One thing a trader needs is a ready flow of trade ideas and opportunities. Generating and recognising that flow of ideas and opportunities can take up the majority of traders time, depending on how and what they trade. The balance of traders' time is likely to be taken up with execution, alongside trade money and exposure management.

However, there are some shortcuts and hacks we can use to simplify that process and help us to identify trades with a higher probability of success.

I thought it might be a good idea to look at some of the ways I surface trade ideas, which might provide you with some inspiration and starting points.

Local knowledge

If you want to get the best out of a holiday or even the neighbourhood you live in, some local knowledge goes a long way. For example, the locations of good restaurants and bars, shortcuts to avoid the crowds or traffic jams, or even that corner of the park, or the beach that nobody goes to.

The same is true of equity markets and sectors. If you know something about stocks in a particular market or sector, and have an idea about what the drivers of price change are in them. Then you have an edge over those traders who don’t .

One stock that I had some local knowledge about was memory chip maker Sandisk SNDK US which was spun off from its parent, Western Digital WDC US, earlier this year.

I posted about Sandisk on 16-06-25 saying:

“(I) quite like the look of SNDK US -recently IPOd,(and) an old fav of mine before they got taken over back in the day”

The green vertical line shows when I made my comments, as you can see the stock didn’t take off immediately. In fact it drifted sideways for a couple of months, but on 21/08/25 something changed.

The stock price bounced away from support, and the 10 day MA line started to move higher, having crossed above the slower-moving 50-day MA line a few days before.

The price went on to break above its prior highs, just below $50.00, on 28/08/25.

And in early September, it posted the first of a series 5 gaps higher, in the share price, with the stock moving from $52.62, to as high as $96.49 in a matter of days.

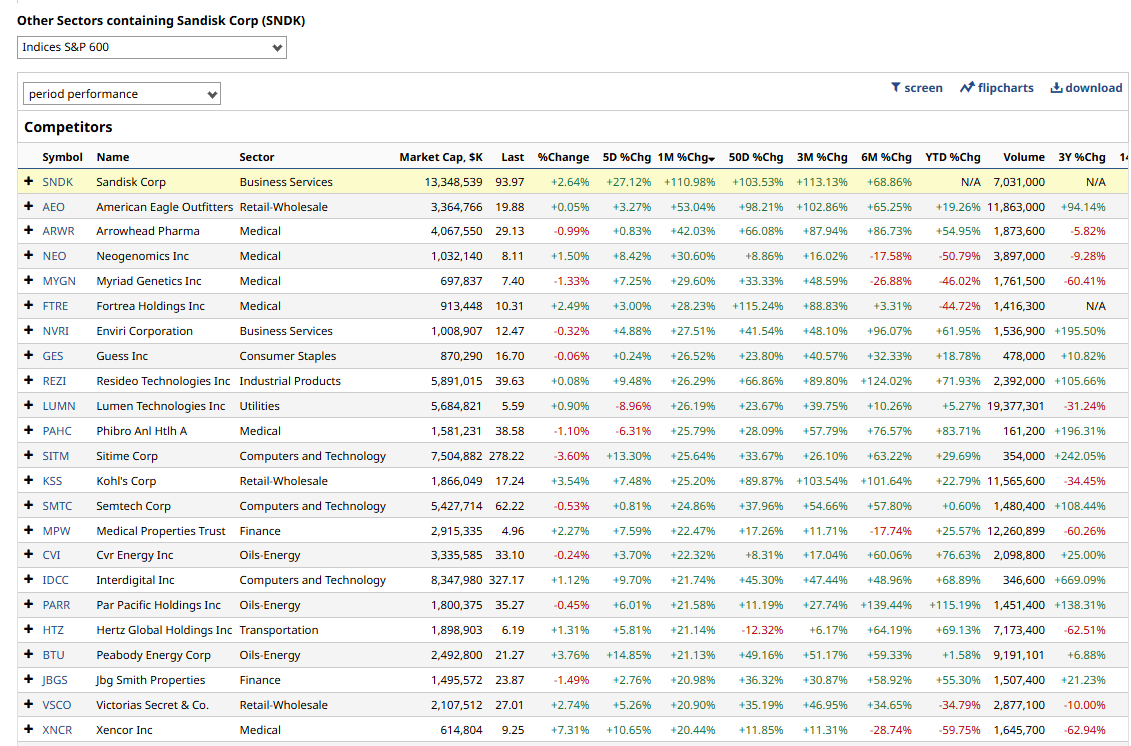

In fac,t if we look at the stock's performance, over the last month, we find it’s rallied by +110.0% making it comfortably the best performing stock in the S&P 600 index over that time frame.

