Q1 2024 earnings season is drawing to a close so it's time to look at what we‘ve learned and what we can take forward into the remainder of 2024.

Overall earnings season in the US has been broadly positive.

More than +90.0% of S&P 500 stocks have reported and 78% of those companies posted a positive earnings surprise, according to data compiled by Factset.

Revenue beats were a bit thinner on the ground, but they still hit +60.0%.

And as of the time of writing, S&P 500 earnings grew by +5.40% in Q1 which is the best, the growth rate’s been for almost two years.

However there is a but, and quite a big but at that

Because, the top five contributors to earnings growth are Megacap and Magnificent Seven stocks, namely Nvidia, Alphabet, Amazon, Meta Platforms and Microsoft

Perhaps that's not so surprising

However, if we strip out their contribution, then the year-over-year earnings growth rate for the S&P 500 drops to -2.40%.

If we dig down into the data we find that 86.0% of stocks reporting earnings in the S&P Information Technology sector, posted an upside EPS surprise, and 65.0% beat on revenues.

Whilst, 71.0% of Communications Service sector stocks beat on earnings, though only 43.0% recorded a revenue beat.

These sectors of course, host the majority of the Magnificent Seven stocks. Tesla and Amazon being categorised as Consumer Discretionary stocks.

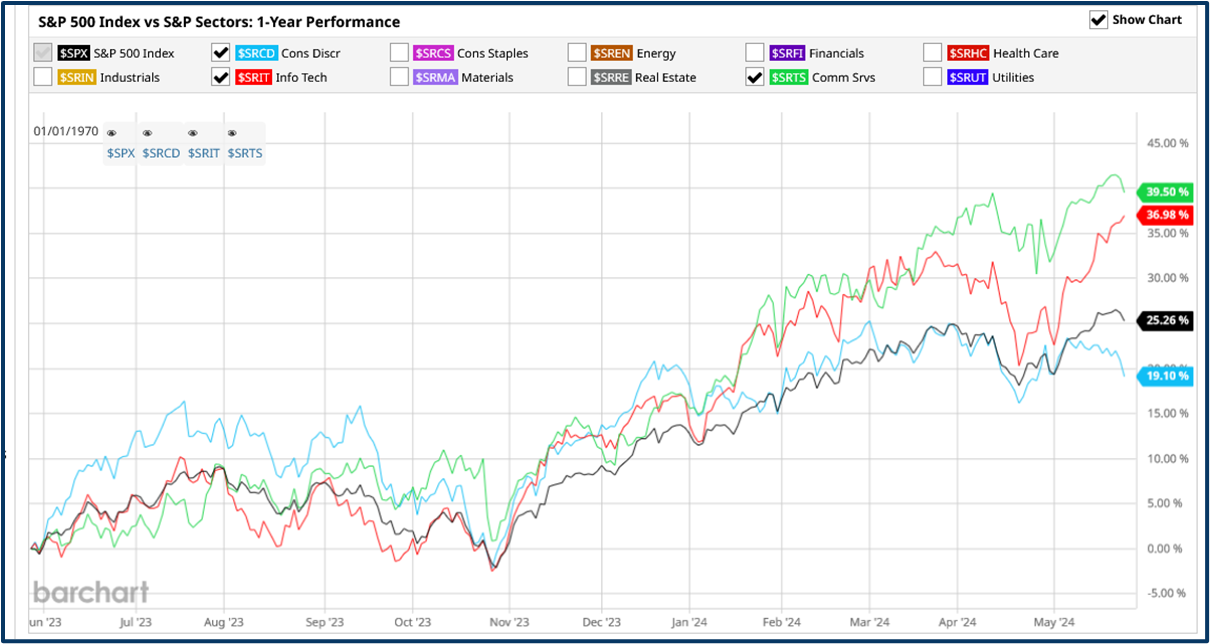

The importance of these stocks and sectors is reinforced in this chart, which plots the S&P 500 against its sector components.

Source: Barchart.com

In this instance I have selected the S&P index, and the Info Tech, Comms Services and Consumer Discretionary sectors. The chart records their 1-year percentage changes.

Once again it's probably no surprise to see Info tech and Comms Services outperforming both the wider market and the Consumer Discretionary sector.

