Weekly Outlook

What Happened This Week?

- May brought a mixed economic picture for China: robust retail sales growth of 6.4% year-on-year (surpassing April's 5.1%) contrasted with a deceleration in manufacturing output, which grew by 5.8% year-on-year, down from 6.1% in April and 7.7% in March, a slowdown potentially linked to increased U.S. tariffs.

- Driven by government subsidies designed to stimulate consumption, China's retail sales in May recorded their strongest increase since December 2023.

- The Bank of Japan maintained its key interest rate at 0.5%, where it has been since its January hike. The central bank also announced plans to slow its bond-buying tapering after April 2026.

- U.S. import prices remained unchanged in May, following a 0.1% rise in April.

- American consumers pulled back significantly in May, causing US retail sales to drop by 0.9%—a larger decline than anticipated and following a 0.1% loss in April. This weakening in spending occurred during a period of heightened apprehension regarding tariffs and geopolitical strains, though year-over-year sales still showed a 3.3% gain.

- In May 2025, the UK's CPI stood at 3.4% year-on-year, a modest decrease from the 3.5% recorded in April, its highest level in more than a year.

- While the Federal Reserve held rates steady in the 4.2% to 4.50% range, its "dot plot" revealed that its committee members now project the benchmark lending rate will fall to 3.9% by the close of 2025, signaling a potential for two rate cuts later this year to a range of 3.75% to 4%.

- The Federal Reserve lowered its economic outlook, now expecting GDP to grow by just 1.4% this year, compared to the 1.7% pace they had forecast in March.

- Amid the unpredictable nature of President Donald Trump’s trade policies and intensifying geopolitical risks, the Federal Reserve projects inflation will reaccelerate to exceed 3% this year, surpassing its earlier forecasts.

- The Bank of England, mirroring the Federal Reserve's decision, held its key interest rate steady at 4.25%. This move comes as the UK central bank grapples with a new challenge: escalating tensions in the Middle East that threaten to push oil and natural gas prices—and thus inflation—higher.

- Hoping to curb its rapidly appreciating currency, Switzerland's central bank slashed interest rates to zero. The Swiss franc has gained over 10% against the U.S. dollar this year, serving as a safe haven for investors amidst growing concerns over U.S. trade policy and Middle East tensions.

- Brazil's monetary committee (Copom) hiked its benchmark rate to 15%. This marks the seventh consecutive rate increase, pushing the rate to its highest level since May 2006. However, the central bank also indicated it might pause its aggressive tightening cycle at its next meeting.

- New Zealand's GDP grew by 0.8% in the March 2025 quarter, compared to the preceding December 2024 quarter.

- Headline inflation in Japan slighltly decreased in May at 3.5% from April's 3.6%. This marks the 38th consecutive month that inflation has exceeded the Bank of Japan's (BOJ) 2% target. Meanwhile, the "core-core" inflation rate saw an increase, climbing to 3.3% from 3% in the prior month.

- Despite recent efforts to support its economy, the People's Bank of China held both its 1-year (3.0%) and 5-year (3.5%) loan prime rates steady. Last month, Chinese authorities had reduced these lending rates by 10 basis points for the first time since October, aiming to mitigate the fallout from trade tensions with Washington.

- Investors have been on edge this week as the intensifying conflict between Israel and Iran sees both nations continuing strikes and their leaders exchanging heated rhetoric.

This Week’s Market Movers

Forex

- The NZD/USD is down more than 1%

- The USD/JPY is up more than 1%.

- The USD/SEK is up more than 1.80%.

- The EUR/RUB is down more than 3%.

