GOLD

Gold prices are trading almost flat as the European session gets underway. The price of the precious metal is caught between two opposing forces. On one hand, there is support arising from growing anxiety over the US regional banking crisis, which caused a drop in risk appetite and fuelled demand for haven assets. On the other hand, this upside has been capped by uncertainty over the Federal Reserve’s stance on interest rates, with some investors unsure on how the central bank will behave after today’s decision. A scenario where the Fed announces a pause after today’s expected 25 basis points hike and hints at the possibility of a cut before year-end, could penalise treasury yields and the dollar, offering further support to gold prices. However, further hawkish posturing from Jerome Powell and Co. would be likely to strengthen the dollar, with a corresponding fall in the price of the precious metal.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

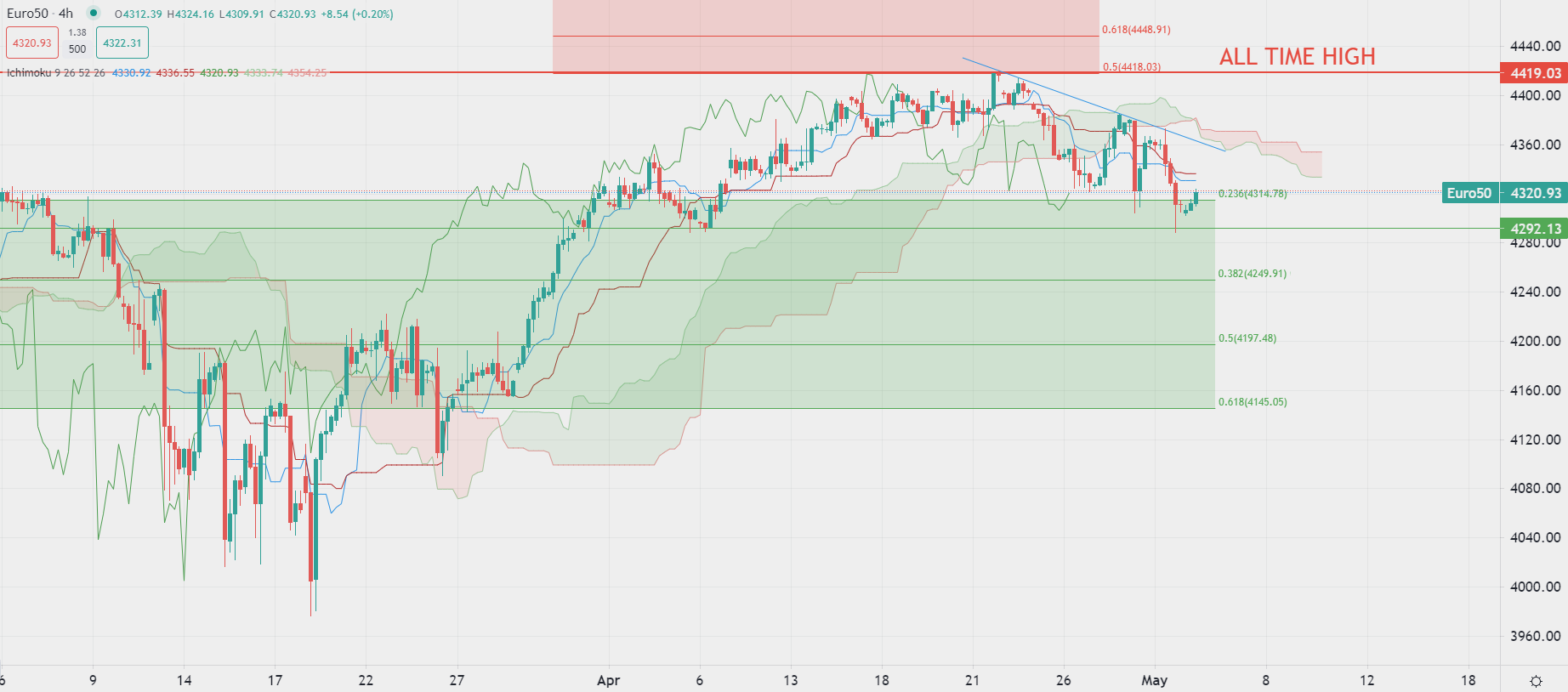

Equity markets ticked higher in Europe on Wednesday, paring some of Tuesday’s losses, despite lingering macro uncertainty, ahead of the Federal Reserve’s decision on interest rates later in the day.

The STOXX-50 rebounded over the 4,300 pts level, and is currently trading above 4,320 pts, led higher by most sectors, with energy shares bringing the best performance so far.

However, this recovery may be short-lived as it only a technical pull-back, supported by short-covering positions ahead of major macro data releases this week.

While investors will be awaiting Friday’s US job report and Thursday’s ECB’s decision on monetary policy, today’s focus will be drawn towards the Fed’s press conference and rate decision.

Even though a 25-basis point rate hike is now widely priced-in, investors betting on a hawkish pause or even a dovish pivot in the June meeting will be cautiously analysing today’s speech from Jerome Powell for further hints about where the Fed will be going in the future, and at what pace. A more dovish stance than initially expected should boost appetite towards riskier assets, while another hawkish wording could significantly dent investor sentiment to stocks and send benchmarks further down.

We expect market volatility to significantly increase as we approach the FOMC’s decision.

Pierre Veyret– Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.