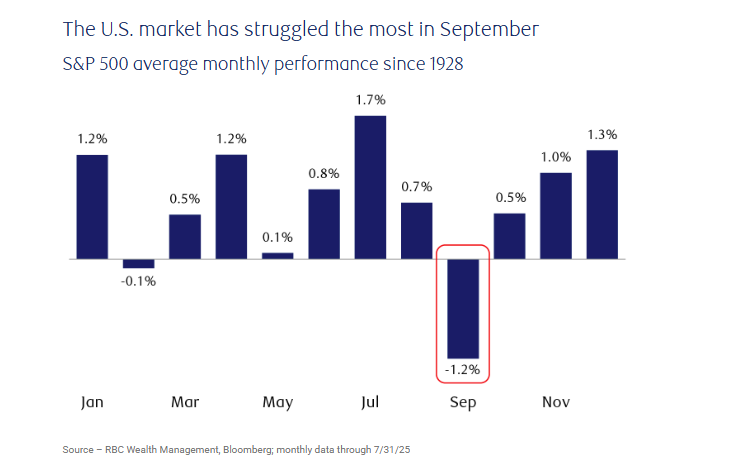

September can be an awkward month for the equity markets; it has a reputation for being the worst-performing month for the S&P 500 index, with, for example, an average decline of -1.15%, during September, dating back to 1928.

S&P 500 Average Monthly Performance since 1928

Source: RBC Wealth

Money manager RBC Wealth highlights that the last 5 Septembers have hosted greater than average declines in the blue chip index, with the S&P 500 falling by an average of -4.20% in the month, during this period.

September does seem to punch above its weight in terms of downside risk, and 9 out of the 40 worst monthly declines in the S&P 500 have occurred in September.

September eclipses its neighbours. For example, October (which is itself associated with market crashes) has only hosted 6 of the 40 worst monthly drawdowns.

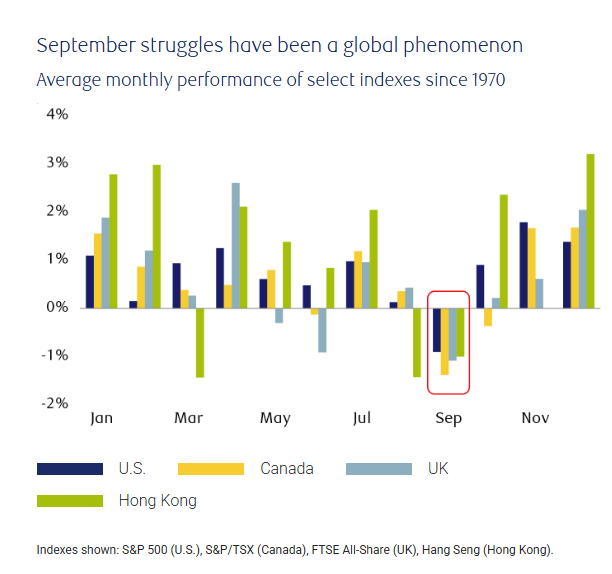

Nor is weakness in September confined to US equity markets; similar trends have been identified in Canada, the UK and Hong Kong.

Source: RBC Wealth

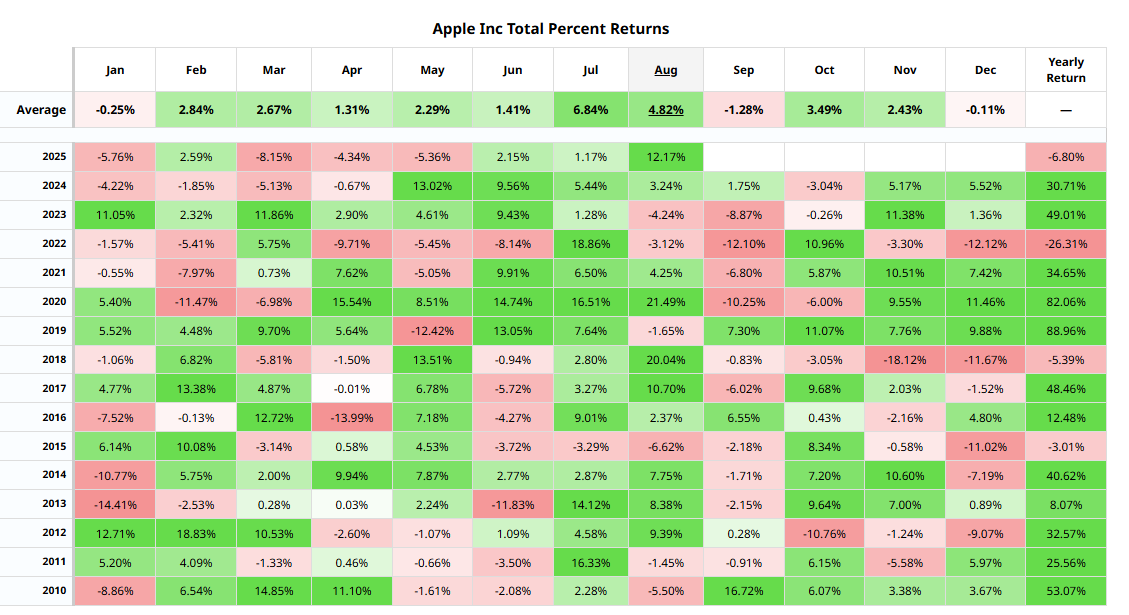

Individual stocks can also suffer from performance issues in September

Take Apple AAPL US, as an example, the table below shows the monthly performance of the stock, dating back to 2010; the average return is -1.20%. One of only two months in the year, over this period, that AAPL tends to decline.

