FOREX

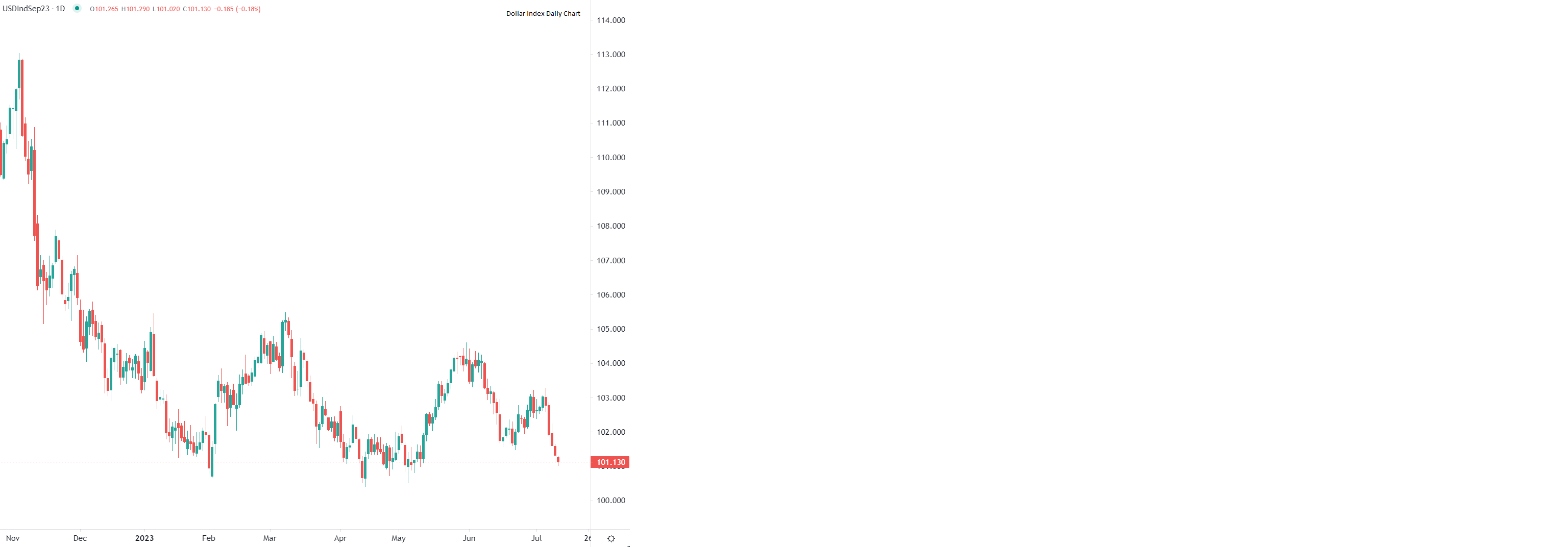

The US dollar was at the lowest level in relation to a basket of other major currencies during early Wednesday trading. After last Friday’s jobs report, which came up below expectations for the first time in 15 months, the mindset of investors shifted towards a greater belief that July will mark the end of the Fed’s hiking cycle. If confirmed, the predicted slowdown in US consumer prices will help to cement this view after June’s CPI figures are published later today. Against this background, the greenback has been softening, with treasury yields also dropping and stocks benefiting, as investors move towards riskier assets. However, the release of US inflation data later today remains a risky event. Should figures be higher than expected, the recent trend could be inverted, generating a dollar revival.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

