Portfolio diversification is one of the keys to investing sensibly, particularly if you’re using leveraged products. If you want to diversify your portfolio, what are the main points to bear in mind? We’ll be looking at a simple, rule-based approach that can be used across asset classes.

What Is Portfolio Diversification?

What does it mean to diversify your portfolio? This is a way of spreading exposure over different assets and risks. Doing this lowers the risk that comes from being invested in a single asset and aims to provide you with steadier returns over time.

You should be aware of the limits on each asset, though, to avoid over-diversification. The right mixture of assets isn’t right for everyone, which is why each investor needs to understand their own situation and goals, as well as the overall subject of diversification.

Why is Portfolio Diversification Important for CFDs?

Leverage shocks can arrive when the value of an asset drops. In a heavily leveraged market, this may trigger margin calls and force traders to sell at a loss. One of the objectives of portfolio diversification is to avoid losing a high percentage of your funds if this situation occurs with one of your assets.

Correlation shocks are when unexpected events cause two assets to become more correlated than normal due to macro events. This causes correlation levels to spike as varied assets start to move together.

This happens when investors panic and sell various types of assets. When correlation rises like this, the portfolio diversification benefits we normally get are lowered or disappear altogether.

When using a contract for difference (CFDs), the leverage present amplifies the results achieved, whether negative or positive. This leads to greater volatility, but good portfolio diversification can help to dampen the volatility in those cases when different assets don’t move together.

Your position sizes are important, since this is how you can ensure that you get the benefits of portfolio diversification. You don’t want too much of your funds to get into one asset or type of asset.

Take into account how much of your portfolio’s risk and volatility each asset covers, rather than simply looking at the percentage it takes up in cash value.

How to Diversify Your Portfolio

The best way to diversify portfolio investments is to take a structured approach. Following these steps will ensure you get a diversified portfolio.

- Pick distinct assets. This could mean investing in forex major pairs, indices, shares from different sectors, ETFs and a commodity, with cryptocurrencies optional.

- Check the correlations between each pair of assets. Bear in mind that you’re looking for the greatest possible degree of diversification.

- Cap the single-position risk. This can be done by setting a cash amount that is the maximum you’d be comfortable losing on any position.

- Set a maximum weight per bucket. This takes into account the risk and volatility of each asset.

- Schedule a regular portfolio rebalancing. Some investors rebalance their portfolios once a year, while others do it quarterly or once every six months. You should also keep an eye on your portfolio to see if any of the assets stray from the weightings you calculated earlier.

Portfolio Diversification Strategy: Sample Mixes by Risk Profile

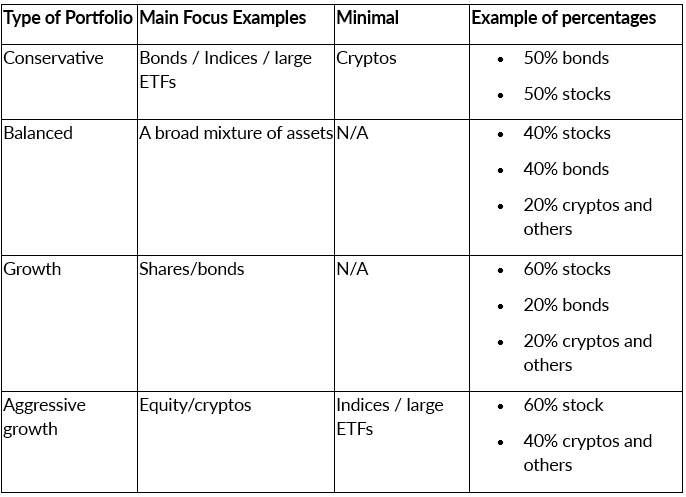

To get a better feel for the types of portfolio diversification you should be looking for, take a look at the table below to see how it can be done in different ways.

Remember that position sizing is carried out per trade to manage the risk level. Consider your objectives and risk tolerance before carrying out any portfolio diversification strategies and calculating the percentage of each asset to use.

Asset Classes to Combine with CFDs

When looking at portfolio diversification examples for CFDs, you need to be aware of the drivers and roles of each asset class.

- Forex. A level of diversification can be gained by choosing currency pairs that move according to different financial news and reports from the other assets in the portfolio.

- Shares. The growth engine is typically used to provide long-term capital appreciation and beat inflation.

- Indices. An easy way to gain diversification is by investing in an index that tracks a sector or region rather than a specific asset.

- ETFs. This is a cost-effective way of diversifying a portfolio by tracking a fund with assets of your choice.