Apple has also suffered from above-average declines in September on 4 of the previous 5 occasions.

Source: Barchart.com

What's behind this phenomenon?

Seasonality in purely financial markets is hard to quantify, though we can probably attribute the weakness in September to the calendar and trader psychology.

The month follows on from Q2 earnings season, and marks the end of the summer holidays in the Northern hemisphere, and it is the start of the final quarter of the year.

Profit taking to lock in P&Ls and bonuses, to pay bills, and to provision for tax demands, likely play their part. Nor can we ignore the concept of self-reinforcement, under which an event becomes well known or familiar to traders and thus self-perpetuating to a certain extent.

Will we see negative performance this time around?

The stats suggest it's possible, perhaps even likely.

The outcome will likely be driven by macro factors, for example, the recent US appeals court ruling that Donald Trump's reciprocal tariffs are illegal, the worsening political and financial situation in France, and ongoing negotiations over the conflicts in both Gaza and Ukraine, are all potential banana skins for the market.

Add that to high hopes of a September rate cut in the US at the FOMC meeting on September 17th, and ongoing political pressure on the Fed from the White House, and you have quite a cocktail.

As one headline puts it:

“The independence of the Fed is hanging by a thread”.

The August Non-Farm Payrolls data on Friday will get the ball rolling. Will we see further revisions to the previous data, I wonder, as we did last month? And if we do, who or what will President Trump vent his anger on?

Of course, September could pass by without a major upset or small drawdown at worst, and there will always be opportunities for traders, however we finish the month.

