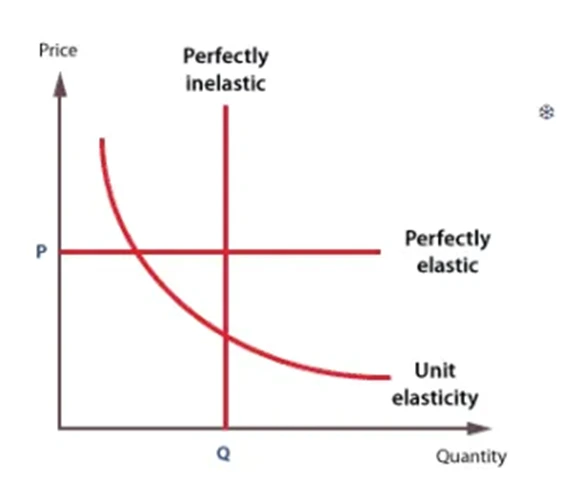

Economists talk about the elasticity of demand.

Elasticity refers to the relationship between the price of goods or services and consumer demand for them. The

Under elastic demand, when the price of goods or services rises, consumers tend to consume, or buy less of those goods and services.

Some goods and services exhibit inelastic demand, however. Which means that consumers continue to buy these goods and services, regardless of their price. Cigarettes would be a prime example.

The chart below plots the price of a given good or service versus the quantity of that good or service that's consumed or purchased at a particular price.

Source: Studymind.co.uk

It’s a good concept as it describes most consumer behaviour very well.

However, like all economic models, it doesn't fit every situation.

For example, it does not take into account human emotions, such as greed and fear, two of the primary drivers of financial markets.

Last week, we were reminded of just how visceral markets can be.

The stairs up and the elevator down

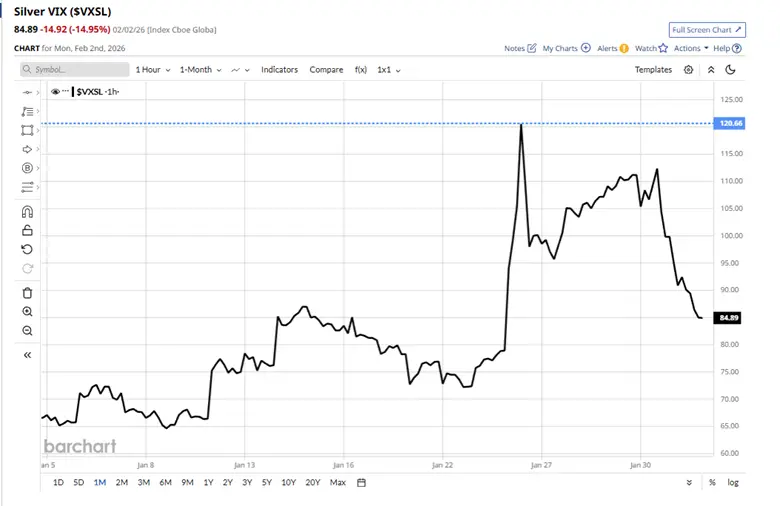

Silver underwent extraordinary moves last week.

Greed, which had been evident in the squeeze up to $121.0 per ounce, quickly turned to fear, as buyers for the precious metal stood aside and panic took its place.

Margin calls ensued, and many (speculative?) positions were either closed or stopped out.

Bank of America had this to say in a note on Tuesday, 2nd Feb

“Last week’s historic price action in gold & silver reinforced many themes from our 2026

Outlook, The Bubble era: (1) Expect boom/bust dynamics: classic vol up/spot up

signature on display as sentiment & positioning overwhelmed fundamentals, followed by

record drawdowns on 30-Jan. (2) Retail & leverage key bubble ingredients: fragility likely

exacerbated by price-insensitive selling from retail (e.g., levered/inverse ETFs) and

institutional (e.g., CTA & option gamma) channels, compounded by margin hikes

(tightening financial conditions)”

Those comments suggest that silver may not be the only instrument to experience extreme price volatility in 2026.

Source: Barchart.com

Spot Silver shed -26.11% on Friday, 30 January.

A move so extreme that statistically speaking, it should happen only once in several trillion years.

Markets don't follow normal Gaussian distributions (the bell curve), however, which is why we see extraordinary events more frequently than would be expected elsewhere.

Nevertheless, the speed at which silver sold off sent shock waves around the world.

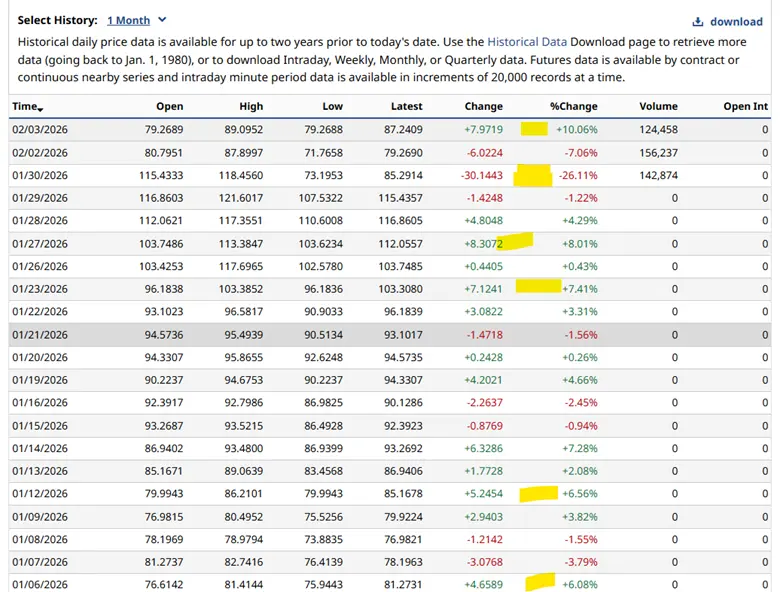

Spot Silver High Low Open Close (Last) from Jan 6 2026

Silver Volatility skyrocketed as you can see below:

Source: Barchart.com

Spot silver printed down to $73.195 before closing the week at $85.29 per ounce.

