There may not be a secret sauce for getting it right all the time in the markets, but there are plenty of sure-fire ways to frequently get it wrong as a retail trader.

And with almost four decades in the markets, I have seen most of them in action.

What’s more, I have seen retail traders make the same mistakes over and over again, without appearing to learn from their experiences.

No one gets it right all the time

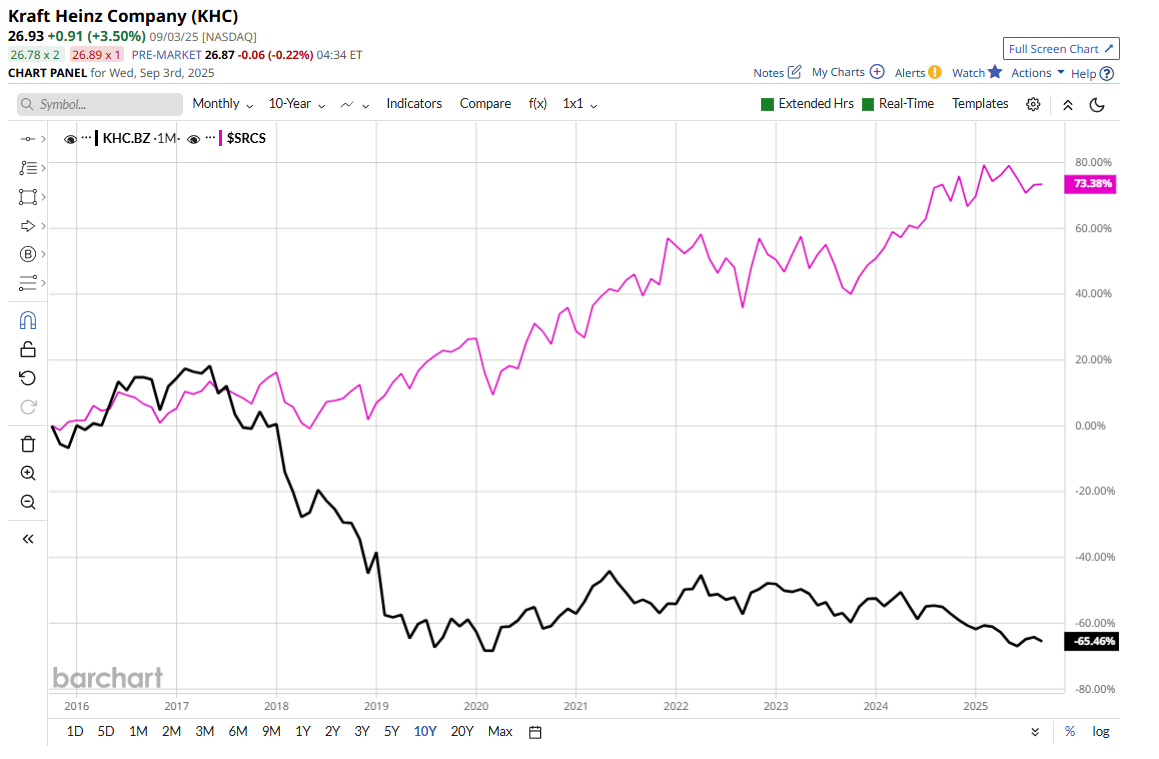

Not even Warren Buffett, who admitted this week that the merger of Kraft and Heinz, which he helped to engineer a decade ago, hadn’t worked out as he expected.

Kraft Heinz KHC US vs the S&P 500 Consumer Staples Sector Index over 10 years

Source: Barchart.com

One thing we can be sure of is that even in his 90s, he will be factoring that “error ”into his investment process.

Making mistakes is part of trading the markets, and they are acceptable, as long as you learn from them.

However, not learning from them likely means repetition and the ruin of your trading account balance.

So, where and why Do Retail Traders Get it Wrong?

I got involved in a conversation about this very thing on LinkedIn this week, with trading mentor Patrick Reid.

Patrick’s point was that the idea that Hedge Funds and HFTs are “out to get retail clients” is misplaced.

Not least because they have far more important fish to fry, and don't waste time and resources looking for retail stop loss levels.

I completely agree with him here.

That’s not to say that retail flow isn’t of interest to Hedge Funds and HFTs, because it is.

We only need to read headlines like this to see that

"Citadel Securities paid US$943m for retail US equity, options order flow in nine months"

Source: Global Trading.Net Dec 2024

However, these firms are interested in the collective flow and the opportunity to make modest amounts of spread on large cumulative trading volumes, rather than individual trades.

Nvidia NVDA US trades an average of 116.75 million shares per day, right now.

A large proportion of which is likely driven by retail traders, capturing that order flow systematically or even buying it in, and making a small turn on the majority of it, is likely to be a very lucrative business indeed.

As I commented on LinkedIn:

“Retail traders get it wrong because of a lack of, or poor processes, and ill discipline around money management, risk reward, and (mis) reading the market. “

Traders are very fond of looking for scapegoats to blame their losses on, be that stop hunters, their trading platforms, other market participants or even wider conspiracies.

What they are often reluctant to do is to look at the way they traded.

Their process, including how they chose the trade, sized it, calculated their risk reward ratio, how it sat within the exposure/money management rules and whether they thought about how the trade would sit within their existing positions.

Remember, having multiple positions won't always equate to diversification, particularly where a common denominator, such as the US Dollar, is involved.

You need to have a sound well well-crafted trading plan, a rules-based way to approach the markets.

You also need to stick to that plan and its money management/exposure rules.

Stop losses are there for a reason, which is to protect your capital, without which you won’t be able to trade at all.

On top of that, you need to understand and respect leverage, which, if used correctly, can enhance your trading profits. However, if used incorrectly, it can diminish them just as efficiently.

And that can be a real problem if, for example, you have been using a running, but unrealised profit, as part of your account equity, to provide you with margin on other open positions.

Think about how you are going to find your trades, what markets you will trade in, and your time horizons, etc.

In front of me on my desk right now is a handwritten note that says:

“Process is greater than all else”

That’s there to serve as a reminder to me not to deviate from my systematic approach.

Not to shoot from the hip or indulge in what’s known as curve fitting.

Where you take a position and try to justify it retrospectively, shoe-horning it into your process, or telling yourself that it meets your criteria.

Because, as I was reminded this week, wanting something to happen and having a clearly reasoned expectation that an event or price movement will occur are two very different things, with two very different PnL outcomes.

This was an expensive lesson and reminder, but ultimately it will be worth it because I won't be making that mistake again.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.