Weekly Outlook

What Happened This Week?

- The Fed lowered its benchmark rate by 0.25 points to 4–4.25%, the first cut in nine months, prioritizing signs of labor market weakness over inflation risks.

- An appeals court rejected Trump’s request to oust Fed Governor Lisa Cook, extending the standoff over central bank independence.

- U.S. housing starts dropped 8.5% in August to 1.307 million units, after 1.429 million in July.

- Weekly jobless claims fell sharply to 231,000 from 264,000 in the United States, easing labor concerns.

- U.S. import prices rose 0.3% in August, above expectations, after a 0.2% gain in July.

- New York’s factory activity slipped into contraction for the first time since June, with orders and shipments sliding.

- Overall data suggests a cooling U.S. economy, pressured by tariffs, weaker factories, and labor market headwinds.

- The Bank of England left its base rate at 4% but slowed its bond reduction program, pointing to renewed inflationary pressures.

- Inflation stayed at 3.8% in August in the United Kingdom, just below forecasts of 3.9%.

- The U.K. jobless rate held steady at 4.7% for the three months to July, while pay growth excluding bonuses slowed to 4.8% from 5.0%.

- Rightmove reported U.K. home prices rose 0.4% in September to £370,257, the first monthly increase since May, though still 0.1% below last year’s level.

- Industrial production in July edged up 0.3% after a 0.6% decline in June in the Eurozone.

- Germany’s financial sentiment improved modestly in September.

- Eurozone exports slipped 0.4% in July compared to June. Shipments to the U.S. bounced to €44 billion after a June dip, but remained well below March’s €72 billion.

- On a yearly basis, European exports to the U.S. fell 4.4% while imports surged over 10%, squeezing the trade balance.

- Manufacturing sales rebounded in July, up 2.5% month-on-month to C$70.3 billion, continuing their recovery from tariff-related weakness.

- The Bank of Canada lowered its key interest rate by 25 basis points, bringing it to 2.5%.

- Canadian manufacturing sales rebounded in July, up 2.5% month-on-month to C$70.3 billion, continuing their recovery from tariff-related weakness.

- The Norges Bank lowered its key rate to 4%, but signaled a more cautious approach to further easing than previously expected.

- China’s economy showed renewed weakness over the summer, with trade and real estate sectors dragging growth.

- Japan’s exports fell 0.1% in August, the fourth monthly decline. U.S.-bound shipments tumbled 13.8% year-on-year, driven by tariffs and weaker demand for autos and chips. The Bank of Japan is expected to keep rates unchanged as it gauges tariff impacts.

- Taiwan’s central bank kept its discount rate steady at 2.00%.

- Indonesia surprised markets with a rate cut to 4.75% amid political uncertainty.

This Week’s Market Movers

Forex

- The NZD/USD is down more than 1.50%.

- The CHF/AUD and the EUR/AUD are up more than 1.10%.

- The USD/RUB is down more than 1.90%.

- The USD/BRL is down more than 1.50%.

