I have been told that I have a good memory, though if I'm honest, it's not as sharp as it was ( perhaps I am behaving more like Einstein as I get older and not bothering to remember things that I can look up, or that’s what I tell myself at least ).

One thing that I haven't forgotten is what it’s like to experience a market crash. After all, I have been in the markets during three major and several minor occurrences.

It might seem premature to be talking about market crashes and corrections with equity indices printing new highs recently, but of course, every correction starts somewhere and has its own catalysts.

It seemed that no sooner had I written these words than President Trump was castigating China and talking about additional 100.00% tariffs on imports from the People's Republic into the USA.

S&P 500 before President Trump, posted about China

Source: Barchart.com

He may have been thinking out loud, but this was the net result.

S&P 500 after President Trump posted about China

Source: Barchart.com

When I look around the markets and the narratives and newsflow within them, I can hear echoes of the GFC, and the dot com boom and bust.

And given that's the case, it would be remiss of me not to point them out.

Not least because we haven't had a major market upset for 17 years, and that means that there are likely several generations of traders in the markets today who have not experienced a crash.

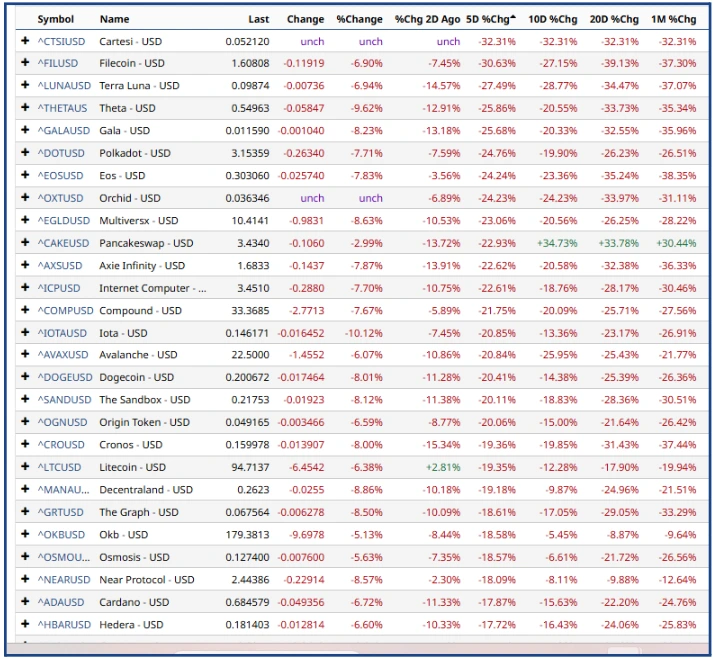

Fragility in Crypto and Alt Coins

I don't really get involved in cryptocurrencies beyond tracking Bitcoin ETFs in the US; however, the Crypto universe is something of a barometer of marginal (or extreme ) investor sentiment. In some ways, they have replaced penny stocks in this respect. The comments on China Trade made by President Trump sent Bitcoin and Ethereum down sharply, and smaller /alternative coins took an even bigger hit, as we can see below.

Alt Coin Performance

Source: Barchart.com

Could an even bigger blow-up here have a knock-on effect on sentiment if nothing else?

Bad Credit?

Investment bank Jefferis JEFF US is licking its wounds after the bankruptcy of auto parts maker First Brands, which recently collapsed with more than $11.0 billion in liabilities.

Jefferies manages a credit fund for clients that has (or should that be had?) significant exposure to the parts maker, which the bank says totals $715.0 million, though Jefferies' own losses are expected to be a fraction of that figure.

You can see the knock-on effect on the company's stock price in the chart below. The bank has a market cap of $10.50 billion, so while the loss will hurt, it's not likely to be fatal.

Source: Barchart.com

JP Morgan has written on the possibility of contagion from First Brands, which it sees as minimal, though it does highlight other entities that have and will be affected by the bankruptcy.

JP Morgan analysts also make the following observation:

“The spillover effects are based on what we learned from CS Supply Chain Finance Funds (Greensill) failure in 2021; 4 years later, we are in a similar situation with limited lessons learnt, as we still see in this situation, business concentration and hence ‘one way risk’ through for example, the First Brand exposures in Point Bonita and O’Connor funds.”

That’s what concerns me because I can hear echoes of the credit crunch in 2007, which preceded the failures of Bear Stearns, Lehman Brothers, and necessitated bailouts for many other banks in 2008, that could no longer fund in the markets, to meet their obligation.

Of course, “One swallow does not a summer make” (Aristotle)

However, with a lot of chatter about trouble in the private markets and private credit, doing the rounds, I have to wonder how many other businesses are out there that could follow First Brands into insolvency?

Nested deals and capital raising

I have already written about the nested and circular nature of deals being struck in the AI and AI-related sectors. Deals involving chip makers, cloud storage providers, and AI chatbot operators such as OpenAI.

The numbers involved are staggering.

OpenAI alone has committed to $1.0 trillion of expenditure, though right now it's unclear where this money will come from. The Chat GPT owner is currently loss-making, and its annual revenues are just a fraction of these commitments.

OpenAI and others may look to the private markets and PE companies for funding; Meta Platforms has already done so. Other businesses, even those perceived to be cash-rich, are issuing debt to cover Capex commitments.

That shouldn't be a problem if AI is the promised land as we are led to believe, but if it turns out to be a dust bowl, then that could be a real issue.

Source: How stuff works

A Last hurrah for retail?

Consider these bullet points about the behaviour of retail traders in recent weeks.

- Retail investors are buying stocks at the fastest pace since 2021, pushing up prices for popular names like SoFi Technologies, Riot Platforms, and Meta.

- Citigroup’s index of retail-favoured stocks has surged 30% since September, far outpacing the S&P 500’s 4.3% gain.

- JPMorgan reports retail buys totalled $7 billion in stocks in the first week of October, up 40% from this summer’s $5 billion weekly average.

- The buying spree forms a classic feedback loop — rising prices attract more buyers, which accelerates price gains.

- Retail options trading is also at record highs, further fueling concerns.

- Wall Street distinguishes between 'smart money' (institutional players) and 'dumb money' (retail investors), with the latter often piling in late during rallies, increasing bubble risks.

The correction in US markets seen on Friday 10th of October, was a reminder about what happens when everyone heads for the exit at the same time.

I also note that a leading US bank saw net retail selling in the bounce seen on Monday, the 13th, even in stocks like Broadcom AVGO US, which rallied almost +10.0%, on, you guessed it, news of a deal with OpenAI.

Could retail clients have been cutting their losses and or banking profits on Monday, concerned about the possibility of a bigger fall to come?

A larger correction or crash isn’t a certainty, but don’t be fooled into thinking that it couldn't happen.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.