It’s often said that the journey to trading success is a marathon and not a sprint, but in truth, it is more like the omnium in velodrome cycling.

The omnium is a compendium of events that run simultaneously. It has a substantial field and there are multiple prizes up for grabs.

The race will have a large number of leaders over its full duration, and specialists within the field will emerge to triumph in a given challenge, before sinking back into the pack.

Consistent performance, a persistent problem

The similarity of the omnium to trading is brought into focus when we consider the issue of consistent performance.

It's incredibly hard to consistently win in trading, to keep your losses to a minimum, and smaller in value than those of your competitors.

Losses are an invertible consequence of trading, which of course, is a speculative occupation.

But keeping losses to a minimum, in terms of both frequency and value, is essential if we are to stay in the race.

That’s important because the truth is that capital growth is achieved through compounding, and compounded returns come about through tenure or time spent in the market.

Finding a winning formula and using that formula as frequently as possible is the holy grail of trading.

The only trouble is that winning formulas are elusive in the first place and don't have an indefinite shelf life.

A strategy that works well today and perhaps for a few weeks or months, may stop working all altogether if the conditions change - Just think about the performance of slick tyres in the rain, in motorsport.

Even the pros struggle

The difficulty of making consistent returns was highlighted in a recent piece of research from Dow Jones S&P Indices, which looked the the performance of European Fund Managers in 2023.

And more specifically whether their performance in 2023 and previous years, could be attributed to luck or skill.

The thinking was that luck would be fleeting, but skilful trading should be persistent and detectable over time.

Looking back to 2019 the researchers found that not one fund manager in equity or fixed income, who was in the top 25% of performers in 2019, managed to remain in the top quarter over the next 4 years.

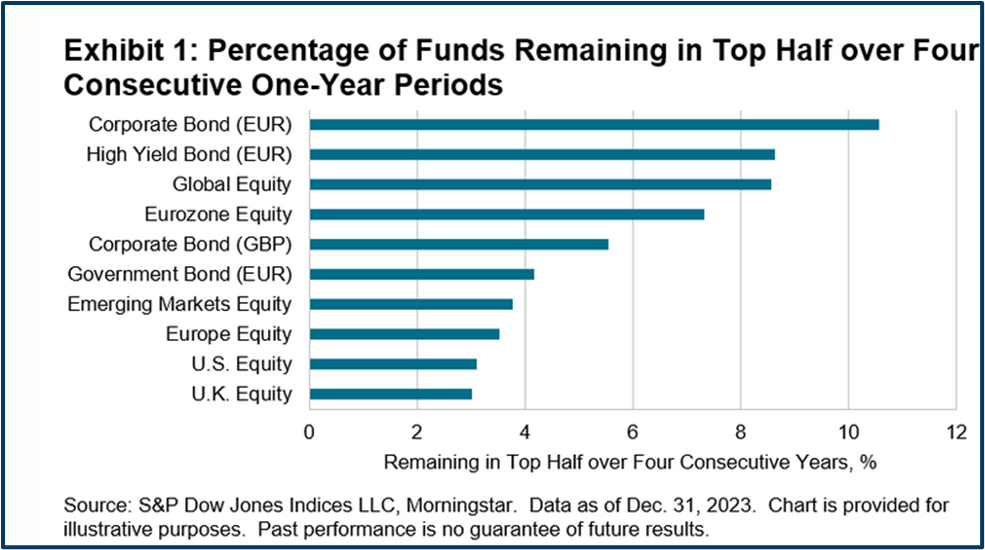

The researchers widened their parameters by looking for managers and funds who remained in the top half of the performance tables over the next four years and they found the following:

Better than average

Staying in the top half of the performance tables means that you have achieved better-than-average performance, and that doesn’t look like you are setting the bar too high.

However, even here the percentage of funds that met this yardstick consecutively for 4 years is minimal.

And even in the best-performing category of European Corporate bonds, it is only just over 10.0%.

Which of course means that just under 90.0% of those funds couldn’t manage better-than-average performance, for 4 years in a row.

Not much equity here

If we look to the bottom of the chart we get sense of just how hard it’s been to consistently make money as an equity fund manager during this period.

With less than 4.0% of equity funds managing to achieve better-than-average performance for 4 consecutive years.

And that’s despite the S&P 500 rallying by +46.40% between 2020 and 2023.

Of course we had the considerable hurdle of Covid-19 and lockdowns to contend with but it was the same for all managers and as we have previously discussed adversity creates trading opportunities.

Retail advantage

Retail traders don’t enjoy many advantages over professional money managers but they do have somethings stacked in their favour.

One of those things is flexibility because the fund managers have to abide by a strict mandate which governs the way they allocate and manage their money and which can dictate the type of stocks they can have exposure to and the way they can trade them.

Which of course could be a severe limitation on performance if, for example, you are running a long-only fund in a market that’s selling off rapidly.

The retail trader is not constrained in this way. They can trade across different asset classes and geographies go long or short as they prefer or their strategy suggests.

What’s more, they can change their view and their position very quickly, if the market starts moving against them.

So count your blessings and keep trading.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.