price move is not a common occurrence, or at least it shouldn't be.

Source: Barchart.com

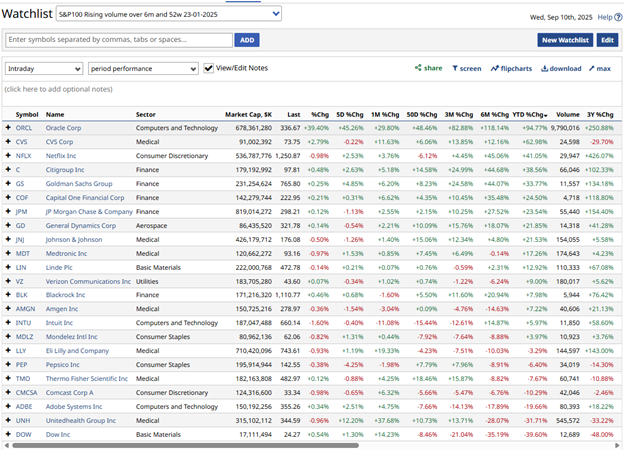

Oracle has appeared in several articles this year, perhaps most intriguingly in the two-part series Turn the volume up, written in February.

Oracle featured in a screen I ran in January on S&P 100 stocks, which looked for names that demonstrated rising volume. Such that the 1-month volumes were higher than their 6-month and 52-week average volumes.

The idea behind that screen was to try to determine whether rising volume could be used as an indicator in its own right.

Here is the list of stocks that the screen surfaced, ranked in this instance by YTD percentage change,

descending

Source: Barchart.com

One thing is clear: There have been very few wallflowers in the list.

Oracle is the standout performer, but there are other stocks with decent gains in the list, as well as numerous names that have moved significantly on the downside.

However, it's not Oracle's performance per se that’s important in this context, but rather the knock-on effect it might have.

At current levels, Oracle has added $240.0 billion in market cap, an extraordinary sum. More than that, though, it’s shown that the AI growth story isn’t confined to the Magnificent 7 and the large language models( LLMs) of their chatbot partners.

As if to reinforce that message, earlier in the week, we saw cloud computing and infrastructure outsourcer Nebius Group NBIS rally by as much as +90.0% on news of a $14.70 billion deal to provide capacity for Microsoft.

Nebius settled at +49.42% higher on Tuesday, taking its 6-month gains to +256.0%.

Source: Barchart.com

While there are opportunities like this in the wild, the market and traders within it are seemingly happy to ignore the inconvenient macro data and geopolitical risks, and instead believe that AI narratives and stocks will continue to support the market, their portfolios and the wider economy.

Next time out, I will look at some of the counter-arguments or at least arguments against complacency, which, of course, can lead to the formation of stock market bubbles.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.