Not everything is rosy for the Magnificent Seven however

Because despite recently rallying of the lowsTesla (TSLA) is still down by -30.0% year to date. Coincidentally its underperforming the wider market, the other Magnificent Seven stocks and the Consumer Discretionary sector by more than - 30.0%.

Source: Barchart.com

Last to report

Nvidia NVDA was the last of these mega-cap stocks to report, publishing its earnings after the close on Wednesday 23-05-2024. It didn't disappoint, easily beating on both earnings and revenues.

It also raised its dividend by +150.0%, and announced at 10 for 1 stock split to make the shares more accessible for retail traders.

Unsurprisingly the stock price gapped higher on the open on Thursday and finished the day up more than +9.0%.

Suggesting that there was still some steam left in the AI story.

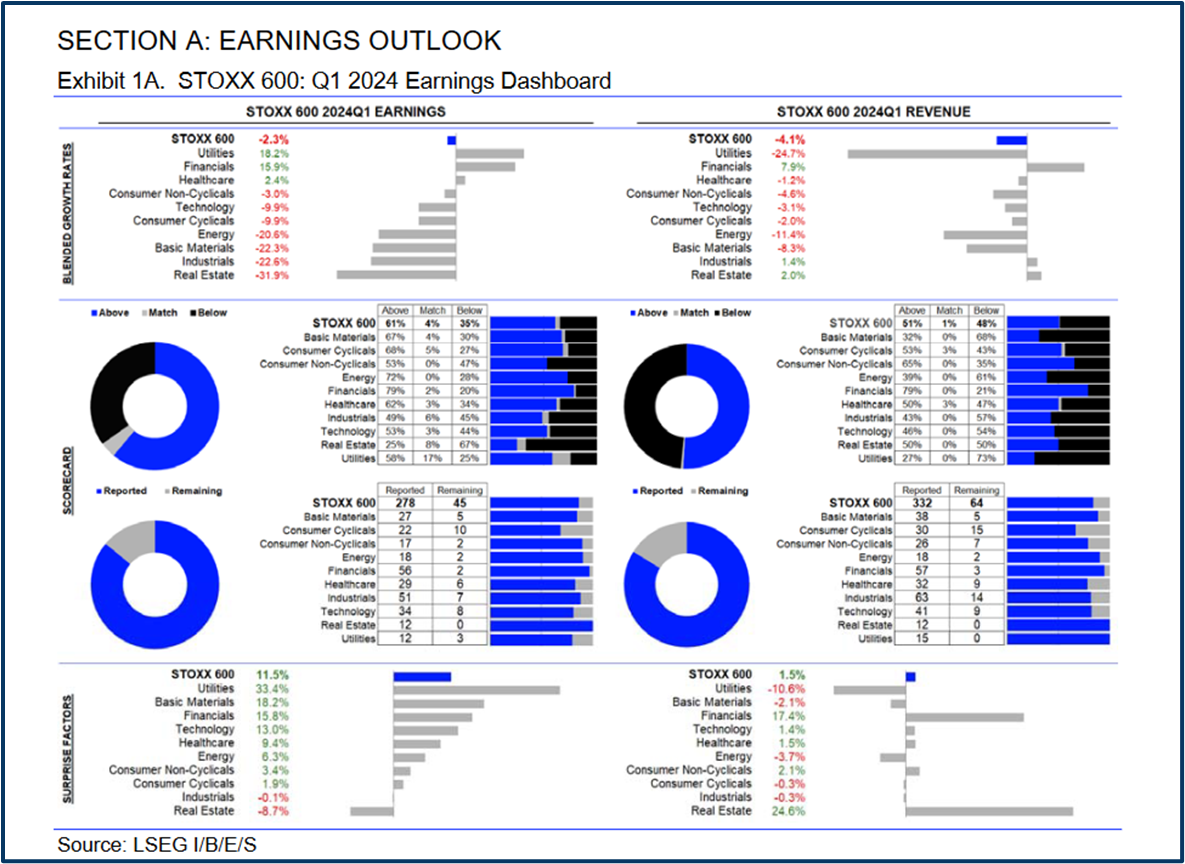

In Europe amiong the STOXX 600 companies that report Q1 2024 earnings (as of the 21/05/25) some 61.0% have beaten analyst’searnings estimates, which is well above the average earnings beat of 54.0%.

