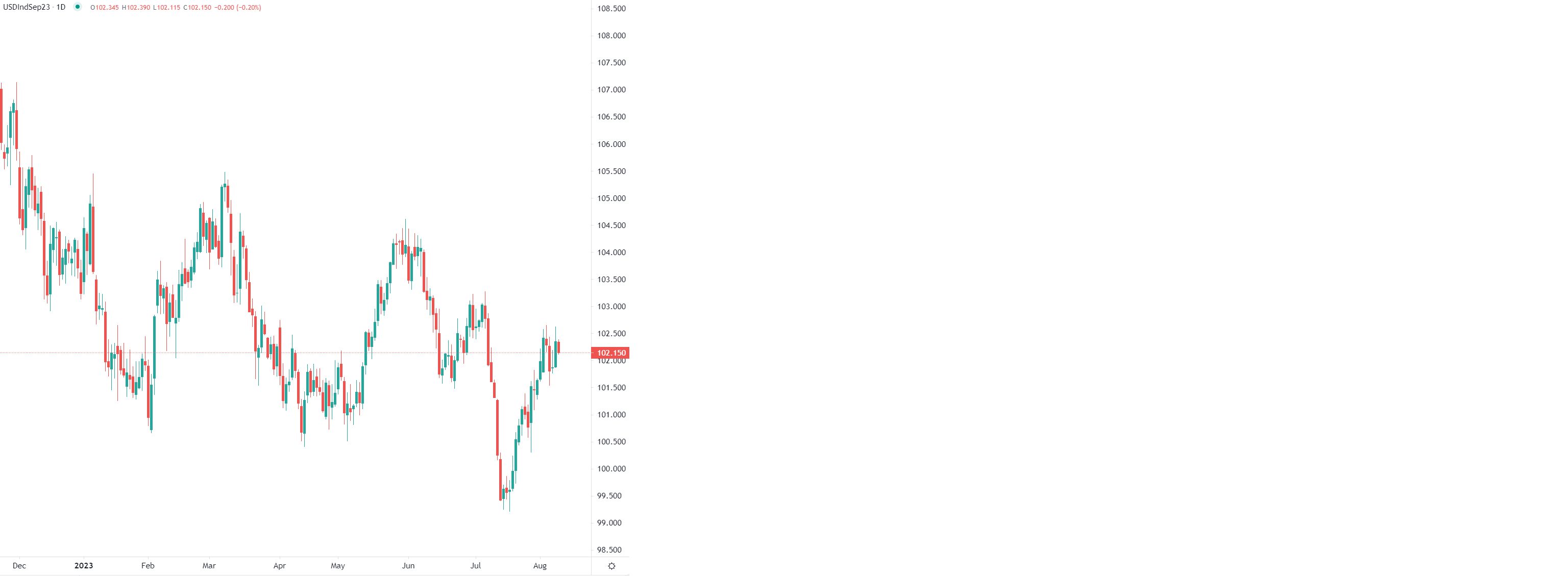

FOREX

The US dollar is on the back foot as the European trading session gets underway, cancelling some of Tuesday’s gains. Yesterday’s drop in risk appetite was felt across the board in financial markets and ended up benefiting the safe-haven dollar. However, today the tune has changed and investors seem to be more optimistic, with the positive sentiment reflected in dollar losses and gains on the stock market. But the weakness of the greenback may not last for long; Chinese inflation data showed that consumer prices have barely moved in July, confirming that the world’s second-largest economy is stalling and may be moving into deflation. Against this background, any greenback losses will be limited as worries over the prospects of the global economy could soon reignite dollar demand.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

Equity markets continued to climb everywhere in Europe on Wednesday, despite Asian shares closing mixed, while US Futures also point to a higher open amid bullish sentiment.

Uneven macro data from China earlier this morning didn’t dent risk appetite in Europe, as the STOXX-50 index is trading close to its first technical resistance towards 4,350.0pts, led higher by all sectors, with Tech and Energy shares as the top performers so far.

Thanks to dip buyers, equity markets have proven to be resilient to uncertainty triggered by Moody’s downgrade of a batch of small and mid-size US lenders and its announcement that the same could happen to major banks.

This strong market sentiment is partly fueled by expectations of more dovish monetary policies after some US FED officials hinted the tightening campaign could soon be over, laying the groundwork for a potential pivot in 2024.

With the lack of any major macro data today, apart from the US Crude Oil Inventories later in the afternoon, investors’ focus is likely to be drawn to the next US CPI report due tomorrow.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.