The stock market and the economy are two separate things

Not least because Economic data points are often backwards-looking, lagging indicators, whilst stock markets are famed for being forward-looking, pricing in what's to come rather than what has been.

That said there are occasions when the economy and its data points do correlate with and influence the stock market, or at least it should do.

Something is rotten in the kingdom of Germany

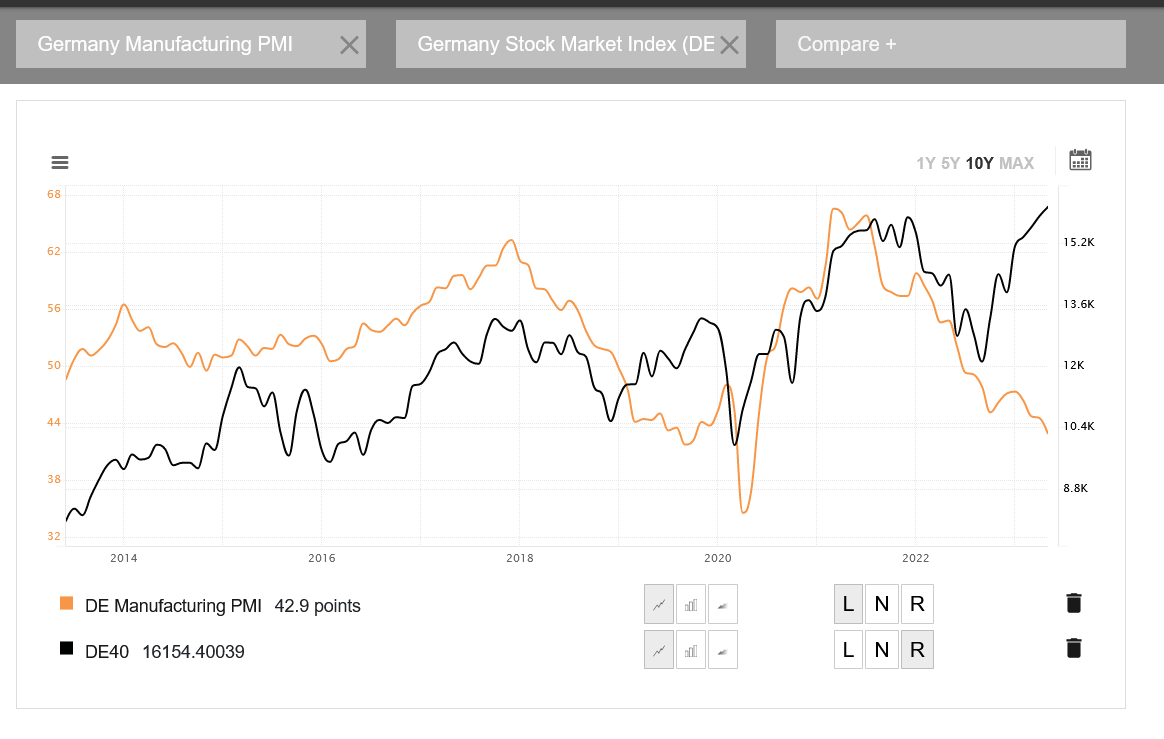

Take a look at the chart below which shows the DAX or Germany 40 index in black overlayed by the German Manufacturing PMI in orange which is a measure of economic activity and expectations among manufacturing companies.

PMI data is survey-based and forward-looking.

Purchasing managers are asked about their plans and intentions for the month ahead.

The survey data is referred to as being soft because it captures what people say they will do, rather than what happens that information comes in backwards-looking hard data, released sometime after the event.

That means that there is a trade-off between accuracy and being able to get an insight into topics such as spending plans, hiring, new orders etc.

The PMI Surveys have a standardized construction and a regular panel of participants.

The data they produce is regarded as an accurate gauge of sentiment and activity, if not the complete picture.

Divergence between indicators is rarely a good sign in the markets

With that in mind, the obvious divergence between the PMI data and the DAX is puzzling if not troubling.

The Dax has pushed on to new all-time highs in 2023 in expectation of a recovery in the German economy which has been battered by Covid 19 and the war in Ukraine.

German is an export lead industrial economy which is largely dependent on energy imports.

Global lockdowns, an uneven and patchy recovery in key overseas markets and a full-blown war, just 1300 kilometres from the front door of the Bundestag (the German parliament) created something of a perfect storm for the German economy.

The sharp rise in energy prices driven by Russia’s invasion of Ukraine caused havoc in Germany with businesses uncertain about future energy supplies and their ability to operate profitably in the future on German soil.

One of the country's largest businesses chemicals giant BASF decided to close a plant in Ludwigshafen and look to offshore production elsewhere.

