What can we learn from Q2 earnings season data?

Q2 earnings season in the US isn't over, however, the vast majority of large-cap companies have now reported.

On balance the data has been pretty positive this time out, with almost 80% of the S&P 500 constituents, that have reported, posting a positive earnings surprise.

A figure that’s above both the five and ten-year averages for the percentage of earnings beats, which sit at 77% and 73% respectively, according to data from research house Factset.

What's more 65% of those S&P 500 companies reporting Q2 earnings, have beaten on revenues, as well.

Overall the S&P 500 stocks have beaten analysts' earnings expectations by an impressive 7.2%, that’s below the 5-year average of 8.4%, but above the 10-year figure of 6.4%.

However, as always, the devil is in the detail. And though we have seen many upside surprises, earnings overall have declined year over year.

Or put another way S&P 500 companies earned less in Q2 2023 than they did in Q2 2022.

In fact, aggregate earnings in the S&P 500 are down by -5.20% over the last 12 months and that's the sharpest drop in almost three years.

A sharp decline

The fact that we have seen such a sharp decline in earnings raises several questions such as what could be the cause of falling earnings over the 12- months to the end of June 23?

We can't really blame the underlying US economy for the decline, because quite frankly that’s been picking up surprisingly well, and outperforming its peers.

As we can see in this chart, which tracks the surprise factor contained in economic data releases in the US, the Eurozone and the G10 economies, over the last two years.

Positive news in the US economy has been pretty consistent since June 2022 and picked up pace once more during April.

Higher prices lower earnings?

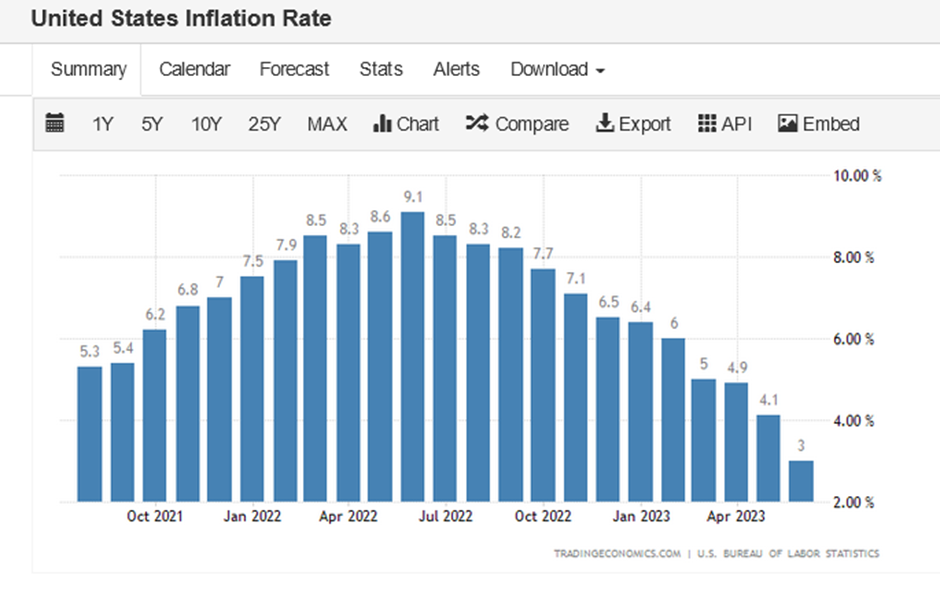

Tempting though it is to try and lay the blame for the year-over-year earnings drop, at the door of inflation, in reality, prices in the US have fallen sharply since June 2022 from a print of 9.1% then to just 3% in June 2023.

So we need to dig a bit deeper to highlight what’s behind the underperformance. And if we look at where the biggest earnings decline came from we find that Energy, Healthcare and Materials stocks were the laggards.

In fact, S&P 500 Energy sector stocks saw their earnings drop by more than half this year (-51.40%) when compared to Q2 2022. Whilst Materials and Healthcare stocks saw their Q2 earnings decline by -28.7% and -27.7% versus the same period last year.

