Did November feel like a good month in the markets to you?

I hope so but I can't say that it did for me.

When I look back at the performance data I just can’t reconcile the moves and the mood music of what was an undeniably a very bullish month for stocks.

I have asked a lot of people about this, fellow analysts and commentators, traders and money managers, and few if any of the people I have spoken to had or felt like they had a good month.

Maybe that’s because I am based in the UK and the FTSE 100 didn’t participate, perhaps?

But then again my focus has increasingly been on US markets over recent years because that's largely where the action has been.

The one that got away

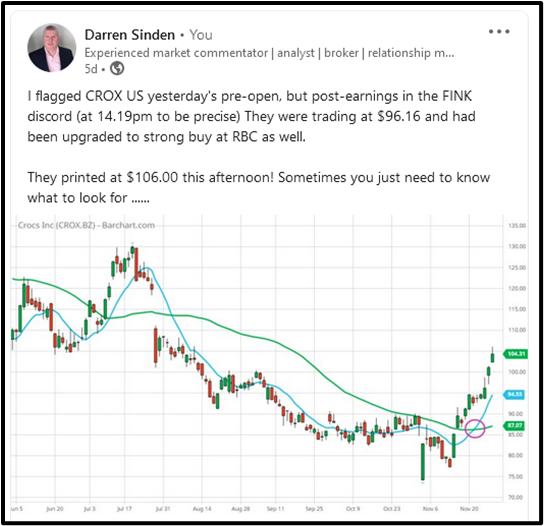

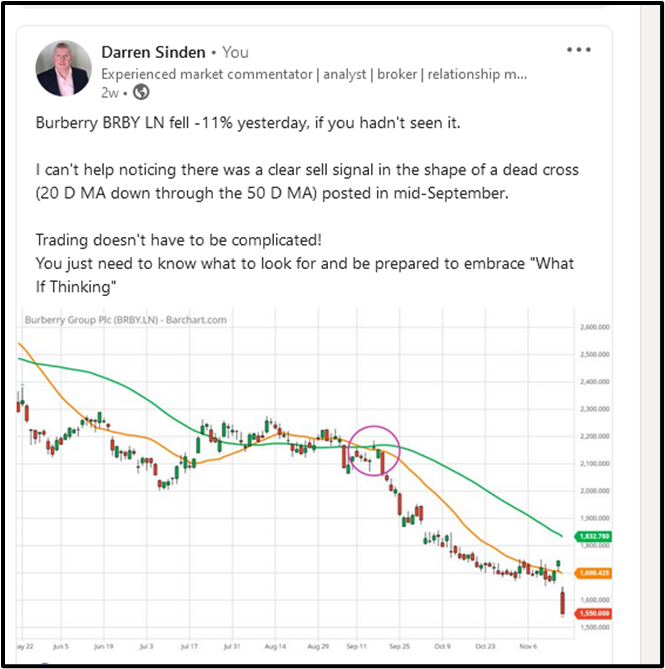

Whatever the reason behind it I have to consider November as an opportunity missed. That’s not to say that I did not find any trading opportunities and ideas just not enough of them. Some opportunities came good, such as these three that I highlighted on LinkedIn.

Yet I still feel like a fisherman with his tales of the one that got away.

Taking stock

However, the good news is that I can now look back and see what I missed and how I could have taken advantage of it.

Any trader worth their salt will regularly look back at their process, profitable and unprofitable trades and missed opportunities. And look to learn from those experiences, to improve their trading performance going forward.

Real Estate Ramp

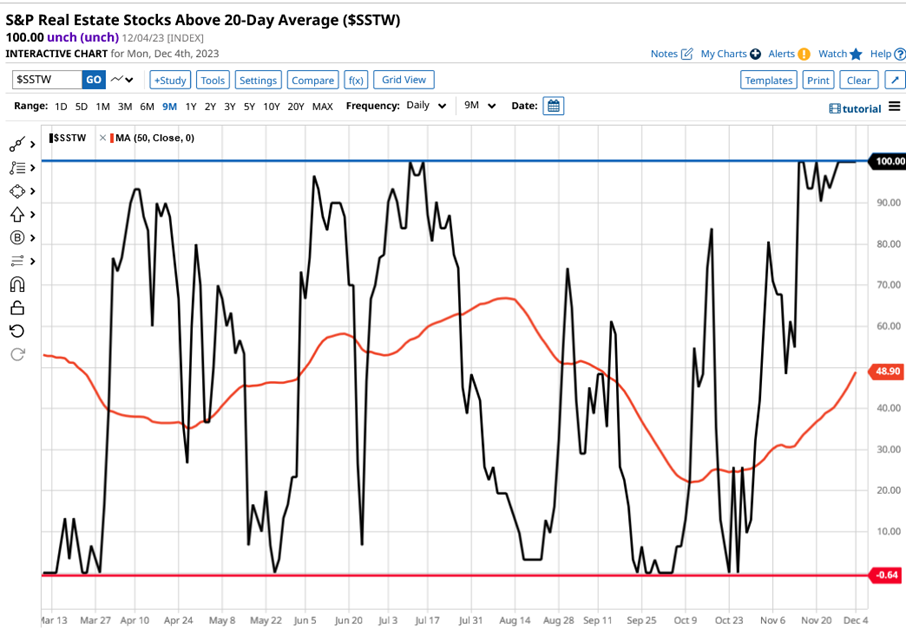

We don't have to look far to highlight a golden opportunity in the shape of the S&P 500 Real Estate sector, which, of course, was shunned by the market since January 2022, as higher interest rates hit property and property-related investments, hard.

However, narratives change and interest rate cycles are, well, cyclical. And that’s what happened here during November.

Simon Property (SPG US), one of the largest REITs or Real Estate Investment Trusts in the US posted double-digit gains during November.

REITS are conservative stocks that rarely experience large price movements. So it says something when we learn that SPG had 13 up days last month. Note the golden cross highlighted on the chart which signaled the rising price momentum in SPG.

How could we and should we have spotted these opportunities?

Well, let's consider the chart above, which shows an indicator, which tracks the percentage of stocks, within the S&P 500 Real Estate sector, that are trading above their 20-day Moving Average.

If we look at the period at the end of October we can see that the indicator (the black line) was effectively reading zero and thus extremely oversold.

However by early November the indicator was rebounding and it moved back through its own 50-day MA line (shown in red), and didn't look back from there. In fact, it posted 11 new highs during November.

I have written regularly about spotting and capturing momentum in price action see here and here. I’ve also written about using the MA Percentages to spot turning points in the market see here, and in August I suggested that the Federal Reserve had finished raising interest rates here.

So I had laid the groundwork, but for some reason, I just didn't connect the dots. Rest assured that I won't be making the mistake again in a hurry.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.