FOREX

The US dollar is on the back foot as the European session gets underway. The greenback retreated in relation to other major currencies, following the Federal Reserve’s decision on Wednesday, to hike interest rates by 25 basis points. The increase in borrowing costs had long been priced into the value of the dollar, however some doubts persisted over what would be the tone used during the announcement. As it turned out, yesterday was a classic example of a dovish hike. Yes, the rates went up by 25 basis points, but Federal Reserve chairman, Jerome Powell, focused on the headwinds facing the US economy, including the still unresolved regional banking crisis. Abandoning the hawkish stance of previous occasions, Powell promised a data dependent approach to future monetary policy decisions, with the dollar losses punctuating what looks to be the end of the current hiking cycle.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

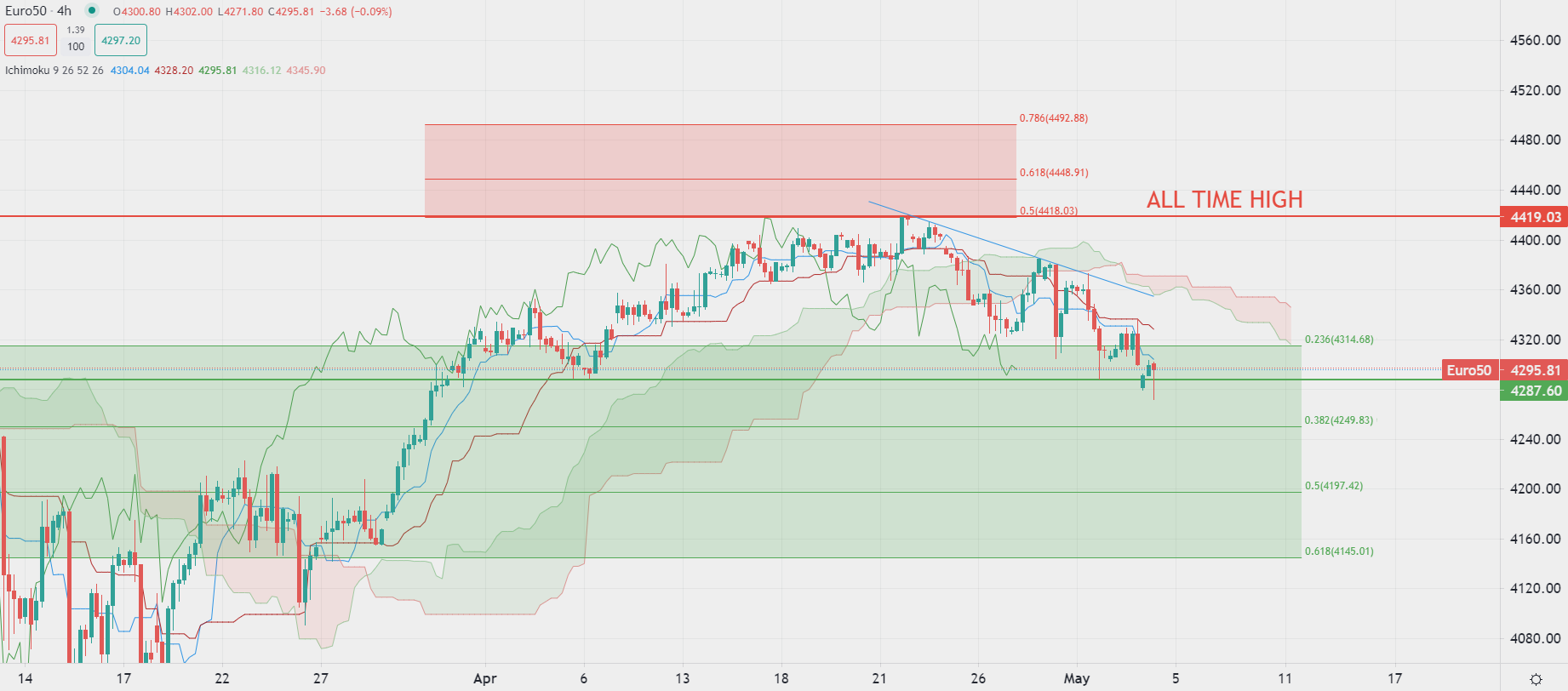

EUROPEAN SHARES

European equities climbed on Thursday, paring some of yesterday’s losses, as market sentiment strengthens following the Federal Reserve’s rates decision and prior to the ECB announcement.

Jerome Powell provided investors with what they were waiting for, lifting borrowing rates by 25 basis point higher to the 5.00%-5.25% target range, the highest since 2007.

While the decision on rates didn’t surprise, investors were interested to see a shift in the wording from the Fed chairman after he hinted this could be the final hawkish move of the current tightening cycle.

This tone change is being welcomed by equity and commodity traders as it lifts some of the pressure brought by a higher US dollar and reduces the prospect of a more aggressive FOMC.

That said, investors still have a lot to digest with today’s decision on rates and press conference from the ECB, as well as tomorrow‘s US jobs report for April, which will certainly contribute to increased market volatility.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.