Weekly Outlook

What Happened This Week?

- Deflation is deepening in China, with consumer prices falling for the fourth consecutive month in May (down 0.1% year-on-year). This negative trend, exacerbated by US tariffs and a shift towards the second-hand market by luxury consumers, began in February with a 0.7% drop.

- China's producer prices also experienced a significant decline, falling 3.3% year-on-year in May, their steepest drop since July 2023. Wholesale prices have been in deflation since October 2022.

- China's exports to the U.S. plunged 35% year-on-year in May, marking their steepest decline since February 2020 and suggesting ongoing trade war effects despite recent agreements.

- Overall Chinese exports grew by 4.8% in May, a weaker performance than anticipated.

- Chinese imports concurrently fell by 3.4%, indicating sluggish domestic demand.

- Europeans are increasingly pessimistic about their national economies, as reported by the Boston Consulting Group.

- British consumers cut back on non-essential spending last month, according to the British Retail Consortium.

- UK job vacancies continued their downward trend, falling 7.9% to 736,000 between March and May, marking the 35th consecutive decline.

- Britain's unemployment rate saw a slight increase, rising to 4.6% in the three months to April from 4.5% in the previous period.

- Canada plans to increase military spending to appease the U.S. and meet NATO commitments.

- Canada has historically fallen short of the alliance's 2% defense spending target.

- In 2024, Canada spent 1.37% of its GDP on defense, ranking it above only Belgium, Luxembourg, Slovenia, and Spain among NATO members.

- The World Bank has lowered its global economic growth projection for 2025 to 2.3%, down from its previous estimate of 2.7%.

- This projected global growth rate would represent "the slowest rate of global growth since 2008, aside from outright global recessions, according to the World Bank.

- US headline CPI rose by 0.1% in May. Over the past year, it increased by 2.4%.

- After growing by 0.2% in March 2025, the UK's monthly real gross domestic product (GDP) is estimated to have experienced a 0.3% decline in April.

- U.S. producer price inflation stayed low across all sectors in May (+0.1%), indicating that tariffs haven't yet led to increased costs for consumers and businesses.

- Crude oil futures surged up to 13% Thursday evening following Israeli airstrikes on Iran, reportedly conducted without U.S. support.

- It’s their largest single-day gain in around 5 years.

This Week’s Market Movers

Forex

- The Dollar Index is trading around its lowest level since February 2022.

- The CHF/JPY is trading at its highest level since July 2024.

- The EUR/USD is trading at its highest level since November 2021.

- The EUR/JPY is up for the 3rd week in a row.

