If asked, I would say that I don't believe in manifestation or cosmic ordering, however, I can't deny that there was something odd, if not slightly spooky going on in recent days.

It all started when something caught my attention on Instagram.

What was it?

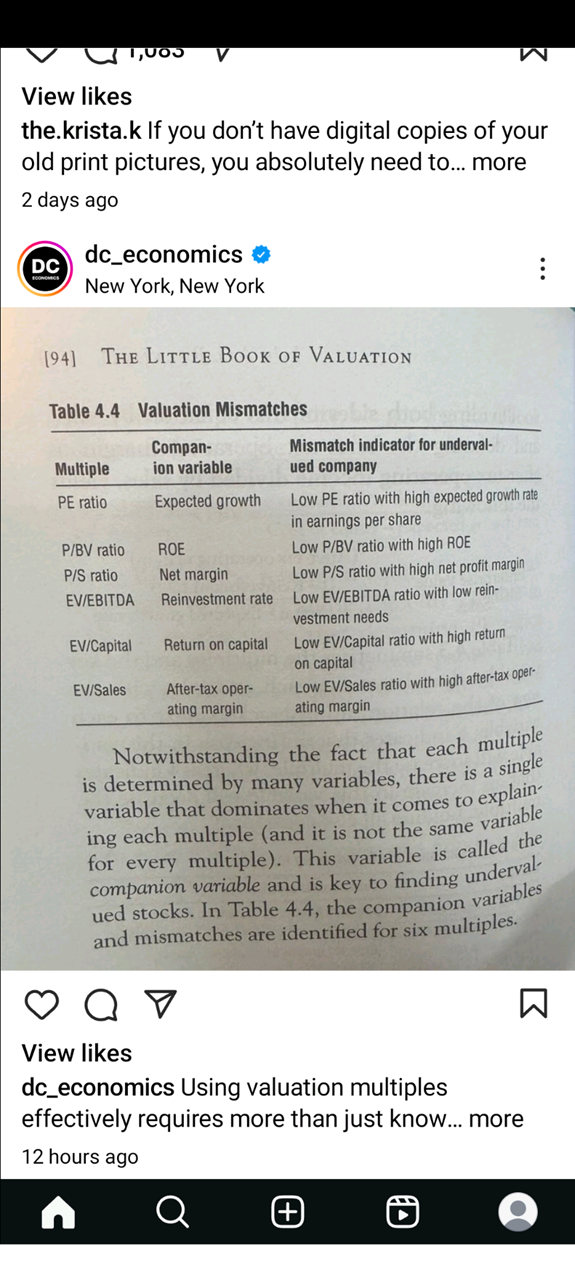

Well, It was a photograph of a page from a book. A book on equity market valuations, and more specifically a cheat sheet, on what I would call “valuation mismatches”.

Now, I wouldn't normally expect to see that sort of thing in my instagram feed. In fact I can't remember ever seeing this sort of post there before.

What's more the post referred to the work of Aswath Damodoran, a highly respected academic at one of America's leading business schools, and a leading authority on company and market valuations.

I know who Professor Damodoran is, because he is kind enough to share some of his valuations spreadsheets online.

Indeed, I had been looking at some of this data recently, but it’s very niche, market geek type stuff.

I decided to screenshot the post on instagram, so that I could refer back to it later.

The screen shot in question

Source: Instagram/DC Economics

My thinking in all this, was that following on from the recent article(s) Fundamentals that can aid your trade in 2025 Part 1 and 2.

It would be interesting to see what other valuation metrics and combinations might highlight undervalued companies, and trading opportunities to us.

A surprising conversation

But before I had started digging into that, I found myself in a conversation on Discord, about equity valuations and fundamentals,a conversation which touched on many of the very things that I was intending to explore.

I didn't prompt or start this conversation. Nor was I an active participant in it. Instead, I was a very interested observer.

As a parting comment, I said I was going to be writing about valuations today and screening the market for opportunities, based on some new ideas I had come across.

The next thing I did was download some S&P 500 data, specifically a ticker list combined with some fundamental ratios, using the cheat sheet above as reference.

