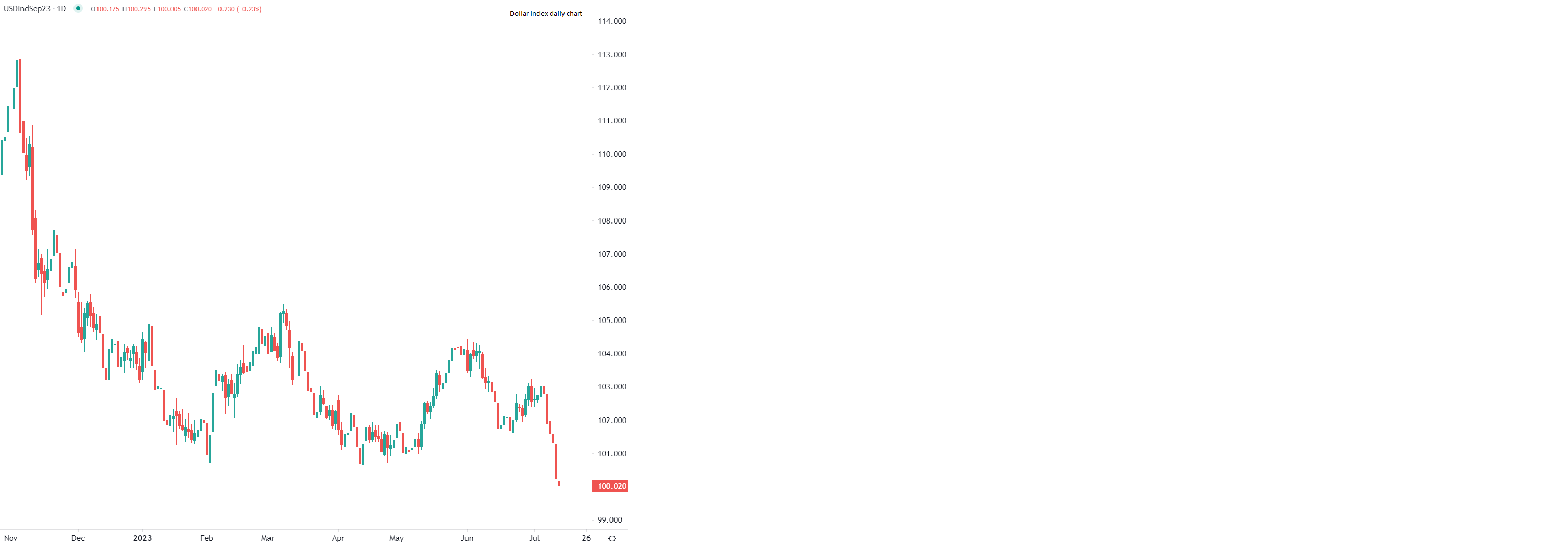

FOREX

The US dollar index, a measure of the greenback’s performance against a basket of other major currencies, touched a 15-month low during early Thursday trading. The dollar’s softness occurs as investors recalibrate expectations over the Federal Reserve’s monetary policy. Yesterday’s CPI numbers surprised to the downside, with the headline number falling to 3% and the Fed’s favourite month-on-month core inflation reading at 0.2%, instead of the expected 0.3%. With inflation slowing down faster than expected, the Fed’s tightening is producing the desired effect, and investors have started to price-in the end of the current hiking cycle, which is now expected to come after this month’s final increase of 25 basis points. The markets can now see a path for a soft landing of the US economy, with inflation being controlled without the country’s economy entering a serious recession. Against this background, investors are pivoting from the haven dollar to riskier assets, such as stocks, creating scope for further greenback depreciation.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.