Creating a strong investment portfolio is a key challenge for every investor, regardless of their level of experience.

This article will look at the most important portfolio management strategies and focus on areas such as asset allocation, diversification, and portfolio risk management.

What Is an Investment Portfolio and Why It Matters

An investment portfolio is a collection of assets chosen by an investor. This can include stocks, bonds, commodities, exchange-traded funds (ETFs), or cryptocurrencies.

A well-constructed portfolio is designed to increase the investor’s wealth over time. It needs to take into account their overall goals, as well as their risk tolerance and the time they want to see returns in.

An investment portfolio doesn’t have to stay the same, since changes can be made to reflect fluctuating market conditions or adjustments to the investor’s goals.

Key Portfolio Management Strategies for Diversification

A solid portfolio diversification strategy is needed to boost the chances of success. There are several ways to approach this, each contributing to a more diversified portfolio strategy.

Diversification

Diversification means that the portfolio has a mixture of assets to stop it from depending on a single source of growth. This diversification can be carried out by choosing different asset classes, like stocks, bonds, and Forex, for a single portfolio.

Another option would be to focus on just one or two asset types, but look for diversification in the exact assets chosen.

Allocation by asset class

Asset allocation begins by distributing the portfolio across various investment categories. The main asset classes all behave differently, meaning that there should be less risk that they all underperform at the same time.

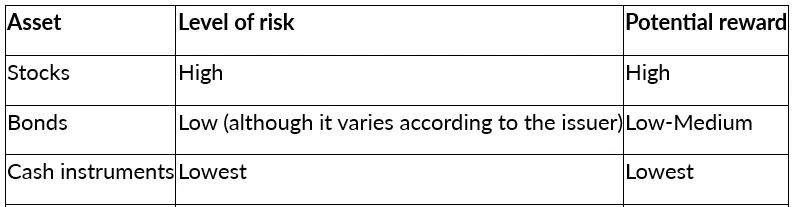

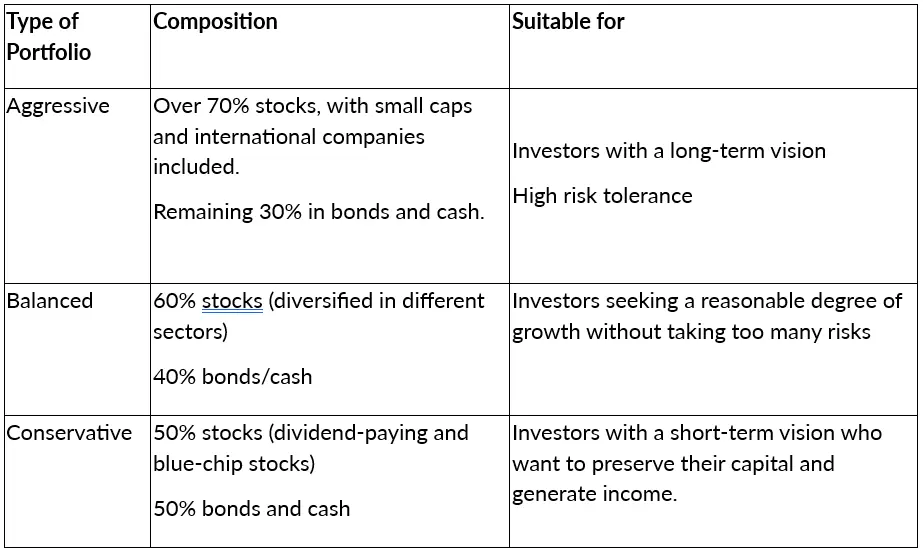

The main asset classes used in investment portfolio strategies are stocks, bonds, and cash instruments. Each of these assets has a different profile that determines what percentage it should represent in a portfolio.

Geographic Diversification

Spreading an investment portfolio over different geographical regions aims to lower the risk of loss. This is on the basis that an economic downturn in one region may arrive at the same time as an upturn elsewhere.

It also allows investors to access emerging markets or sectors that don’t exist in their home country. In addition, it can work as a longer-term portfolio management strategy, since economic cycles don’t always fall into place at the same times across the planet.

Balancing Risk

There are various ways to balance risk through portfolio diversification. Investors sometimes choose to lower their exposure to riskier assets when they’re more experienced, depending on their goals and risk tolerance.

This leads to the need for portfolio rebalancing strategies. Ideally, your portfolio should be assessed once a year, to take into account any changes that affect your outlook, goals, or risk tolerance.