We can quickly identify why energy companies saw their earnings slashed, by simply looking at what has happened to oil prices between June 2022 and June 2023. See the chart below.

Barchart.com

Underperformance in the materials sector can probably be explained by the dip in other commodity prices, as represented by the CRB Index shown here.

And the drop in Healthcare earnings can be attributed to a post-pandemic normalisation in Healthcare spending.

Not a one-way street

However, not all sector earnings were down on the year Consumer Discretionary stocks saw their earnings bounce by 52.1% as consumption defied talk of constrained householding spending and a possible recession.

Whilst earnings in the Communication Services sector jumped by 18.7% compared to 2022, a rebound in online ad spending benefiting the likes of Alphabet and Meta Platforms.

So where does all this data leave us?

Q2 earnings are certainly a mixed bag and one that doesn't have too many clear trends but what about valuations? If we look at the S&P 500 as a whole then it sits on a 12-month forward price-earnings ratio of around 19.20 times which is above both its 5 and 10 -year averages.

What's more Wall Street analysts are forecasting very modest earnings growth in Q3 2023 with average growth rates estimated to be just 0.20% with Q3 revenues expected to grow by just 1.30%.

None of this suggests that the S&P 500 should be trading at a premium rating and that may help to explain the pullback seen in the index during the early part of August.

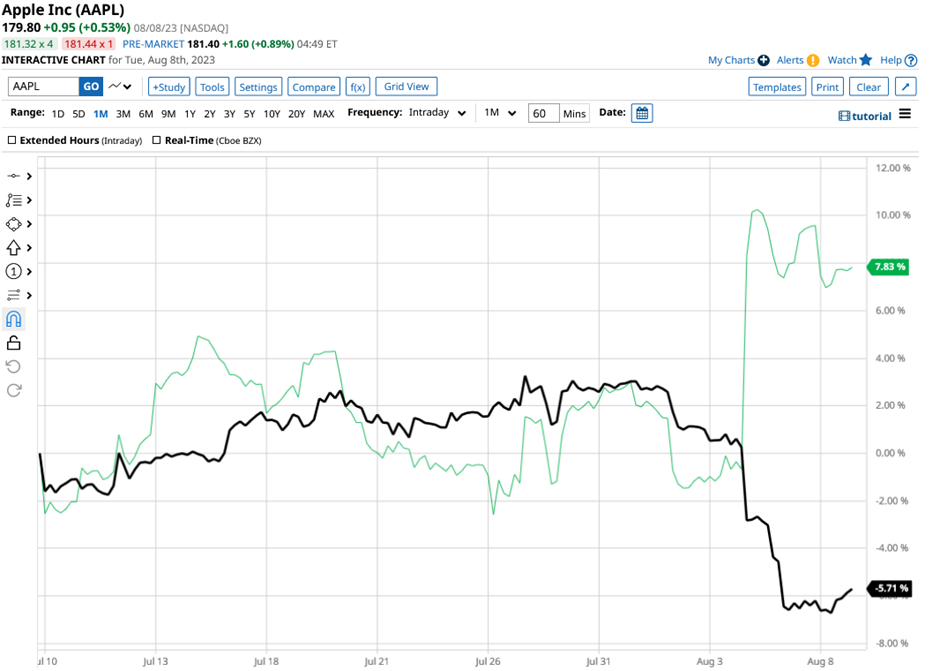

But here’s the thing I said 2023 was likely to be a stock pickers year and not one in which we coud use a broad brush approach as we did in 2020/21. And I think that this sentiment still holds, and is encapsulated perfectly in this final chart which captures the % change in Apple (AAPL) the black line and Amazon (AMZN) the green line, over the last month during which time both stocks reported Q2 numbers.

Barchart.com

This level of divergence between two of the mega-cap 7 stocks suggests to me that the run into year-end could be very choppy indeed. Perhaps to the extent that we don't have a clear trend in the S&P 500 index in the final three months of the year.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.