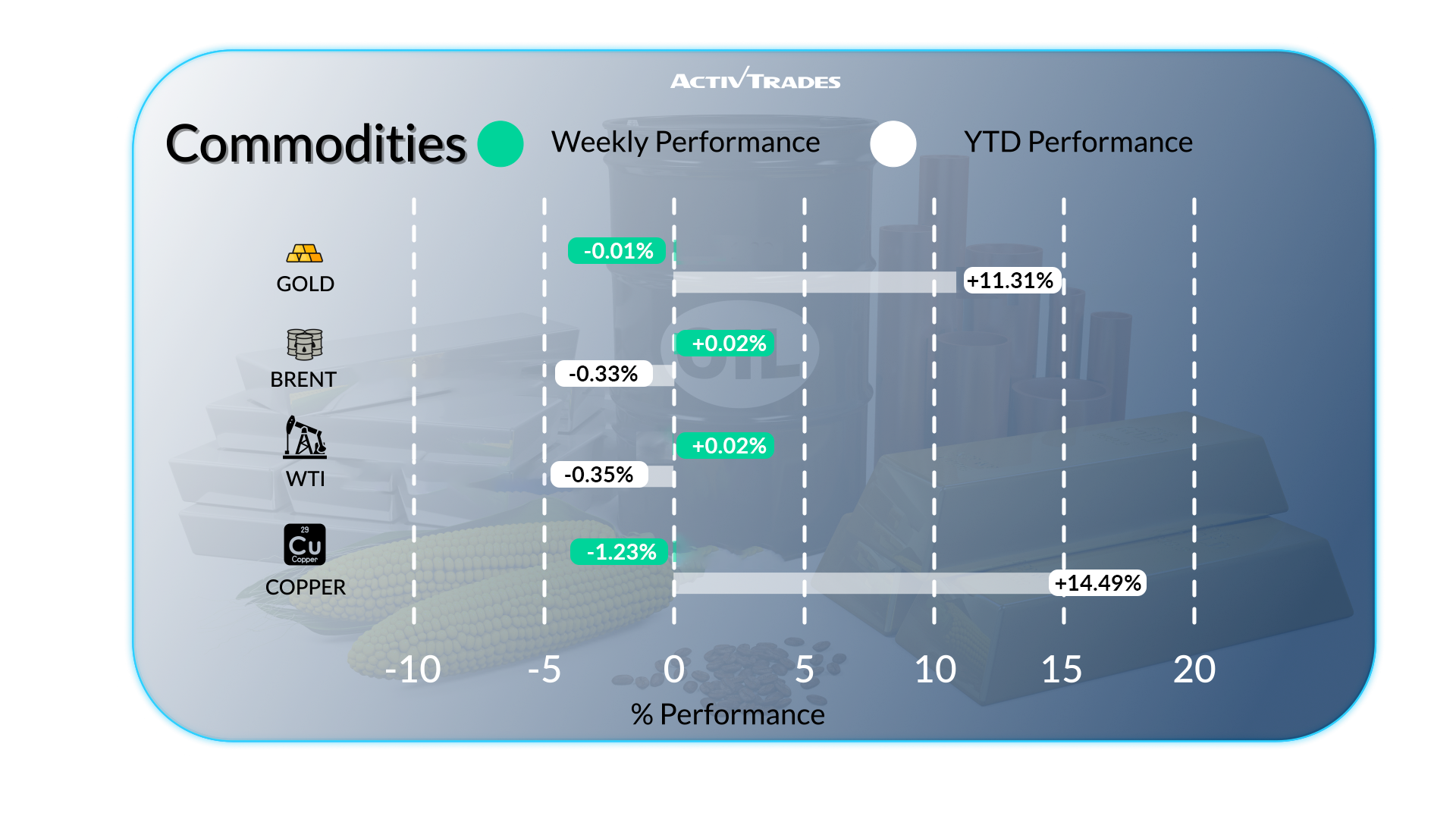

Commodities

- Gold prices touched a new all-time high above $3,700.

- Silver Futures are up more than 3.20%.

- Palladium Futures are down mre than 2.90%.

- Copper Futures are down more than 1.20%.

Indices

- The Bovespa index is up more than 2.20%.

- The Kospi index is up more than 1.80%.

- The STOXX 50 index is up more than 1.70%.

- The S&P 500, the Nasdaq and the Dow Jones all touched new highs this week.

Shares

Tops

- Warner Bros. Discovery: +40.59%

- Intel: +23.47%

- Magazine Luiza: +20.11%

- Tesla: +19.04%

- Paramount Skydance: +19.01%

- Natura Cosmeticos: +18.87%

- CrowdStrike: +17.37%

- Lam Research: +16.59%

- ASML Holding: +16.02%

- Applied Materials: +15.71%

- Synopsys: +15.42%

- Micron Technology: +14.33%

- Kering: +13.18%

- Stellantis: +12.06%

Flops

- Continental: -21.76%

- FactSet Research System: -17.10%

- Centene: -10.56%

- Oracle: -10.21%

This Week’s News to Follow

Monday 22 September

- 11:00 PM - Australian S&P Global Manufacturing PMI Flash (September)

- Previous: 53.0

- Forecast: 52.7

- 11:00 PM - Australian S&P Global Services PMI Flash (September)

- Previous: 55.8

- Forecast: 51

Tuesday 23 September

- 07:15 AM - French HCOB Composite PMI Flash (September)

- Previous: 49.8

- Forecast: 50.4

- 07:15 AM - French HCOB Manufacturing PMI Flash (September)

- Previous: 50.4

- Forecast: 51

- 07:15 AM - French HCOB Services PMI Flash (September)

- Previous: 49.8

- Forecast: 50.1

- 07:30 AM - German HCOB Manufacturing PMI Flash (September)

- Previous: 49.8

- Forecast: 50

- 07:30 AM - German HCOB Composite PMI Flash (September)

- Previous: 50.5

- Forecast: 50.5

- 07:30 AM - German HCOB Services PMI Flash (September)

- Previous: 49.3

- Forecast: 49.5

- 08:00 AM - European HCOB Composite PMI Flash (September)

- Previous: 51

- Forecast: 51.1

- 08:00 AM - European HCOB Manufacturing PMI Flash (September)

- Previous: 50.7

- Forecast: 51

- 08:00 AM - European HCOB Services PMI Flash (September)

- Previous: 50.5

- Forecast: 50.5

- 08:30 AM - UK S&P Global Manufacturing PMI Flash (September)

- Previous: 47.0

- Forecast: 49

- 08:30 AM - UK S&P Global Services PMI Flash (September)

- Previous: 54.2

- Forecast: 51.7

- 01:45 PM - American S&P Global Composite PMI Flash (September)

- Previous: 55.1

- Forecast: 54.6

- 01:45 PM - American S&P Global Manufacturing PMI Flash (September)

- Previous: 53.0

- Forecast: 52

- 01:45 PM - American S&P Global Services PMI Flash (September)

- Previous: 54.5

- Forecast: 53

Wednesday 24 September

- 08:00 AM - German Ifo Business Climate (September)

- Previous: 89.0

- Forecast: 88.4

- 12:30 AM - Japanese S&P Global Manufacturing PMI Flash (September)

- Previous: 49.7

- Forecast: 50.3

- 12:30 AM - Japanese S&P Global Services PMI Flash (September)

- Previous: 53.1

- Forecast: 53.4

Thursday 25 September

- 06:00 AM - German GfK Consumer Confidence (October)

- Previous: -23.6

- Forecast: -23.3

- 12:30 PM - American Durable Goods Orders MoM (August)

- Previous: -2.8%

- Forecast: -0.5%

- 12:30 PM - American GDP Growth Rate QoQ Final (Q2)

- Previous: -0.5%

- Forecast: 3.3%

- 02:00 PM - American Existing Home Sales (August)

- Previous: 4.01M

- Forecast: 3.98M

Friday 25 September

- 12:30 PM - American Core PCE Price Index MoM (August)

- Previous: 0.3%

- Forecast: 0.3%

- 12:30 PM - American Personal Income MoM (August)

- Previous: 0.4%

- Forecast: 0.3%

- 12:30 PM - American Personal Spending MoM (August)

- Previous: 0.5%

- Forecast: 0.4%

Major Earnings Reports to Watch

Tuesday 23 September

- Micron Technology

Wednesday 24 September

- Carmax

Thursday 25 September

- Costco

- Accenture

Source: The Wall Street Journal, Trading Economics, TradingView and ActivTrades’ Data as of 19 September 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.