OIL

Brent oil prices are flat during early Wednesday trading after touching a multi-week low the previous day. Investors remain relatively unmoved by the potential impact that the additional voluntary production cuts agreed by the OPEC+ members will have on the market. Since the last day of November, the price of Brent has dropped more than 6%, showing that the markets’ concerns are tilted towards the demand side, as fears over an economic slowdown gain traction. The recent release of softer-than-expected economic data amplified this sentiment. Still, the downside has been limited by lingering fears of an escalation of the conflict between Israel and Hamas, which could end up disrupting the crucial Middle Eastern supply routes. Against this background, Brent oil prices are likely to continue to find resistance around the 80-dollar level.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

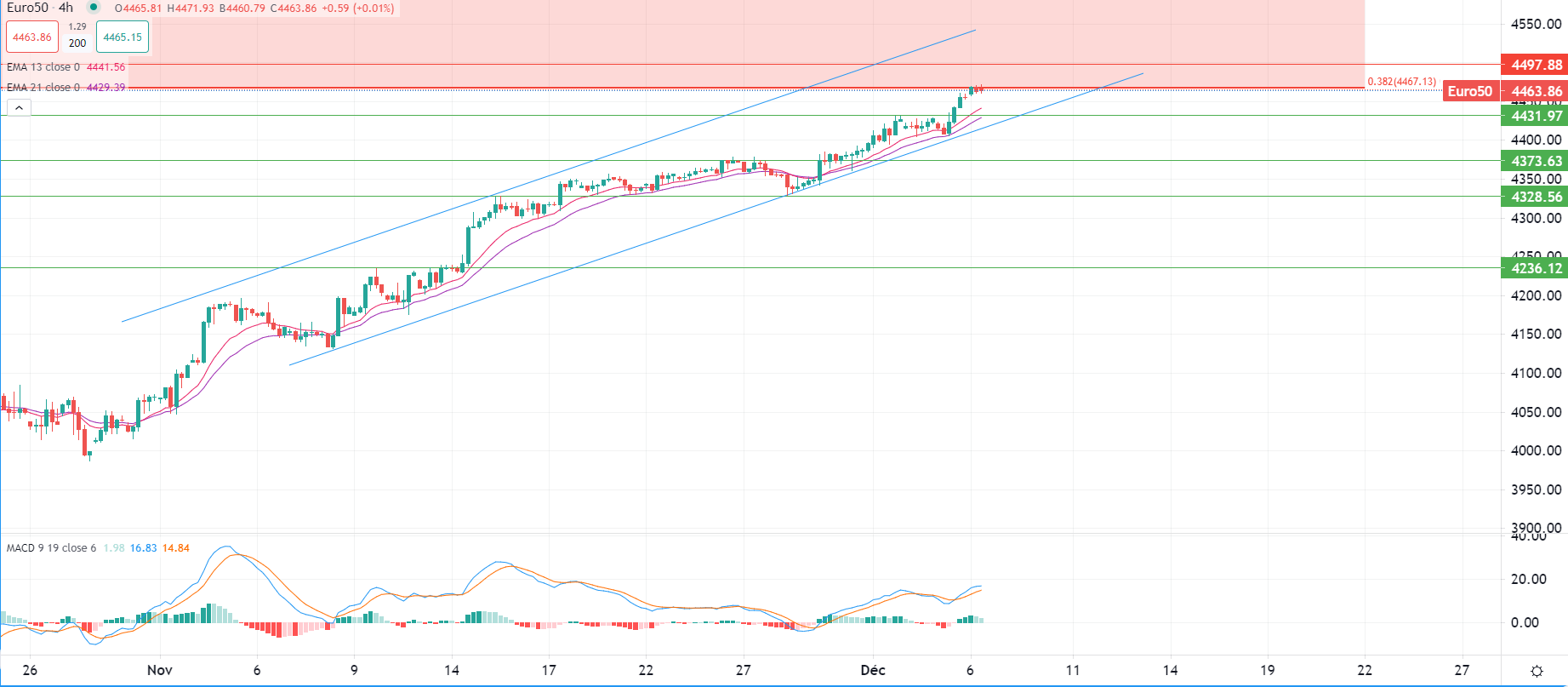

Stocks edged higher in Europe on Wednesday, extending gains registered in Asia overnight, as the prospects of a monetary dovish switch bolstered market sentiment.

In Europe, investors continue cheering on the recent dovish hints provided by ECB officials. Market sentiment towards riskier assets has significantly improved since historically hawkish central banker Isabel Schnabel confirmed inflation had slowed significantly, paving the way for the ECB to end its tightening campaign.

Another bullish leverage to stocks came from softer than anticipated US readings regarding employment, which also opens the door to a more dovish monetary policy in 2024, as the Fed will likely want to support a cooling economy to avoid a potential recession.

Of course, these are only anticipations so far and need to be confirmed with next week's FOMC meeting. But risk appetite remains high for now despite this morning's disappointing German factory orders data. Market volatility isn't likely to slow down as traders brace for today's US ADP Nonfarm employment change, another decision on rates from the BoC, and the US crude oil inventories later in the afternoon.

Technically speaking, the STOXX-50 has now hit a crucial long-term resistance at 4,465.0pts (38.2% Fibonacci Daily Fibonacci extension). A pull-back to the newly established floor over 4,430.0pts may take place before potentially reaching new highs.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.