One of the mantras that I try to live by in the markets is to be pragmatic rather than dogmatic.

Which means don’t get hung up on the reasons why something happens, but instead just acknowledge that that’s the case, and go with the flow.

Trying to be right instead of trying to be profitable is a mistake that many traders make.

Of course that doesn't mean that we shouldn't think about what’s going on in the world and the effects that can have on prices, and trading opportunities of course. But what we mustn’t become consumed by the need to be proven right.

However I am finding it increasingly hard not to have an opinion right now and in particular about what’s going on in the world of technology which these days means AI.

Here is an example a deal announced at 9.00 am New York time on Monday Nov 3rd

As with most AI deals it contains some significant numbers: even in this day and age $38.0 billion is a substantial sum of money, and the deal aligns Amazon with a new customer, as AWS cloud hasn’t worked with Open AI before.

Source: CNBC

Amazon’s stock price, which had gapped higher last week, after its earnings report moved higher. Opening by as much as +5.0% higher on the day. A great move as far as the bulls were concerned and very painful one for any lingering shorts in the stock.

Source: Barchart.com

However I find myself asking if the news is as good as it looks?

I posted this on a trading and investing social network I contribute to, on Monday morning, London time (and thus before news of the OpenAI deal had broken) highlighting that Morgan Stanley were bullish on AMZN.

“Amazon AMZN US is something of a marmite stock right now.

Morgan Stanley are fans however and have made a bullish case for the e-commerce to cloud computing giant, which can be summarized as follows:

Morgan Stanley analysts project that AWS is entering a powerful AI-driven growth phase, driven by massive capacity expansions, surging AI demand, and increased capital spending that will outpace its peers.

Key Points from Morgan Stanley’s AWS Analysis:

Unprecedented Compute and Data Center Expansion

AWS will add 1 GW of compute capacity by the end of 2025, with plans to double its Trainium2 chip installations.

Over the next 24 months, AWS plans to bring 10 GW of new data center capacity online, representing one of the biggest buildouts ever seen in the cloud industry.

AI Demand and Revenue Acceleration

AWS signed $18 billion in new business contracts in October 2025 alone, eclipsing its entire Q3 performance, driven by exploding AI workloads and partnerships.

Morgan Stanley forecasts that AWS revenue will grow by 23% in 2025 and 25% in 2026, adding an incremental $6 billion per year from AI specialization.”

All of which sounds impressive, but is it really??

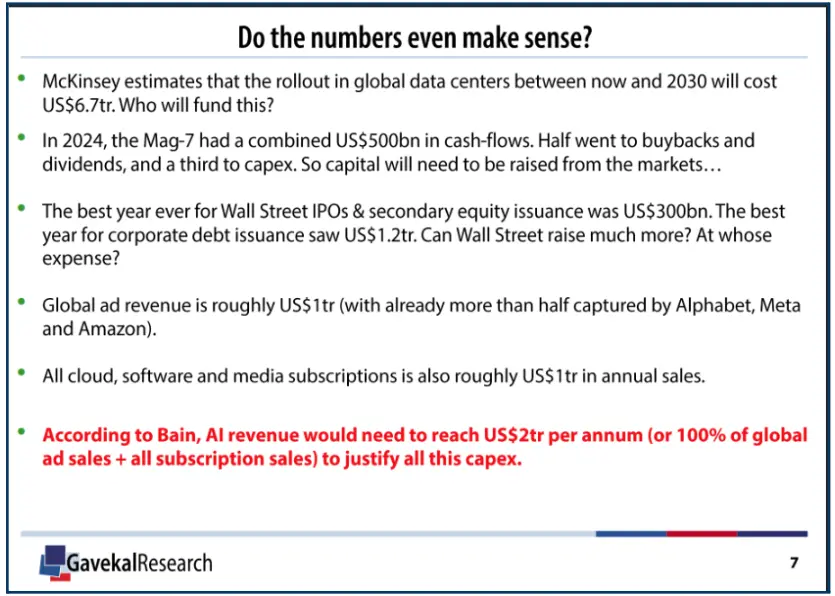

Take look at look a this slide from a recent report from the independent research house Gavekal:

The second point on the slide takes my eye straight away even the biggest most successful companies have finite resources. In terms of revenues and cash, and they can only be spent once so investors and traders may have to reorganise their priorities.

Source: Gavekal Research

Point three is also very telling because in its best years ever, Wall Street raised a combined $1.50 trillion less than a quarter of the projected spend on data centres globally by 2030.

Are the markets willing or able to put up more cash and receive less in terms of shareholder yield/ rewards (that’s dividends +buy buy-backs) for doing so?

Mark Andreessen, one of the world's leading Venture Capitalists, famously said that:

“Software was eating the world”

Looking at the numbers above, maybe that quote should be modified to:

“AI is eating the world’s cash “

We have recently seen what can happen to a Mag 7 stock price when earnings and outlook disappoint, with Meta Platforms META US falling by -15.00% over the last three trading sessions. As of the close 02/11/2025.

Source: Barchart.com

Meta bulls would probably say that an unexpected, but one-off tax charge, of between US$15.0 & 16.0 billion is what spooked the market, and that's probably true.

However, I would counter that it reminds us that the direction of travel can be derailed, even in a business with revenues of $164 billion per annum, when Capex is the major focus of that business, and cash resources are put under strain.

For now, at least, new deals in the AI space are being rewarded by the market; however, I think we can detect signs of what we could call “reward decay”.

For example, in this chart of Oracle, which you may recall signed a $300.0 billion deal with OpenAI back in September, the stock added almost 36.0% in one day, on that news; however, the subsequent trend in the price has been downward, as we can see below.

Source: Barchart.com

Does this tell us that traders and investors are no longer blindly taking these deals at face value and are instead starting to question the mechanics, work and cash flows in these arrangements?

I will be watching the Amazon chart from here for any signs of similar behaviour/price action.

In the second part of this short series of articles, I will look at where pinch points might be found in the supply chains that keep big tech and AI dreams alive.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such, is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.