A chill ran through Natural Gas, too

Silver wasn't the only commodity to experience wild price swings of late.

US Natural Gas also had a torrid time- gas prices spiked as Arctic weather engulfed the Northern and mid- Western USA, with temperatures in Chicago falling to -15C.

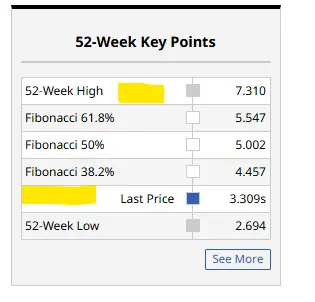

Spot Nat Gas prices ran up to $7.31 on Jan 27, having added +29.0% in the previous session.

Nat Gas key price points 04-02-2026

Source: Barchart.com

Natural Gas Price Percentage Change

Source: Barchart.com

However, those gains were short-lived as weather forecasts showed that the extreme low temperatures were fading away and that more moderate winter temperatures were likely to return.

Chicago Weather Forecast

Source: Google

On Consumer Staples, or should that be stable?

Consumer staples are the goods that we have to buy, the necessities of life.

And as such, they have a degree of inelastic demand. The fact that they are essential means the companies that make and sell them are seen as being defensive in nature, or if you prefer, are considered to be Risk -Off assets compared to, say, high-growth tech stocks.

What’s more, Consumer Staples stocks tend to have stable earnings and revenues, and though profit margins may not be high in the sector, turnover and cash flow often are.

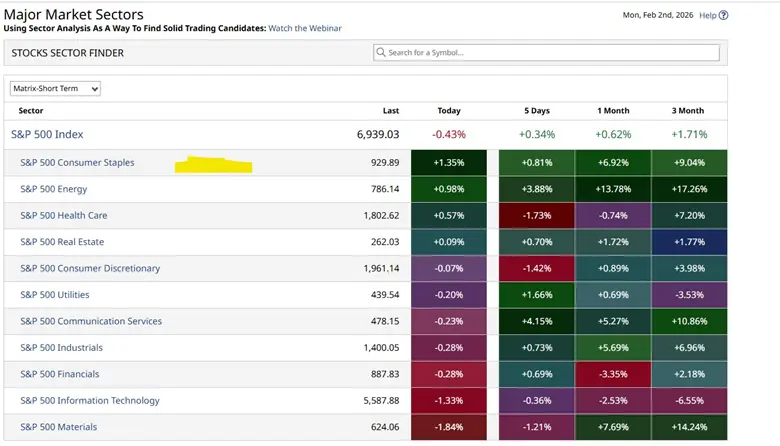

S&P 500 Sectors short-term price performance

Source: Barchart.com

What's interesting to me is that Consumer Staples have been amongst the best performing stocks within the S&P 500, over the last three months, massively outperforming the information technology sector, for example.

Foremost amongst the Consumer Staples stocks has been Walmart WMT US, which reached a trillion-dollar market cap this week, trading as high as $128.15 on Tuesday.

Regular readers may recall that I have written on Walmart and the wider Consumer Staples before, for example, here in September 2024, at which point Walmart were trading at $79.70 per share.

Source: Barchart.com

Walmart has experienced an +85.0% price rise since that article was published.

It's not clear that the stock price has finished rising either, because the group is continuing to grow its e-commerce business and has yet to fully benefit from the introduction of AI into the company's workflow and systems.

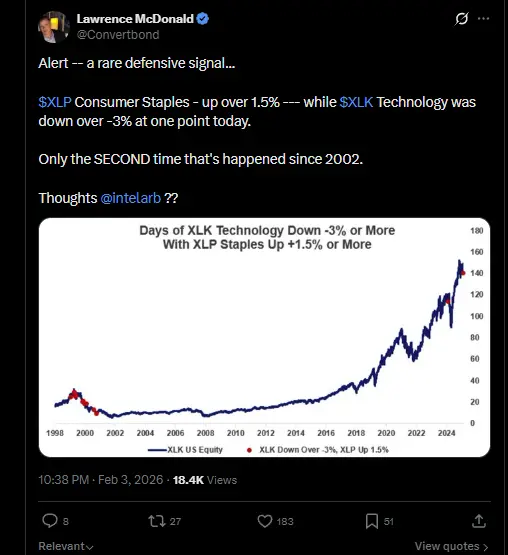

On Staples over Technology

Source: X / @convertbond

It’s exciting and tempting to trade “glamour" stocks and other instruments with big moves and plenty of media coverage, but sometimes it's safer, and potentially more lucrative, to trade something that’s running its own race, in the background.

Because the tortoise can beat the hare, sometimes.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.