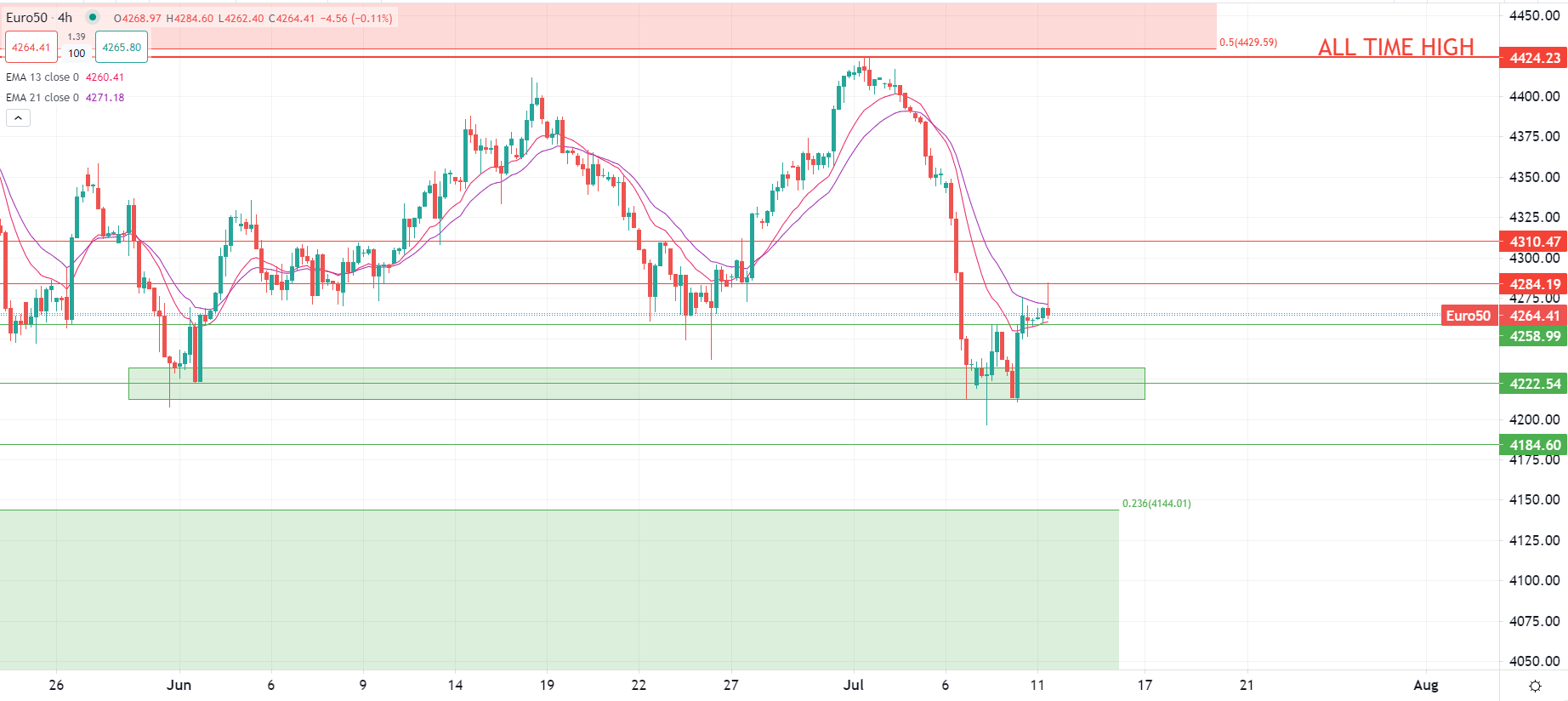

Equities continued to rise on Wednesday in Europe, despite an uneven trading session in Asia, as investors bet on less monetary tightening.

The STOXX-50 index pushed higher in the early exchanges this morning, led by miners and tech shares, after inflation figures from Spain didn’t deliver any nasty surprise to investors.

Moreover, traders’ focus is likely to be put towards the other side of the Atlantic ocean as the crucial US CPI report, expected to provide more hints on the path monetary policies will take in the next FOMC meetings, looms later today. This new inflation report is widely expected to display a decreased price pressure in June, boosting hopes of a coming end to the current monetary tightening campaign from the Federal Reserve. Investors are already buying the rumour, with an increased appetite towards riskier assets in Europe and the US, while the relative strength of the US dollar keeps sliding lower.

However, a sharp price reaction should occur if the US CPI report delivers a number outside the 3.1%(expected) vs 4% (previous) window. Furthermore, there is also a chance investors could “sell the news” after “buying the rumour” if the report comes as expected. In that case, we expect the market to register a pull-back to test newly established floors before returning to a much more directional trend.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.