A forex economic calendar, also known as an FX calendar, is a tool that lets you quickly see what major upcoming events could affect the market. We’ll be looking at how to use this tool and what you can expect to learn from it.

What Is an FX / Forex Economic Calendar?

A forex calendar is a schedule showing the upcoming economic events and updates that can have an effect on the currency market. It's laid out in standard calendar format, but with filters that allow you to quickly search for the events and indicators that you're interested in.

No matter what currency pairs you want to trade, the FX calendar lets you see the big events that you should take into account when working out what might happen next.

FX Calendar Filters: Region, Impact, Category

As this is a global market, the forex calendar covers events from all over the world. To make it easier to use, there are a variety of filters listed that let you focus on what matters most in your strategy.

You can filter the FX economic calendar by region, such as the European Union (EU) or G7 countries. It’s also possible to filter by individual country or look at all the events relating to every country. Other filters include the level of event importance and the type, which is divided into holidays and economic events.

These filters let you focus on specific currency pairs and the news that moves them. If you’re looking at the EUR/USD pair, you’ll be most interested in the likes of interest rate news and monetary policy decisions from the EU and the US.

Using the Forex Calendar Today: Sessions, Alerts, Stand-Aside Windows

How should you use the forex economic calendar today to be effective? The forex market is open 24/5, so you risk being overwhelmed if you try to catch all the big events every day. There are economic data releases virtually every day, so you need to focus on the most important ones.

This is why it makes sense to focus on the main trading sessions. The Asia–London–US sessions are the most important, with the highest levels of liquidity and volatility at these times. But you should consider which is most crucial for the currency pairs you’re interested in trading.

The next point in your usage today of a forex calendar is to consider what the main news stories will break. This tends to happen during the key sessions above. It makes sense to set alerts just before high-impact events like employment data and inflation data.

Stand-aside windows are important periods where you take a break from trading. This is a form of risk management that sees you close your existing trades and not open any new ones close to the release of potentially high-impact news from central banks and other authorities. This is when the markets tend to be extremely volatile.

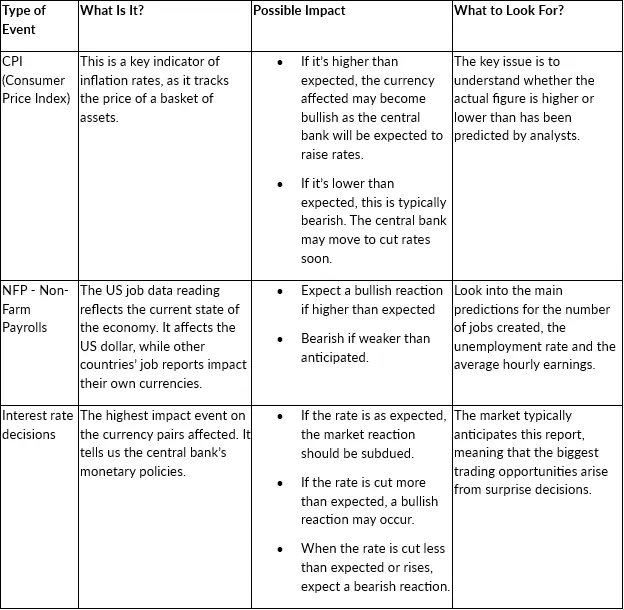

Event Playbooks: CPI, Jobs, Central Banks (FX, Indices, Shares)

To use the forex events calendar well, you need to understand the main events and how to interpret them. Here are the main events and what to look for in them.

Forex Calendar News View: Headlines Around Releases

You could use the FX news calendar as a type of news feed that lets you view the latest releases at all times. It gives you a way to check out real-time headlines and see at a glance the latest economic news around the world.

By using a calendar with forex news, you can also plan ahead. Look for the dates of the big events we’ve covered here. Then check to see what analysts are predicting. This lets you work out a strategy based on whether the results are expected or not.

Risk Notes Around Calendar Releases: Volatility, Spreads, Gaps

The release of economic data and other important news adds volatility to the markets. Many traders decide not to make any trades in the 30 minutes or so before one of the major events on the forex news calendar.

The forex market can have wild swings and false breakouts in the immediate aftermath of one of these events. The first few minutes after the announcement are generally particularly volatile and best avoided.

It’s a good habit to use smaller position sizes around major releases. You might also want to use protective orders, such as stop-loss limits, to ensure that you’re protected from big swings.

You might also notice a difference in the spread around big dates on the FX calendar. The spread is the difference between the sell and buy price. Lower liquidity tends to see it widen, which can affect stop-loss orders and increase losses.

Gaps suddenly occurring in the price because of a large jump are another issue. This can see the price jump over your stop-loss in a single movement. You might find that your orders are only partially filled in this case, or not filled at all.

Putting the Forex Calendar to Work: A Simple Workflow

Using the economic calendar for forex trading is a process that can be carried out by planning ahead. These short steps let you see how to get ready and then react to the news once it’s been released.

- Check the ActivTrades Economic Calendar. This is a solid starting point, as you’ll see all the big upcoming events on this forex news calendar.

- Mark key releases for pairs/CFDs. Not every release is going to interest you or cause an impact on the currency pairs you want to trade. Use the filters to narrow down your selection,

- Set alerts. Make sure you don’t miss any major event that could affect your trading.

- Decide on your stand-aside windows. At this point, you need to work out when you plan to simply stand on the sidelines and watch rather than risking a trade.

- Pre-define your risk management approach. This is the stage where you work out what position size you’re comfortable with and what stop-loss limits to use.

These economic events also affect other financial markets, like share trading and commodities. However, the impact is different in each case, so you should assess each area independently.

Economic Calendar Forex FAQs

Do I Need to Follow All the Events on the Forex Calendar?

No, the forex economic calendar covers a wide variety of reports and updates. You should focus on those which directly affect the currency pairs you plan to trade.

What Are the Most Important Elements on the Forex News Calendar?

Central bank interest rate decisions, employment news and inflation reports are the key economic events that forex traders need to be aware of.

What Is Trading the News?

This is a trading strategy that’s based on taking advantage of the volatility that’s often seen following major economic data releases. This is a high-risk strategy, which explains why many traders prefer to take a break during this highly volatile period.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.