How to Create and Manage a Stock Portfolio

The process of creating a stock portfolio begins when you assess your profile. This is where you need to think about the following points.

- Investment goals. Is this portfolio being created as a way to boost your retirement? Or is it to pay for something specific, like a property or a car?

- Time horizon. If you’re looking at a longer-term investment, you may be willing to take more risks than you would with a shorter time frame.

- Risk tolerance. This is where you need to consider how much money you’re comfortable putting at risk.

By taking these factors into account, you can work out the best stock portfolio approach for your needs. However, once you’ve created your portfolio, you should work out how to monitor and track it.

Sites such as Google Finance, Yahoo Finance, and Seeking Alpha all offer portfolio trackers. When using MetaTrader 4, MetaTrader 5, TradingView, or ActivTrader with ActivTrades, you can track your portfolio with the tools provided.

Signing up for email alerts can also be useful, as this lets you remain aware of changing market conditions. Set aside a date each quarter or year for rebalancing your assets, which is when you can decide what changes are needed, if any.

Managing Risk: Portfolio Risk Management Explained

Carrying out appropriate risk management is vital for anyone who wants to stay in control of their investments. Various portfolio risk management strategies can be used to do this effectively.

- Hedging is where you take the opposite position from an asset in your portfolio. It acts as a form of insurance designed to help offset potential losses in your main position.

- Position sizing is about how much money goes into each asset. This is based on the investment portfolio analysis and risk factors mentioned earlier.

- Asset allocation is the strategy that sees you split your portfolio across different assets.

- Stop-loss policies are instructions to automatically close a position if the price drops to a certain level. Take-profit orders close the position when it reaches your goal.

ActivTrades has a range of risk management tools that have been designed to support investors with their investment analysis and portfolio management. They include stop-loss orders, take-profit orders, and in-depth market analysis.

Combining Assets: From Forex to ETFs, Bonds, and More

Different asset classes like Forex, ETFs, stocks, commodities, cryptocurrencies, bonds, and indices can all be used to create a diversified investment portfolio. This approach aims to balance opportunities for growth with a controlled level of risk.

It means that a downturn in a particular sector isn't going to affect you as badly as it would if it were the only element in your portfolio. It also allows you to take advantage of the different cycles that each asset typically goes through.

Each investor needs to take their own situation into account when working out the exact level of investment portfolio diversification that suits them best.

Passive vs Active Portfolio Management Strategies

Passive portfolio trading is a hands-off approach. This type of strategy will typically see the portfolio set up with a specific goal, such as matching a chosen market indicator. The portfolio is then left to run, with a minimum amount of intervention needed.

An active portfolio management strategy is classed as being hands-on; you look to outperform the market by rebalancing the assets when needed. This can also involve tactical shifts when you see that an opportunity arises elsewhere.

Active trading portfolio management is more suitable for experienced investors and those who have the time to study the market before making decisions. It is a higher risk approach that may involve higher fees and the added risk of trying to time the market correctly.

Start Building a Diversified Investment Portfolio with ActivTrades

You can use the tools and platforms available from ActivTrades to start building your own diversified investment portfolio. MetaTrader 4, MetaTrader 5, TradingView, and ActivTrader will all help assess the latest charts and choose varied assets.

With access to multiple asset classes, including leading indices, commodities, ETFs, and Forex, you can choose the assets and the portfolio diversification strategy that are right for you. It's then a question of using the analysis and insights on our platform to guide you as you continue diversifying.

FAQs – Key Portfolio Management Strategies

What is the Main Goal of a Portfolio Strategy?

Each investor has their own goals. These typically range from capital growth to capital preservation and income generation. Understanding your goals is the first step to choosing a portfolio strategy that’s right for you.

How Can I Assess My Risk Tolerance for Investing?

This is your ability to deal with a falling or fluctuating market, both financially and emotionally. Consider what kind of losses or instability would be acceptable for you.

What Are Some Common Investment and Portfolio Management Mistakes?

Some of the most common errors include making emotional decisions, trying to time the market exactly, and chasing the assets that have performed most strongly in recent times. Having a sensible and balanced portfolio strategy in place when you start investing will help you to avoid these issues.

Is Over-Diversification a Portfolio Management Strategy Risk?

The main risk of over-diversification is that the returns from the best-performing assets are diluted. By including a large number of assets, you’re more likely to edge towards the overall market benchmark, which lowers the impact of your best choices.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.