- Commodities. They’re not correlated to the stock market or bonds and can climb when there are geopolitical tensions or rising inflation.

- Cryptocurrencies. These digital assets provide a high degree of volatility, and their price movements are often unrelated to any other financial market.

- Bonds. These assets are used to preserve capital and provide stability as part of a portfolio diversification strategy.

Position Count, Correlation, and Rebalancing: Simple Rules for Portfolio Diversification

The process of investment portfolio diversification includes three basic rules that can’t be overlooked.

- Hold enough lines to reduce idiosyncratic risk. This is the risk that is inherent in a particular asset rather than the overall financial system. For example, you might want to hold 20 different shares covering different industries and geographic regions.

- Choose lower-correlated exposures. Look to make the historic correlation between your assets as close to zero as possible.

- Rebalance portfolio according to your schedule. This should also be done if it drifts from the pre-established bands you set at any time.

By sticking to these simple portfolio diversification rules, you can keep your investments diverse at all times without increasing the risk.

Tools & Checks: Portfolio Diversification Calculator

Once you have a portfolio diversification formula, the next step is to keep track of how you’re doing. There are several ways of doing this that will help keep your investments on the right track.

A portfolio diversification calculator is a financial tool that weighs up factors such as the correlation between assets. It lets you manage risk levels and easily rebalance the portfolio when necessary. You can find this type of calculator easily online.

The other option is to set up a simple spreadsheet to do the same job. This means tracking weights, keeping an eye on correlation levels and using maximum weight caps. Either of these tools will do the same job, meaning that it just comes down to your personal preference.

Risks, Costs, and Trade-Offs to Know First

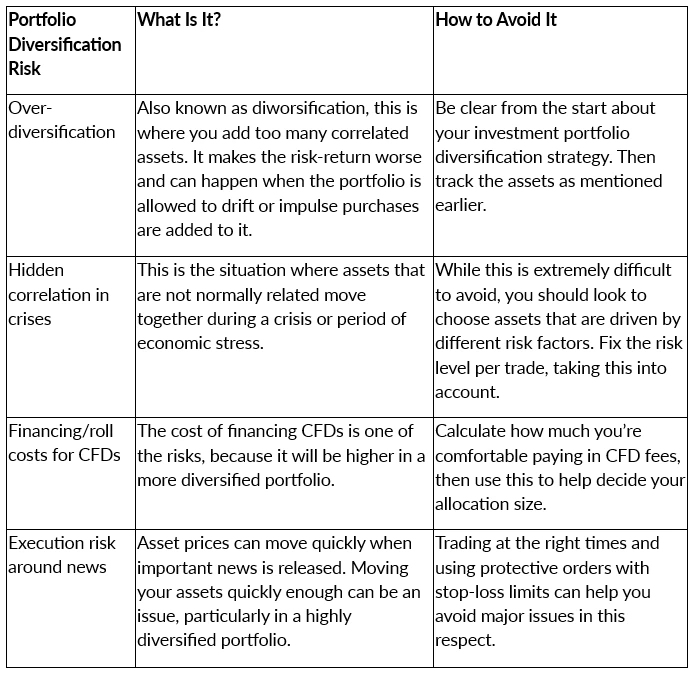

When we look at diversification and portfolio risk, there are some crucial points to be aware of. Here are some of the main risks that you should know about, and how to avoid them.

A One-Page Portfolio Diversification Checklist

The concept of portfolio diversification begins when you set your investment goals. After that, choose between four and six different asset classes. You should then set the maximum weight for them and the fixed risk per trade you’re going to use.

Continue verifying correlations during your investment portfolio diversification process. By reviewing performance monthly, you can choose to rebalance your portfolio when needed.

How to Diversify Portfolio – FAQs

What Is Unsystemic Risk or Specific Risk?

This is the type of risk that is specific to a certain industry, region or company. It explains how one asset could be performing very well while another has a much poorer performance.

What Is an Example of Uncorrelated Assets?

Stocks and bonds are typically given as examples of assets with low correlation between them. However, they sometimes show a negative correlation. This can occur when stock prices fall and money is moved into safer investments like bonds.

How Can I Achieve Portfolio Diversification in a Single Asset Class?

We can look at the example of stocks, where you could invest in a mixture of sectors, regions and market caps. However, this only gives a certain degree of diversification of the portfolio, with other assets needed to lower the risk further.

What is the 110 Rule in Portfolio Diversification?

This rule suggests that you should subtract your age from 110. The resulting number tells you the percentage of your overall portfolio to invest in the stock market. For example, someone aged 60 would make it 50%, while a 30-year-old would put 80% into stocks, according to this theory.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.