Weekly Outlook

What Happened This Week?

- Manufacturing sector experienced its third consecutive month of contraction in May to its lowest level since November 2024 with new export orders hitting their lowest level since 2009.

- This contraction follows a two-month period of expansion. Prior to that expansion, the sector had contracted for 26 consecutive months.

- Factory activity in Asia declined in May. This slowdown was largely due to uncertainty surrounding U.S. tariffs.

- New orders from Taiwan, South Korea, and Vietnam saw significant drops.

- Tariffs on steel and aluminum are set to double to 50%, effective on Wednesday.

- The European Union (EU) stated this increase undermines ongoing trade negotiations with the U.S.

- The EU indicated it is prepared to implement retaliatory duties, but a EU trade team has been dispatched to Washington for further discussions on Monday.

- The global economy is expected to slow down this year to 2.9% according to the Organization for Economic Cooperation and Development (OECD), mostly due to uncertainty from changing U.S. trade policies.

- China's manufacturing sector contracted in May, with the Caixin PMI falling to 48.3. This was driven by a sharp decline in new orders, especially export orders, which hit their lowest since July 2023.

- Tariffs and trade tensions negatively impacted factory activity, though businesses are now more optimistic about a potential easing of these conflicts.

- Bank of Japan Governor Kazuo Ueda has indicated that interest rates will not be raised until the economy demonstrates sufficient resilience, leading to speculation that an increase is not imminent and that rates are likely to remain at 0.5% at the next meeting.

- The Bank of England plans to continue cutting interest rates. However, the pace and extent of these cuts are uncertain due to volatile global economic conditions.

- Eurozone inflation dropped below the European Central Bank's (ECB) target of 2% in May as it reached 1.9%.

- Swiss consumer prices dropped in May (deflation) with inflation down 0.1% last month. This is the first time Switzerland has seen deflation since March 2021.

- The Reserve Bank of Australia (RBA) considered a larger interest rate cut of 50 basis points in May, due to concerns about global growth and geopolitical tensions, minutes show. Ultimately, the RBA decided on a smaller 25 basis point cut, bringing the official cash rate to 3.85%.

- Key new challenges await new South Korea President Lee Jae-myung, especially navigating the political and economic instability left by Yoon's administration and Trump’s tariffs.

- Donald Trump's new tariffs on imported steel and aluminum (from 25% to 50%) are now in effect, which are likely to impact the US, as the country is the largest steel importer after the European Union.

- Brazil, Canada, Mexico and South Korea are its biggest source of steel.

- Annual economic growth in Q1 remained flat at 1.3% in Australia and increased 0.2% on a quarter-on-quarter basis, but it grew less than anticipated.

- U.S. services sector activity shrank in May, the first time since June 2024.

- The Bank of Canada (BoC) maintained its interest rate at 2.75%, primarily due to uncertainty surrounding U.S. trade policy and its inflationary impact on goods prices.

- In April, the U.S. trade deficit significantly shrank to its lowest level since September 2023, reaching $61.6 billion.

- This was largely due to a 16% drop in imports, with consumer goods, especially pharmaceuticals, seeing a substantial decline. Conversely, exports rose by 3% to a record $289.4 billion.

- The European Central Bank (ECB) has cut its main interest rate to 2%, marking the eighth such reduction and reaching its lowest level since early 2023.

- This decision further widens the monetary policy divergence between the ECB and the U.S. Federal Reserve.

This Week’s Market Movers

Forex

- The EUR/USD is trading at its highest level since 2022.

- The EUR/GBP up for the 2nd week in a row after 6 weeks in the red.

- The CHF/JPY is up for the 3rd consecutive week.