Strategy brainstorm

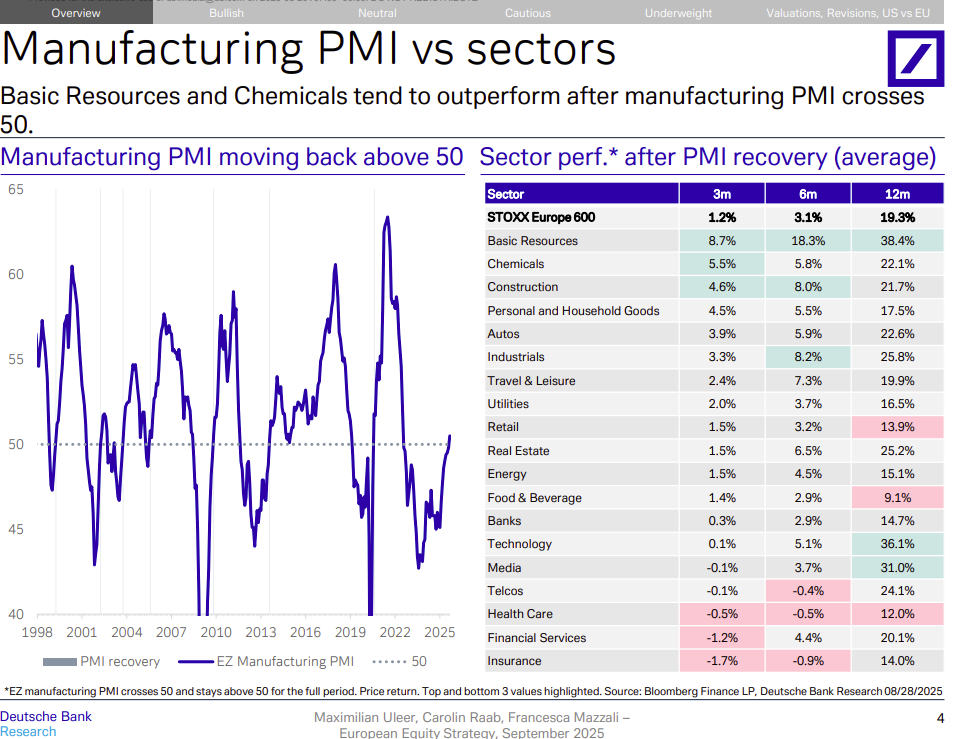

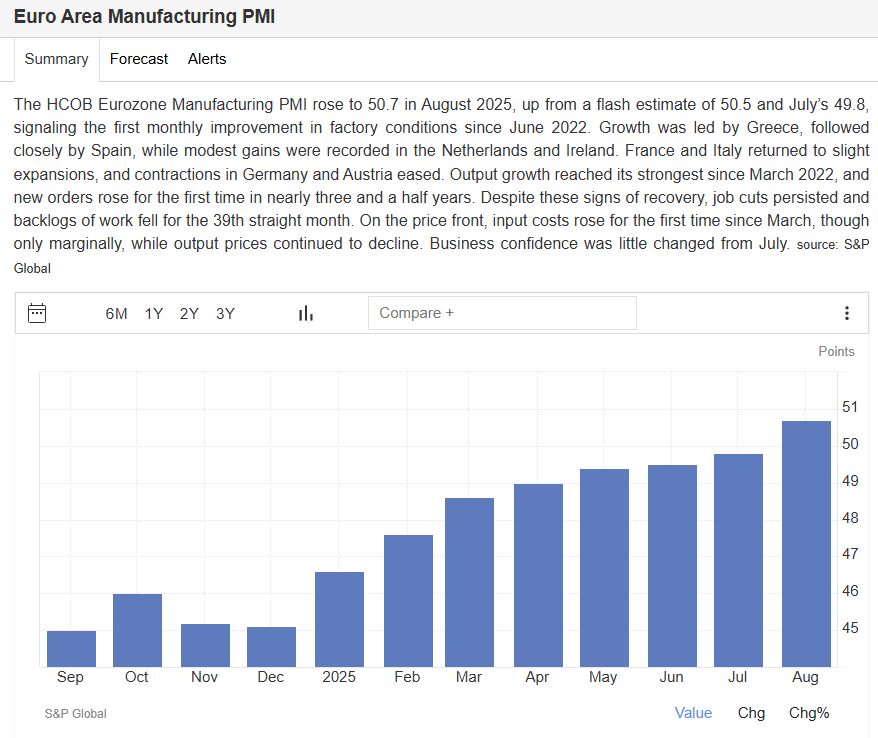

Deutsche Bank recently published a European equity strategy note, which, amongst other things, contained the table below, which shows us the reaction of equities/sectors across the continent, to an improvement in Europe’s Manufacturing PMIs, a key gauge of economic activity.

Source: Deutsche Bank Research

PMI readings above 50 indicate economic expansion or growth

The most recent figures, for August, show a reading of 50.70% for European Manufacturing PMIs, meaning they are back in expansion territory.

True, the August data was the first reading in 2025 that came in above 50; however, it forms part of an uptrend in the data, suggesting that European manufacturing is recovering despite ongoing economic challenges, boosted perhaps by growing investment in data centres and defence.

Source: Trading Economics

If the PMI recovery continues, then cyclical stocks and sectors such as Basic Resources, Construction and Chemicals are expected to do well according to the Deutsche Bank research.

Discretionary sectors such as Autos and Personal and Household Goods are seen as picking up later in the cycle. While Technology and Media ultimately register the biggest gains. However, they don’t show up until 12 months after the PMI recovery gets going.

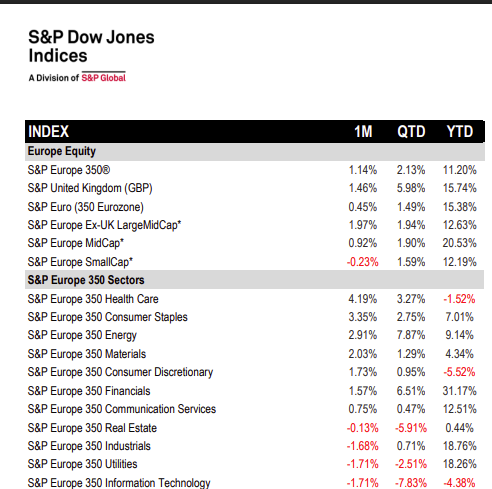

Looking at the performance of European equities at a sector level over the last month suggests that the market isn't currently factoring a manufacturing PMI recovery, and associated sector rebounds, into the price as yet.

Source: S&P DJI Global Indices

Though I note that the materials sector was positive during August, as it was over the prior quarter and year-to-date.

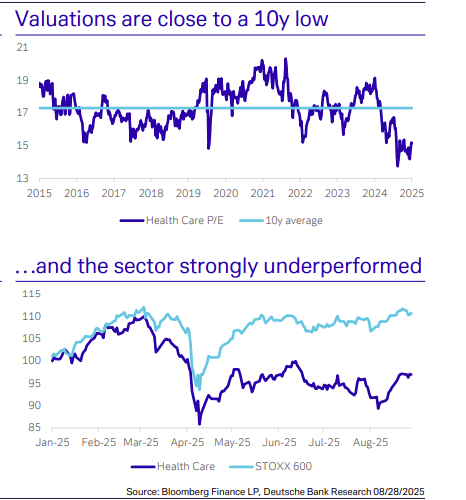

Deutsche Bank's top pick at a sector level in its strategy note is Healthcare, which, in its view, now has lower tariff risks, valuations that are close to 10-year lows and the potential for “strong EPS growth.

Note that the sector added +4.19% in August, according to the data from S&P Global Indices above.

European Healthcare sector valuation and performance

Source: Deutsche Bank Research

Seasonality in September and Deutsche Bank’s view on European equity strategy may not appear to have much overlap at first glance, but these are just the kind of inputs that can help traders identify trading opportunities and to manage their risk in the month ahead.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.