That quote is often heard in the world of sports, particularly in team games and competitions.

However it would be equally appropriate to the equity markets right now.

Why do I say that?

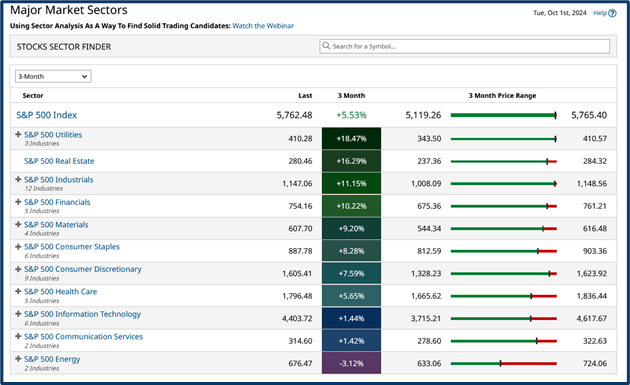

Take a look at this table that shows the performance of the S&P 500 and its constituent sectors, over the third quarter of 2024, which ended on Monday.

Can you see which sector finished at the top?

S&P 500 sectors 3-month performance

Source:barchart.com

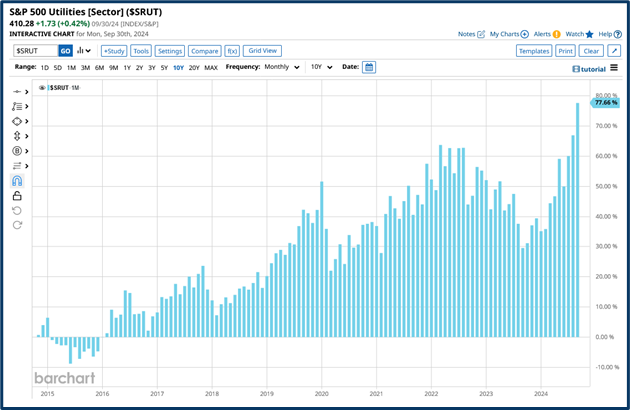

Then look at the chart below, which plots the S&P 500 Utilities sector monthly percentage change, over the last 10 years.

The Utilities sector hasn't had a losing month in 8 years. That strikes me as quite extraordinary.

After all these are meant to be defensive stocks, bond proxies that are unexciting plodders. Which provide stability to portfolios, with the added benefit of some dividend income, thanks to their dependable cash flows.

S&P 500 Utilities sector monthly percentage change

Source:barchart.com

They are not meant to be rockstar stocks

The total return from the S&P 500 Utilities sector over the last 10 years annualised out at +10.41% per annum, according to data from S&P Dow Jones Indices.

I highlighted the defensive nature of the sector back in April, in the article The Importance of Defensive Stocks and Sectors .

When I suggested that we could see a regime change and that Utilities could form part of that change. I am pleased to say that I was right.

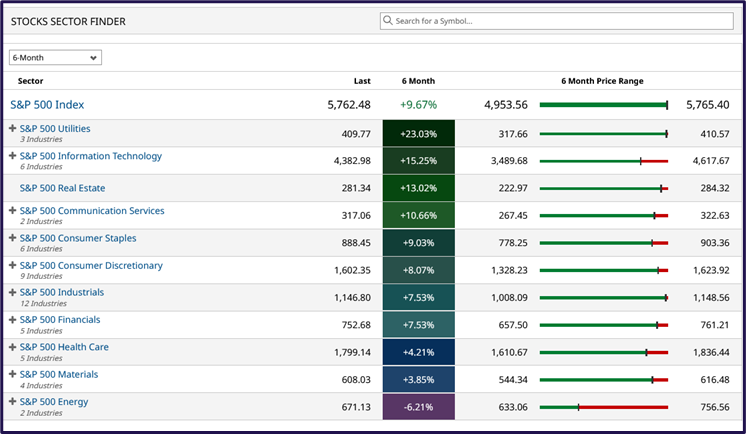

And as we can see below, the Utilities sector was the best performer over the last 6 months.

Comfortably outperforming all of its peers, including high flying Information Technology stocks, and the interest rate sensitive Real Estate Sector.

S&P 500 sectors 6-month performance

Source:barchart.com

No one left behind

Not one stock within the Utilities sector is down on the year to date, and two components have posted triple digit percentage gains in that time frame.

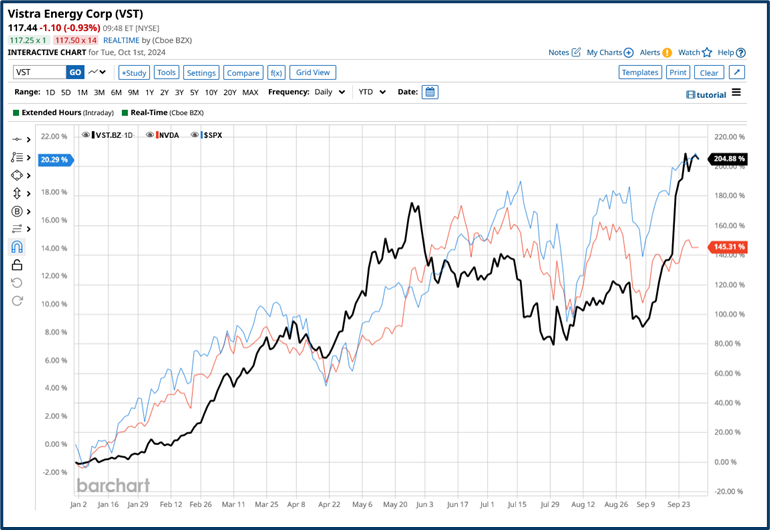

Vistra Energy VST US is officially the best performing stock in the S&P 500; it's up by over +200.0% in 2024.

In the chart below we see the YTD percentage change in VST US. compared to that of the S&P 500, in blue on the left-hand-scale, and Nvidia NVDA US, drawn in red and shown on the right-hand scale.

Vistra’s performance has blown them both away, it’s posted 60 new, year-to date- highs in the process that’s an average of 1.50 a week.

Source:barchart.com

Being realistic

Enough of the back slapping because now I have to admit I was right but for the wrong reasons.

Or at least I wasn't right for the reasons I set out in April, because although we did see a significant sell-off in August, it was short lived and reports of the death of growth stocks were greatly exaggerated.

You may think that doesn’t matter after all if you could bank +23.0% on your money and outperform all comers between April and October you’d be happy wouldn't you?

However, you would also be falling victim to what's known as outcome bias, under which you judge the success or failure of something, solely by the end result. ignoring the journey to get there, the risk you took and the reasons why it happened the way it did.

That’s blinkered thinking, and can lead to anchoring and worse, Anchoring is when you use false information or processes or beliefs in your decision making and carry them forward rather than recognising your mistake.

An evolving picture

I am not going to beat myself up, however, because my argument was well thought out and was based on well established market maxims.

However I do recognise that I was lucky with this call. Yes you make your own luck in the markets.

However, there is a strong sense of irony here, because much of the growth and gains enjoyed by the Utility sector over the last six months were driven by the power requirements of the mega-cap tech stocks.

The very names that should have been overthrown in a regime change.

The other reason that I feel justified is that I covered the narrative about the power demands of AI back in July, in the article Different paths to the same destination

The markets are a jigsaw puzzle without the box and sometimes your job as a trader is to workout what the finished image looks like, by building the picture from its constituent pieces. That picture can evolve in the running and that's exactly what happened here.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.