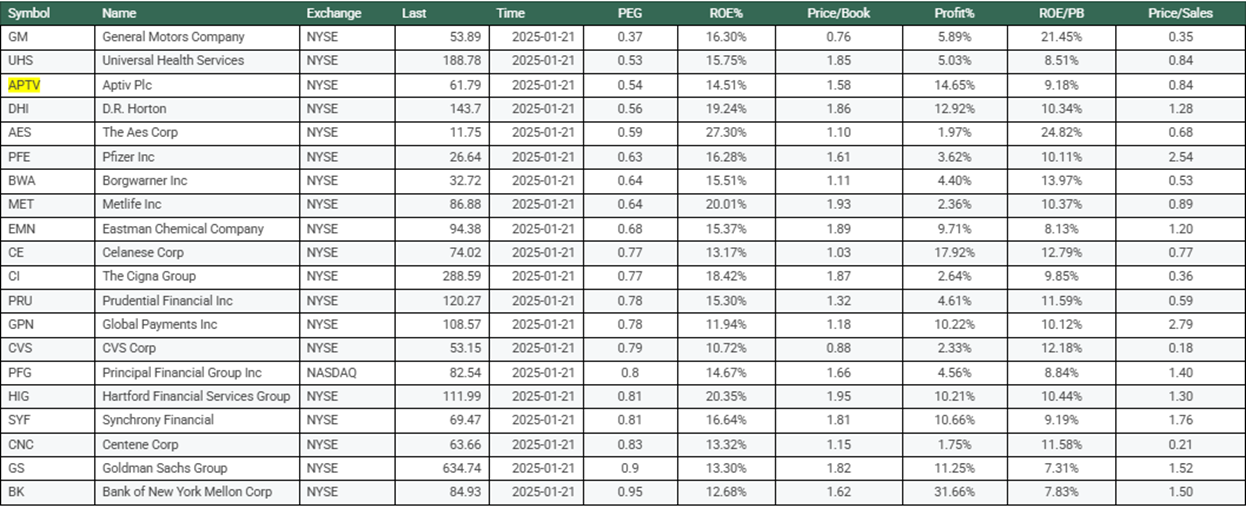

As I usually do, I screened the list of the S&P 500 stocks looking for those that met certain criteria.

In this case those names which had a low price to book ratio, combined with a high ROE or return on equity.

I then added my own filter by looking for stocks that had a low PEG, or price earnings growth ratio, which trimmed the list down to the 20 names you see below.

So what’s made me sit up and take note?

Well just look at the third entry on our list: Aptiv PLC Ticker APTV US.

A mini conglomerate which operates in the aerospace, transportation, telecoms and industrial markets.

S&P 500 Stocks with low price to book ratio, combined with a high ROE (return on equity) and low PEG (price earnings growth ratio)

Source: Darren Sinden

The stock has added +5.00% today and that's unusual.

In fact it's a three standard deviation move, which means that we should see a move of this size in the Aptiv share price, no more than once a year.

If we look at the Aptiv Chart, we find that in fact we had already had a much bigger, downside move back in November and that since then the stock price has been trying to recover.

Source: Barchart.com

Right Place, right time

It turns out that Aprtiv reaffirmed its full year guidance and EPS estimates today, and that it also announced plans to spin out its electrical distributions operations, EDS, into a standalone business, which the market seems to like.

In the end it seems that this wasn't a case of the universe interfering, rather it was good, or coincidental timing.

What this whole episode says to me, however, is that you can make your own luck in the market.

And what I mean by that is, that if you are looking in the right places/areas of the market, using the right methodology and systems, then trading opportunities will present themselves to you.

At the start of the week JP Morgan’s European Quant’s wrote that their model was signalling:

“ Further upside for Value vs Quality stocks in 2025, highlighting Value, Small Caps,and high Risk, at the expense of Momentum, Quality, Low Risk and Large Caps”

Aptiv could certainly be considered a value stock and as its headquartered in Dublin it's certainly European.

So in fact, what I stumbled into was the right stock at the right time, alongside the right market zeitgeist.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.