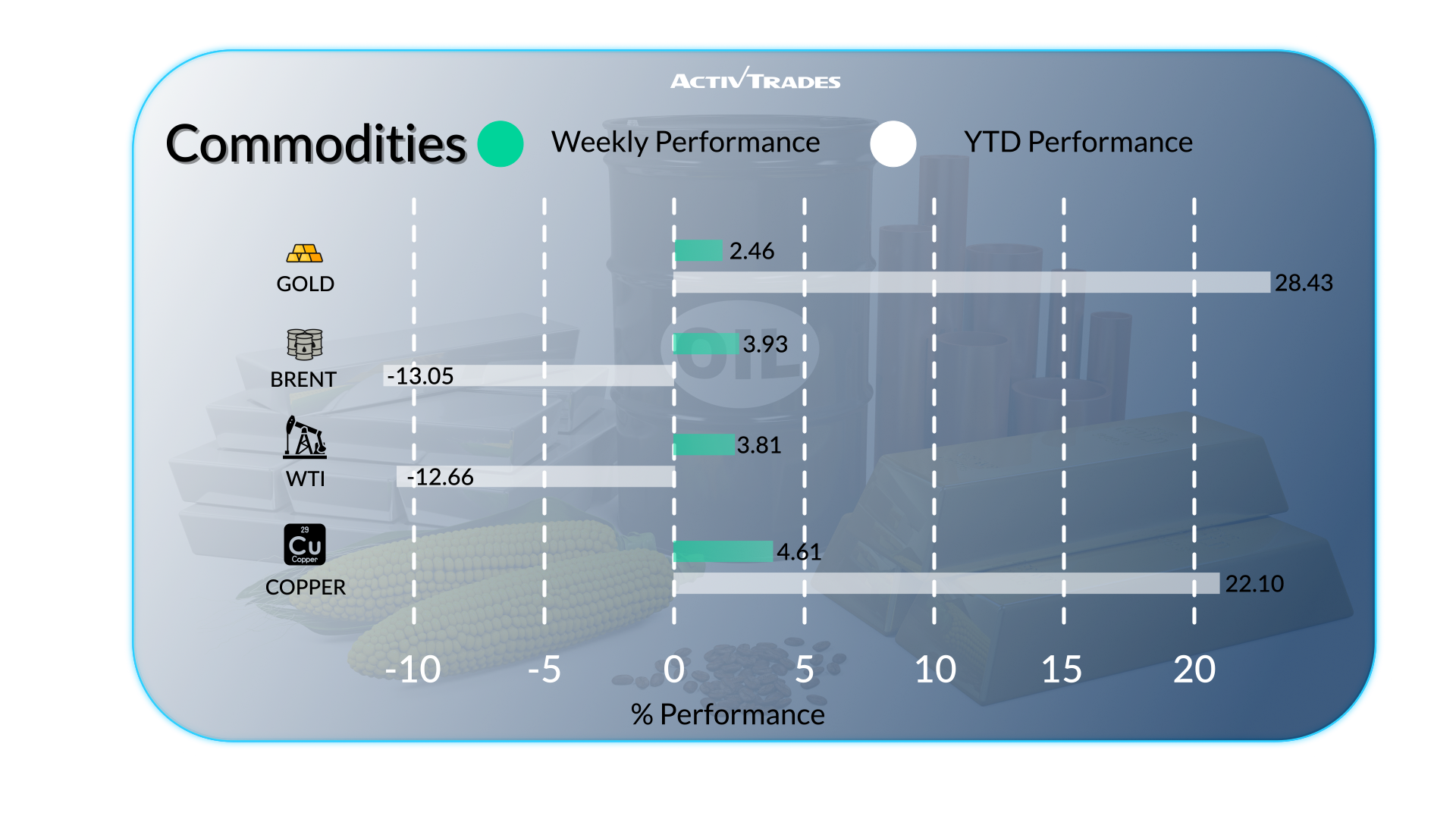

Commodities

- Silver 's price surges past $36, the highest in 13 years.

- Cocoa prices up after two weeks down.

- Natural gas up more than 7% over the week.

- Coffee prices up after 3 weeks down.

- Orange juice prices down after 3 weeks up.

Indices

- The DAX40 index is trading clost to its highest level above 24,285 points.

- The Brazilian index (Bovespa) is down for the 3rd week in a row.

- The UK100 index is up for the 4th consecutive week.

- The Hang Seng index is up more than 3.40% over the week - its largest weekly gain since the week of the 20th of April.

Shares

Tops

- Zscaler : 17.99%

- Babcock international : 17.55%

- Fresnillo : 17.26%

- Yduqs part: 13.37%

- On Semiconductor : 13.29%

- MRV: 11.95%

- StMicroelectronics: 10.63%

- Ulta Beauty : 10.06%

Flops

- Tesla : -22.06%

- Brown Forman: -20.20%

- Regeneron Pharmaceuticals : -19.09%

- The Cooper Companies: -11.84%

- Carrefour : -10.63%

- Braskem : -10.54%

- Texas Pacific: -10.37%

This Week’s News to Follow

Monday 09 June

- 01:30 AM - Chinese Inflation Rate YoY (May)

- Previous: -0.1%

- Forecast: -0.2%

- 03:00 AM - Chinese Balance of Trade (May)

- Previous: $96.18B

- Forecast: $70.0B

- 03:00 AM - Chinese Exports YoY (May)

- Previous: 8.1%

- Forecast: -4.0%

- 03:00 AM - Chinese Imports YoY (May)

- Previous: -0.2%

- Forecast: -3.0%

Tuesday 10 June

- 12:30 AM - Australian Westpac Consumer Confidence Change (June)

- Previous: 2.2%

- Forecast: 1.0%

- 01:30 AM - Australian NAB Business Confidence (May)

- Previous: -1

- Forecast: -3

- 09:00 AM - UK Unemployment Rate (April)

- Previous: -4.5%

Wednesday 11 June

- 12:30 PM - American Core Inflation Rate YoY (May)

- Previous: 2.8%

- Forecast: 2.9%

- 12:30 PM - American Inflation Rate YoY (May)

- Previous: 2.3%

- Forecast: 2.6%

Thursday 12 June

- 06:00 AM - UK GDP MoM (April)

- Previous: 0.2%

- 12:15 PM - American PPI MoM (May)

- Previous: -0.5%

- Forecast: 0.1%

Friday 13 June

- 02:00 PM - American Michigan Consumer Sentiment Prel (June)

- Previous: 52.2

- Forecast: 52.1

Major Earnings Reports to Watch

Monday 09 June

- Oracle

Tuesday 10 June

- Broadcom

Wednesday 11 June

- Industria de Diseno Textil

Thursday 12 June

- ADOBE

Friday 13 June

Nothing

Source: Trading Economics, TradingView, and ActivTrades’ Data as of May 30 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.