OIL

Oil prices dipped during early Friday trading as the market absorbed the Federal Reserve's commitment to prolonging higher interest rates. The surprising resilience of the US economy, evident in the latest PMI data released on Thursday, provides the Fed with greater leeway to sustain its restrictive monetary policy for an extended period. This dynamic constrains economic growth and suggests reduced future oil demand, contributing to the price decline. Nonetheless, the downside for the barrel's price remains limited by supply-side concerns stemming from ongoing geopolitical turbulence in the Middle East. This instability casts doubts on the reliability of crude oil flow from the Gulf region and remains present in the minds of traders, offering support to oil prices.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

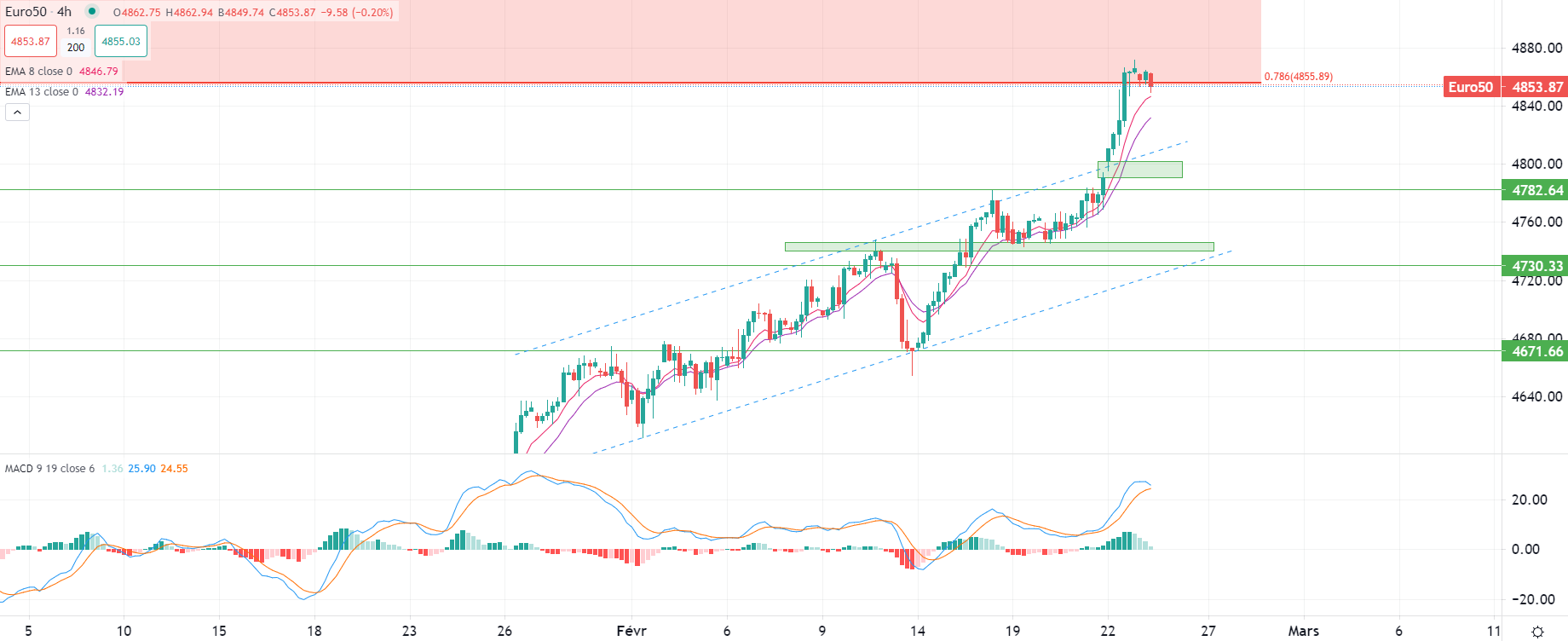

European benchmarks opened mixed for the week's last trading session, trading sideways following new record levels reached yesterday.

Volatility decreased as investors have digested the latest batch of major developments this week, ahead of a much calmer day on the macro front.

The STOXX-50 index is currently challenging its newly established support level over 4,850.0pts/4,855.0pts, with the top movers being among the basic materials sector while the worst performers are among utility shares.

Even if a correction may occur following yesterday's sharp rise on the STOXX-50, the technical configuration doesn't make this scenario very likely.

With the lack of significant macro developments today, we expect markets to hold their gains before next week's new batch of economic news, including the US PCE/GDP, Chinese PMI, and German CPI.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.