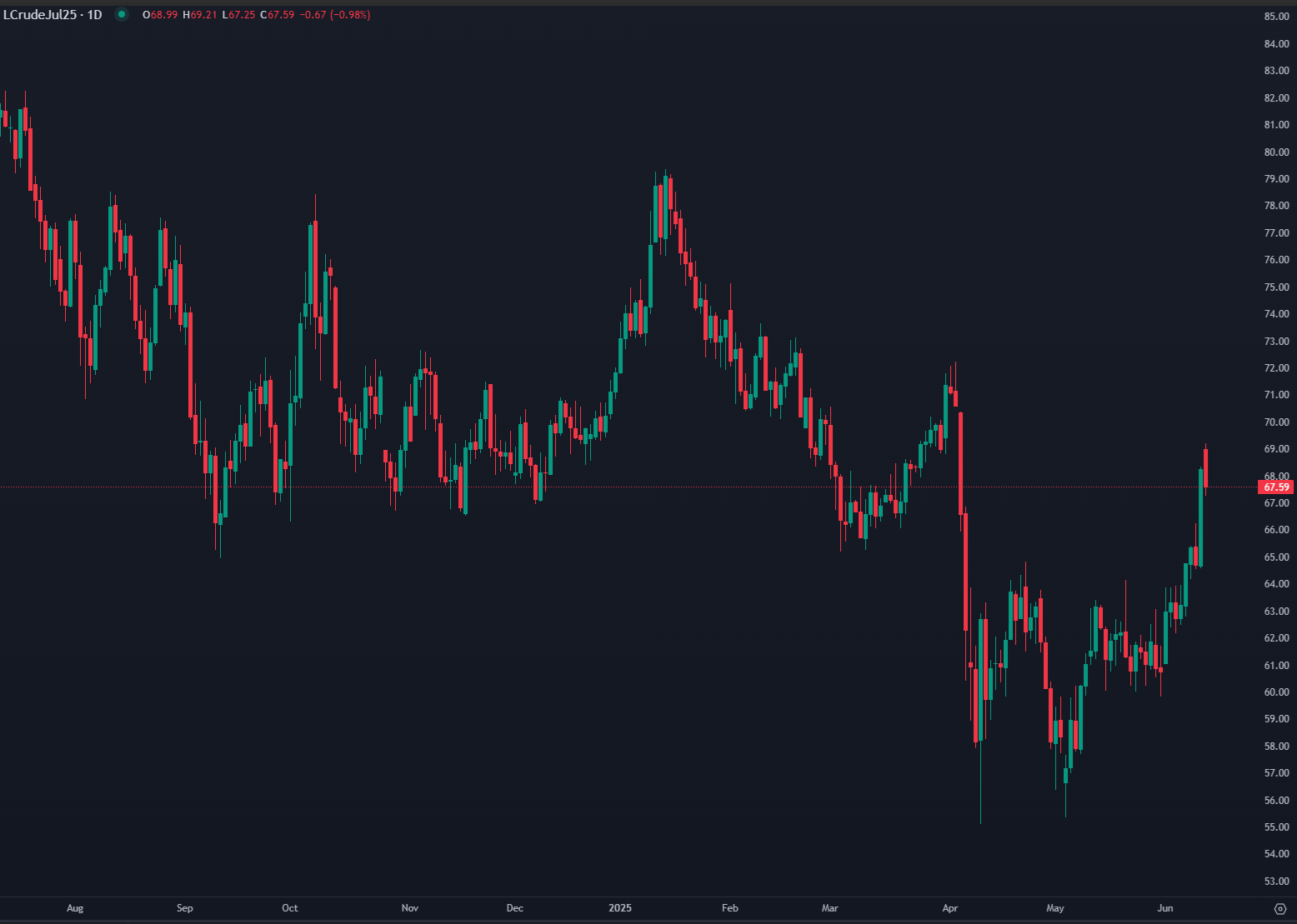

WTI crude oil prices reached a two-month high in early Thursday trading before retreating slightly from those gains. Tensions in the Middle East have flared once again, with reports suggesting that Israel may be preparing to launch an attack on Iran—an escalation that could threaten supply from the world’s most important oil-producing region. Prices also found support from the latest round of US-China talks. While the outcome was ambiguous, it was not overtly negative, helping to improve the outlook for global oil demand. In addition, the latest US inventory data revealed a larger-than-expected decline in crude stocks, reinforcing concerns over tightening supply. Against this backdrop—marked by a heightened risk of supply disruptions and a modest improvement in demand projections—the path of least resistance for oil prices appears to be to the upside.

Ricardo Evangelista, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.