Paying attention

Whilst you may know some stocks well, you can't hope to know about all of the thousands of stocks and other instruments that are out there. But perhaps you don't have to, because of network effects.

Think about this; if you know 50 stocks well, but you also know 10 other people who are each familiar with 50 other stocks, then between you have insight into 500 stocks.

And of course those networking effects can be amplified exponentially by social media and trading communities.

Here is an example of a stock that I knew nothing about, but which contacts of mine were interested in. and they appeared to have a handle on what was happening in it,

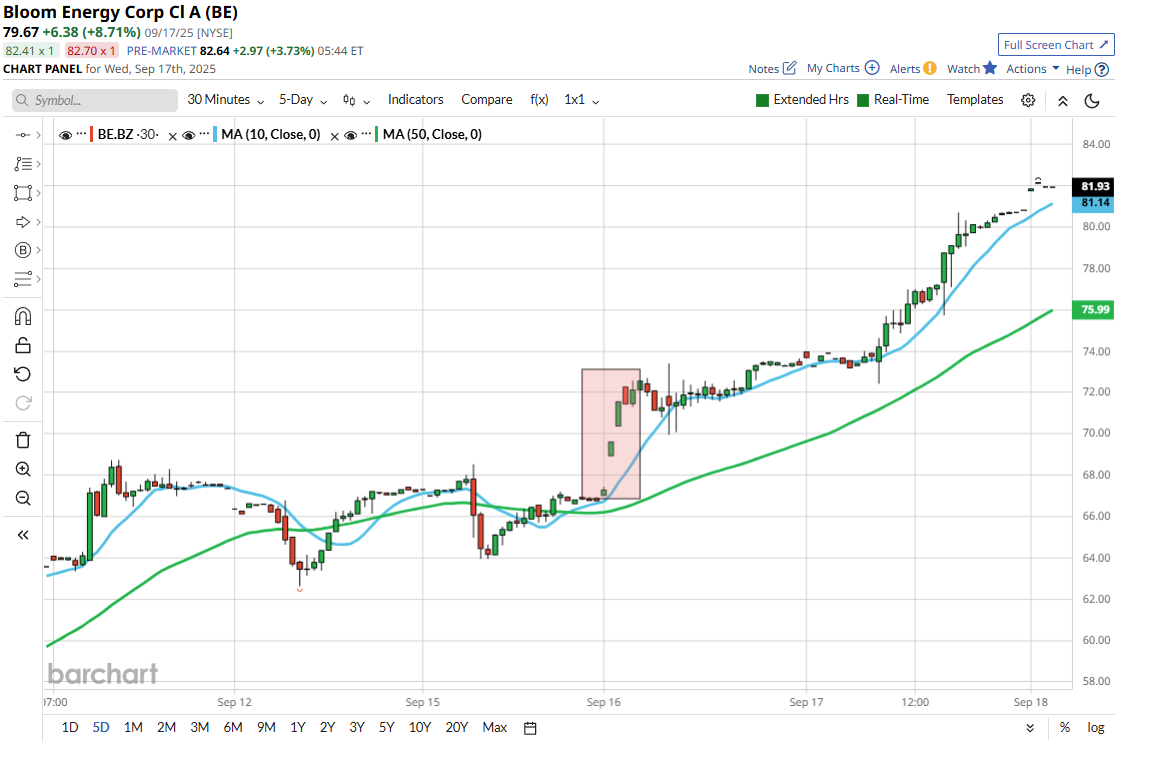

The stock in question is Bloom Energy BE US.

Here is the six month percentage chart for BE US which has added +222.0% in that time frame, most of those gains have been delivered in the last couple of months.

A quick search of X (formerly Twitter) using the search terms Bloom Energy and $BE, reveals plenty of comment, charts and news flow on the stock, including news of contract wins and broker upgrades.

Now of course you have to have your wits about you when you use social media to gather information on stocks, because not everybody on there is honest, many people are talking their own book, and some may be outright liars.

However, you should be able to get a sense of what’s genuine and useful, and what’s flim flam, clickbait, just plain misleading/wrong, or worse.

This is the kind of information and news flow you are ideally looking for

And here is the reaction in the Bloom Energy stock price following that upgrade

I have picked two real-world examples of idea/ trade generation, both of which have played out very well in recent weeks.

Neither trade required expensive charting or trading systems or news feeds, just the right knowledge and application. If you knew where to look and what to look for, then all the information was out there and up for grabs. When charts, fundamentals, technicals and sentiment align in a stock then there will nearly always be a significant response in the price action, which is exactly what traders want to see.

In the next part of this article, I will look at how we can use simple tools and parameters to create short lists of potential trading opportunities.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.