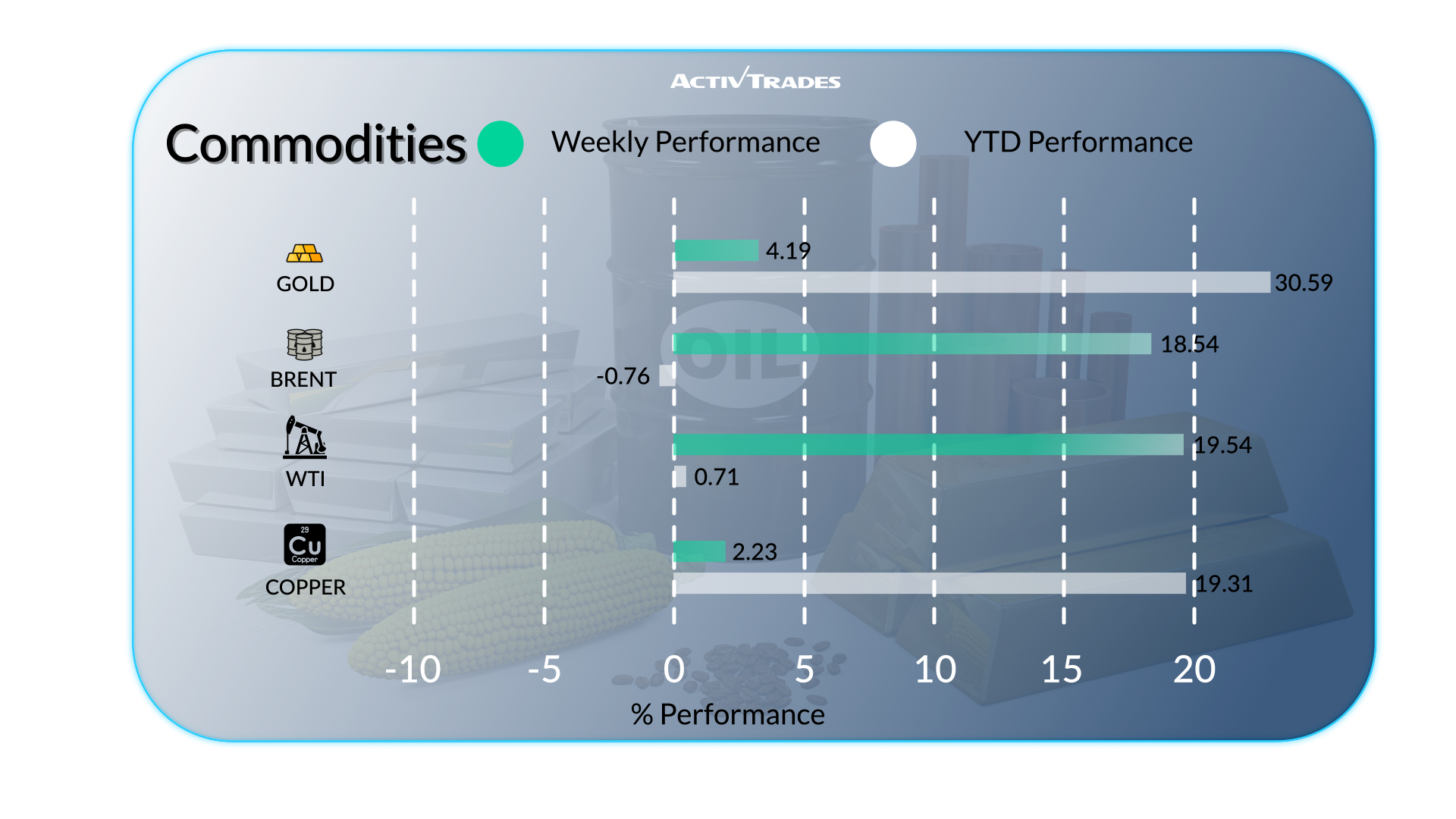

Commodities

- Light Crude and Brent futures are up more than 13% following conflicts in the Middle East between Isrel and Iran.

- Gold prices are up more than 3.5%.

- Natural gas prices are down more than 6%.

- Oats prices are up for the 4th consecutive week in a volatile environement.

- Platinum prices are up more than 8%, after +11.65% the previous week.

Indices

- The VIX index is up more than 11%.

- The German DAX40 index is down almost 4%.

- The UK100 is trading at its highest level above 8,850 points.

- The Euro50 is losing almost 3%.

- The Brazilan index Bra50 is down after 3 weeks up.

Shares

Tops

Flops

- lululemo Athletica: -26.28%

- The J.M Smuckler Company: -12.70%

- Pacific Gas & Electric: -10.62%

This Week’s News to Follow

Monday 16 June

- 02:00 AM - Chinese Industrial Production YoY (May)

- Previous: 6.1%

- Forecast: 6%

- 03:00 AM - Chinese Retail Sales YoY (May)

- Previous: 5.1%

- Forecast: 4.9%

Tuesday 17 June

- 03:00 AM - Japanese BoJ Interest Rate Decision

- Previous: 0.5%

- Forecast: 0.5%

- 09:00 AM - German ZEW Economic Sentiment Index (June)

- Previous: -1

- Forecast: -3

- 12:30 PM - American Retail Sales MoM (May)

- Previous: 0.1%

- Forecast: 0.1%

- 11:50 PM - Japanese Balance of Trade (May)

- Previous: ¥-115.8B

- Forecast: ¥-170.0B

Wednesday 18 June

- 06:00 AM - UK Inflation Rate YoY (May)

- Previous: 3.5%

- Forecast: 3.6%

- 12:30 PM - American Building Permits Prel (May)

- Previous: 1.422M

- Forecast: 1.4M

- 12:30 PM - American Housing Starts (May)

- Previous: 1.361M

- Forecast: 1.36M

- 06:00 PM - American Fed Interest Rate Decision

- Previous: 4.5%

- Forecast: 4.5%

- 06:00 PM - American FOMC Economic Projections

- 06:30 PM - American Fed Press Conference

Thursday 19 June

- 11:00 AM - UK BoE Interest Rate Decision

- Previous: 4.25%

- Forecast: 4.25%

- 11:30 PM - Japanese Inflation Rate YoY (May)

- Previous: 3.6%

- Forecast: 3.6%

Friday 20 June

- 06:00 AM - UK Retail Sales MoM (May)

- Previous: 1.2%

- Forecast: -1.0%

Major Earnings Reports to Watch

Wednesday 18 June

- Aurora Cannabis

Thursday 19 June

- Carmax

Friday 20 June

- Accenture

Source: Trading Economics, TradingView, and ActivTrades’ Data as of June 13 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.