Whilst from a revenue perpsective just under 51.0% of the companies reporting have beaten forecasts, compared to the long term average of 58.0%.

So its very much a mixed bag the scorecard below from LSEG provides us with a fuller picture at both and index and sector level.

So what are the takeaways

Firstly there hasn’t been anything, in Q1 earnings, to spook investors.

True, it wasn’t all one way traffic, but there were more positives than negatives, and very few absolute shockers in the numbers

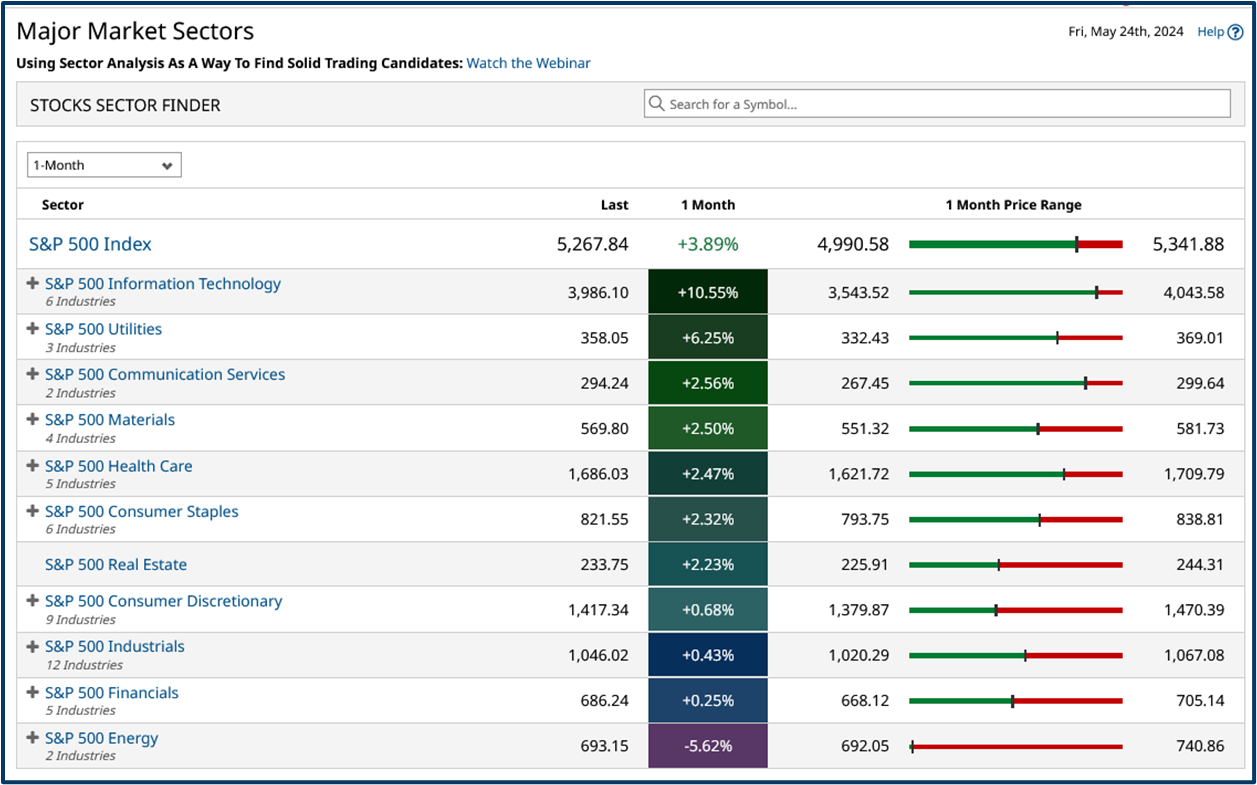

If we look back to April 12th when the major US banks reported, the S&P 500 has added just over +2.80% since then, rallying almost +6.0% from its mid-April lows to date.

Despite a wobble, leadership in the market remains with the IT and Communications Services sectors whilst the Energy sector has struggled.

Source: Barchart.com

In my next article i will look at some the themes we can carry foreword and areas in the markets where we might find some interesting trading opportunities.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.