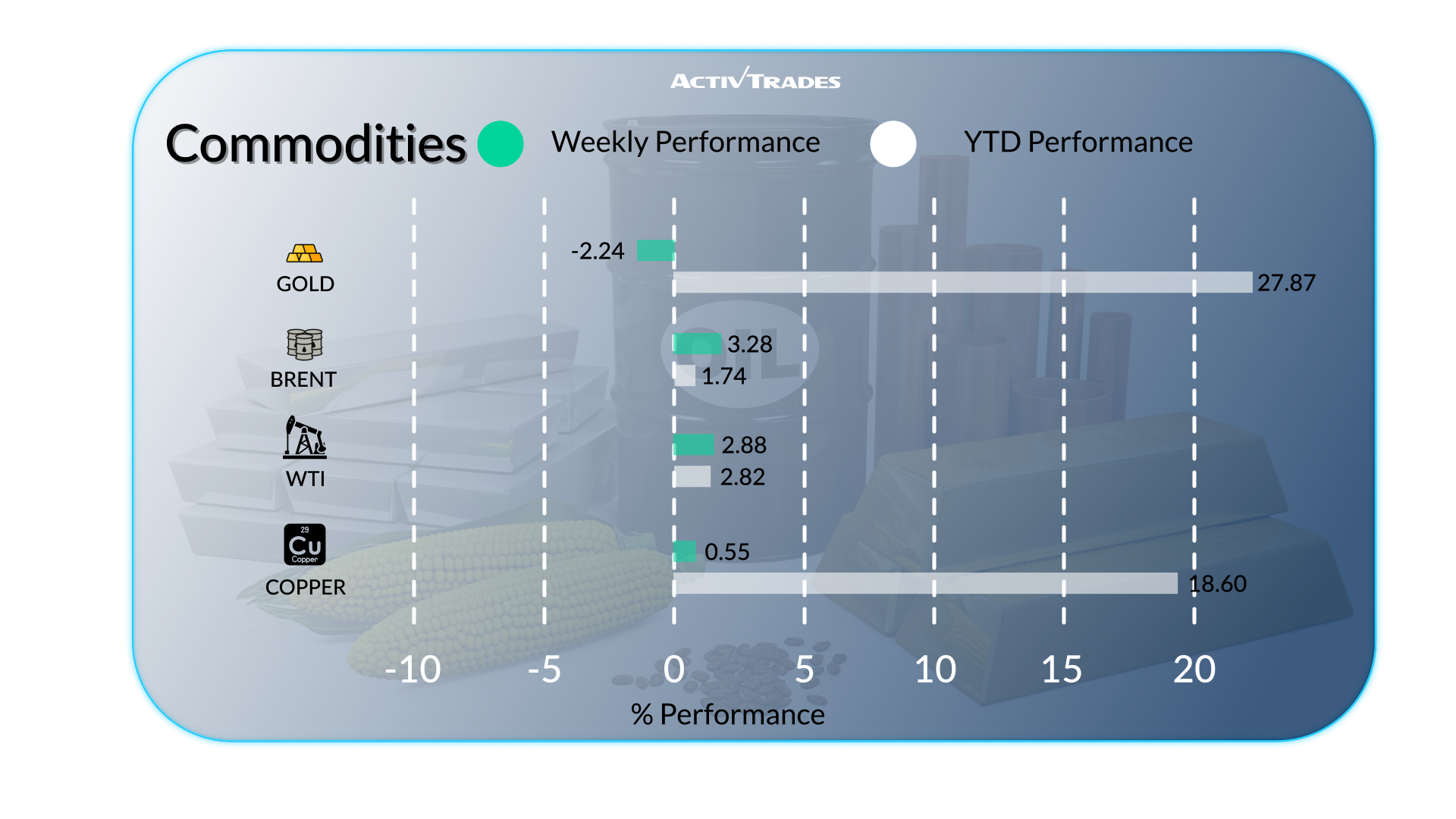

Commodities

- Light Crude and Brent futures are up more than 10%.

- Natural gas prices are up more than 16%.

- Lean hog futures are up more than 8%.

- Cocoa futures are down around 10%.

- Coffee futures are losing more than 7%.

Indices

- The VIX index is up more than 18%.

- The German MDAX index is down more than 4%.

- The Swiss SMI index is down around 3%.

- The Euro50 is losing more than 3%.

- The Hang Seng index is down more than 2%.

Shares

Tops

- Oracle : +18.77%

- Jabil : +15.31%

- Coinbase Global : +14.81%

- Eintain: +13,51%

- Bunge Limited : +12.54%

- Archer-Daniels-Midland : +10.43%

- Petrobras : +10.27%

- Embraer : +10.20%

Flops

- Enphase Energy : -20.34%

- Teleperformance : -16.45%

- First Solar : -15.49%

- Lululemon Athletica : -12.35%

- Usiminas: -12.19%

- Renault : -12.05%

- CVC Brasil: -11.83%

- United Airlines : -11.02%

- Applovin : -10.85%

- Lennar : -10.30%

- Corpay : -10.26%

- Builders FirstSource : -10.21%

This Week’s News to Follow

Monday 23 June

- 07:15 AM - French Manufacturing PMI Flash (June)

- Previous: 49.8

- Forecast: 50.5

- 07:15 AM - French Services PMI Flash (June)

- Previous: 48.9

- Forecast: 49.5

- 07:30 AM - German Manufacturing PMI Flash (June)

- Previous: 48.3

- Forecast: 49.5

- 07:30 AM - German Services PMI Flash (June)

- Previous: 47.1

- Forecast: 49

- 08:00 AM - European Manufacturing PMI Flash (June)

- Previous: 49.4

- Forecast: 50.4

- 08:00 AM - European Services PMI Flash (June)

- Previous: 49.7

- Forecast: 50.1

- 08:30 AM - UK S&P Global Manufacturing PMI Flash (June)

- Previous: 46.4

- Forecast: 46.6

- 08:30 AM - UK S&P S&P Global Services PMI Flash (June)

- Previous: 50.9

- Forecast: 50.5

- 02:00 PM - American Existing Home Sales (May)

- Previous: 4M

- Forecast: 3.9M

Tuesday 24 June

- 08:00 AM - German Ifo Business Climate (June)

- Previous: 87.5

- Forecast: 88.2

- 12:30 PM - Canadian Inflation Rate YoY (May)

- Previous: 1.7%

- Forecast: 1.5%

Thursday 26 June

- 06:00 AM - German GfK Consumer Confidence (Jul)

- Previous: -19.9

- Forecast: -19

- 12:30 PM - American Durable Goods Orders MoM (May)

- Previous: -6.3%

- Forecast: 0.2%

- 12:30 PM - American GDP Growth Rate QoQ Final (Q1)

- Previous: 2.4%

- Forecast: -0.2%

Friday 27 June

- 06:45 AM - French Inflation Rate YoY Prel (June)

- Previous: 0.7%

- Forecast: 0.9%

- 12:30 PM - American Core PCE Price Index MoM (May)

- Previous: 0.1%

- Forecast: 0.1%

- 12:30 PM - American Personal Income MoM (May)

- Previous: 0.8%

- Forecast: 0.6%

- 12:30 PM - American Personal Spending MoM (May)

- Previous: 0.2%

- Forecast: 0.1%

Major Earnings Reports to Watch

Wednesday 25 June

- Micron Technology

- General Mills

Thursday 26 June

- NIKE

- McCormick & Co

- Walgreen Boots Alliance

Source: Trading Economics, TradingView, and ActivTrades’ Data as of June 20 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.