The US dollar remains a dominant force in the global financial arena. Its strength, measured against a basket of other major currencies through the Dollar Index (DXY or USDIND on the ActivTrader trading platform), can have far-reaching consequences – impacting everything from international trade to investment decisions.

For those curious about navigating the complexities of the currency market, understanding the DXY is a valuable first step.

Whether you're a seasoned investor or just beginning to explore the world of currencies, the Dollar Index offers a unique window into the ever-evolving dynamics of international finance. In this guide, we'll delve deeper into the USD Index, exploring its composition, the factors influencing its movements, and the various ways to leverage its fluctuations for potential gains on the Forex market.

Understanding the Dollar Index

Developed in 1973 by the US Federal Reserve after the end of the Bretton Woods System, the Dollar Index is a benchmark that gauges the overall strength of the US dollar against a basket of six major world currencies, helping analysts and investors to understand how the US dollar fares in the global currency market. Think of it like a scorecard, indicating if the dollar is appreciating or depreciating compared to this basket of currencies.

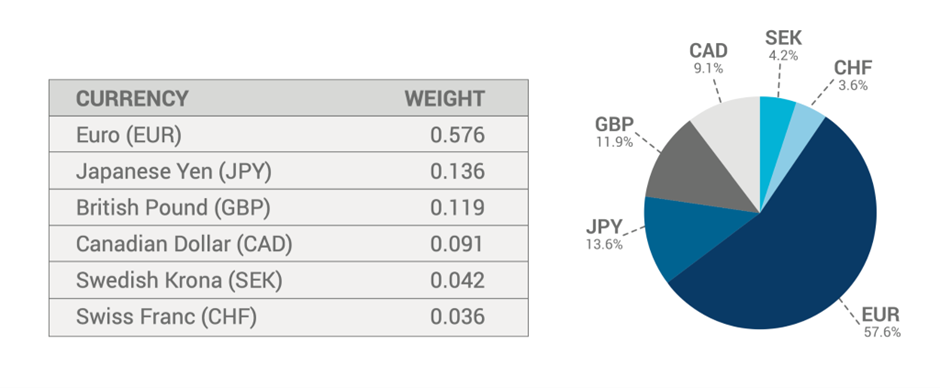

To calculate the Dollar Index, a geometric average is used, taking into account the weighted value of each currency within the basket, reflecting the relative importance of each currency.

Currently, the Dollar Index considers six major currencies: the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK), and Swiss Franc (CHF), but some believe that there have been discussions about incorporating currencies like the Chinese Yuan (CNY) to reflect China's growing economic importance.

Source: ICE futures U.S. - U.S. Dollar Index

Historical trend of the Dollar Index

The Dollar Index has been on a rollercoaster ride over the decades, mirroring shifts in the global economic landscape, trade relations, and the US dollar's strength compared to other major currencies. Its history is marked by dramatic rises and falls. It peaked in 1984 at nearly 165, only to plunge to a record low of around 70 in 2007. These significant movements often coincide with major world events and changes in central bank policies.

Take 2017 for example. The US dollar lost significant ground against its peers, with the DXY dropping from 102.835 to 91.88, a decline of over 13%. This depreciation stemmed from a confluence of factors: concerns about the Trump administration's ability to deliver on its promises and President Trump's unpredictable leadership style, a strengthening Euro fueled by Europe's improved economic outlook, and lower expectations of US interest rate hikes.

Conversely, the period between May 2021 and September 2022 saw the Dollar Index surge by more than 25%, climbing from 89.81 to 112.1095. This appreciation was driven by anticipation of tighter US monetary policy, followed by actual interest rate increases. These aggressive measures by the Federal Reserve to combat inflation contrasted with the more relaxed stance of other central banks, bolstering the US dollar's position.

Monthly Chart of the US Dollar (Futures Contracts for a Delivery in June 2024) - Source: ActivTrader

While these changes in the Dollar Index offer opportunities to Forex traders, they also act like a financial weather vane, influencing economic conditions around the world, especially in emerging markets. When the index strengthens (meaning the US dollar appreciates relative to other currencies), other economies often feel the pressure for several reasons, especially emerging and developing countries.

First of all, a strong dollar makes imports from the US more expensive for emerging economies, which can hurt businesses that rely on imported materials or equipment, leading to higher production costs and potentially higher consumer prices. A rising dollar can also trigger depreciation in emerging market currencies, which makes it more expensive for these countries to repay dollar-denominated debt. Many emerging economies have quite significant dollar-denominated debt, so a strong dollar increases the burden of servicing this debt, as they need to spend more of their local currency to meet their dollar obligations.

Furthermore, investors may be more inclined to move their capital to dollar-denominated assets, leading to capital flight from emerging markets and potentially hindering their economic growth. Sometimes, to defend their weakening currencies, emerging market central banks may be forced to raise interest rates. While this can help stabilize their currency, it also makes borrowing more expensive for businesses and consumers, potentially slowing down economic activity.

By grasping the relationship between the Dollar Index and emerging economies, you can gain valuable insights. This knowledge can help us anticipate the broader effects of a rising or falling USD on global economic dynamics, proving beneficial for various financial decisions, especially if you focus on exotic currency pairs or low-liquidity markets for instance.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.