Something that would have been largely unthinkable pre-pandemic.

Energy prices are lower for now

Energy prices have subsided and will probably remain low throughout the summer months. Analysts at RBC believe that LNG or liquid natural gas prices will be kept in check by a combination of increased US exports and weaker Asian demand.

Whether that can continue into winter 2023 is as yet unclear. As per the FT, the German government has drawn up plans to subsidise 80 per cent of electricity costs for energy-intensive companies this winter.

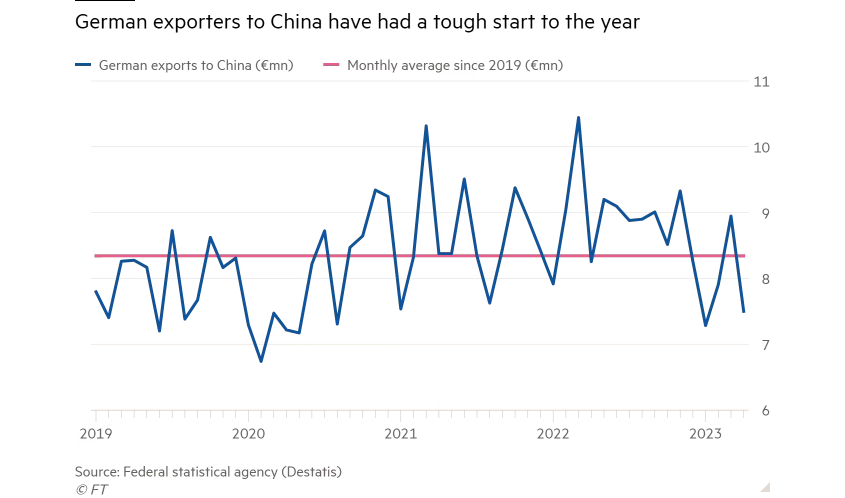

The concept of weaker Asian demand may benefit European energy prices but it doesn't help a struggling german industrial sector. Just this week the FT highlighted an -11.3% drop in German exports to China, over the first four months of 2023.

The FT said that:

“Several big German companies with considerable businesses in China reported significant declines in first-quarter sales in the country, including chemicals group BASF, the country’s leading carmaker Volkswagen and auto parts producer Bosch.”

As this chart shows German Exports to China have been declining since 2022 of even more concern is the news that Germany's European peers have been growing their Exports to China EU exports to China rose by 2.9% YoY in the first quarter of 2023.

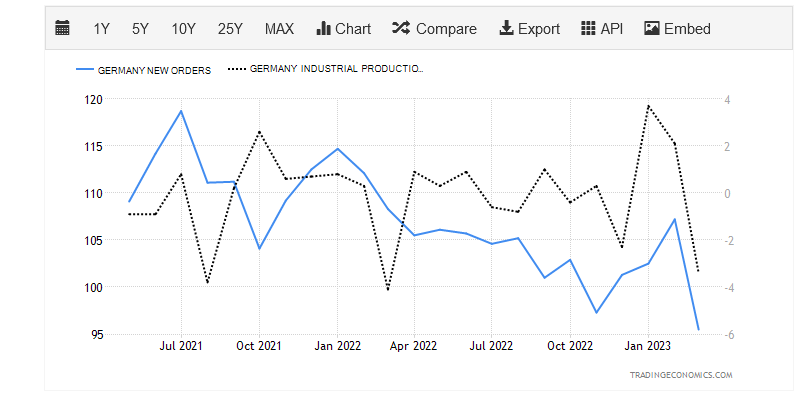

Looking at German industry as a whole we find that new orders ansd industrial production are declining in tandem.

One of the reasons that investors were so bullish about German, and other European equity indices, was an expectation that the reawakening of the global economy and re-opening in China would see German order books rapidly filling up, but that hasn't been the case.

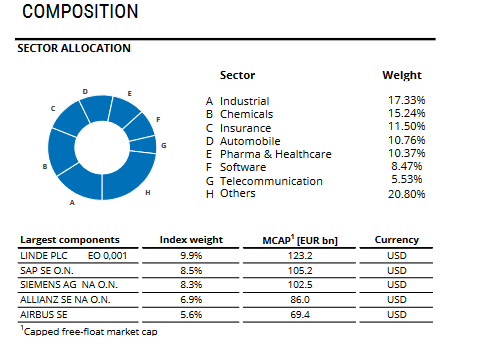

The DAX index is up 16% year to date but given the composition and weighting in the index that’s set out below I’m not sure those gains are justified, when three out of four of the top sectors are energy-intensive industries that have major exposure to Chinese markets.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.