Markets are full of sayings and catch phrases; some of them are humorous observations, but others have more than a kernel of truth within them.

“The trend is your friend” is one of these.

Let's look at a real-world example that shows exactly what I am talking about.

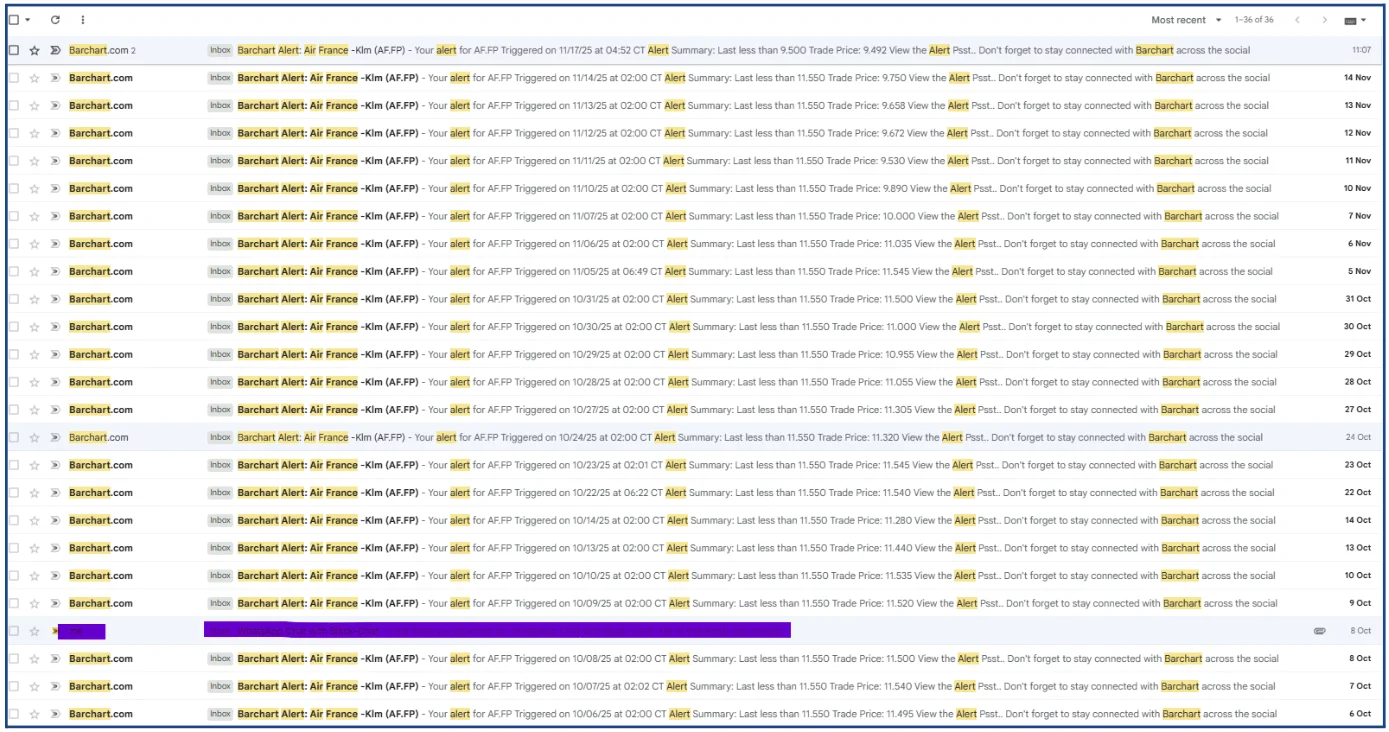

Air France KLM AF FP came to my attention in September.

I had previously set an alert to highlight when, and if, the stock traded below €12.00.

That alert was triggered six times in a row between the 19th and the 26th of September.

(See the image of my alerts inbox below)

Six consecutive alerts suggested a clear pattern or bias in the price action, and to test that theory

I reduced my alert level to less than €11.60.

Lo and behold, that was triggered on September 29th.

In fact, there were 36 alerts triggered in Air France KLM between September 19th and November 17th, running all the way down to a print of €9.396.

That’s around a -21.0% fall in the stock price over two months.

And to be honest, you didnt really need to look at a chart in that timeframe to be able to trade the opportunity.

The list of alerts would have been all the intelligence that you needed

I use these alerts to track price action and to remind me about stocks that I looked at weeks or sometimes months before.

It's easy to miss proce changes across multiple charts, time frames and stocks. However, the email alerts I receive create a traceable chain and keep stocks that trigger those alerts at the front of my mind. If nothing else at the end of the business day, or before the open, I can review the alerts i have received and corresponding stock charts.

Once I have familiarised myself with the set-up, I use alerts to confirm what I suspect is happening, or is likely to happen to the price.

In the case of Air France, that was the beginning of a new downtrend.

Thereafter, the alerts track the trend’s performance.

Remember that a downtrend is defined as an ongoing series of lower lows and lower highs on the price chart.

Air France KLM price alerts

Air France KLM 6-month daily candle chart

And though I didn't do this myself. There would be nothing to stop you from setting alerts to specifically identify lower lows and lower highs in the stock price, compared to those seen in the previous session.

I use Barchart.com for my price and technical alerts, but many other price display and trading platforms offer an alerts service.

Making Memories

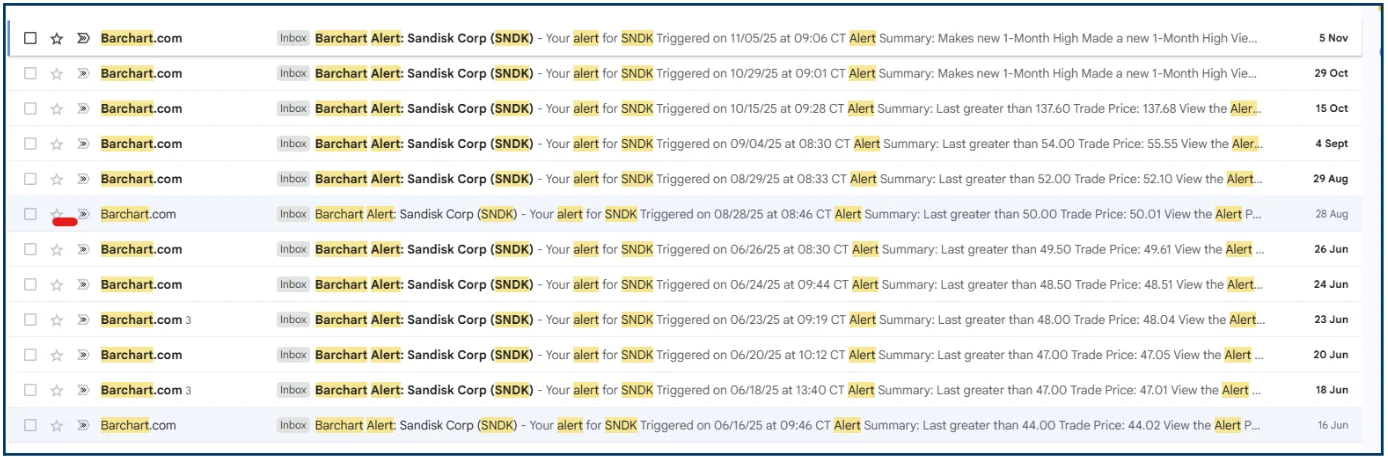

Here is another example of how price alerts can be used to track the trend in a share price, in this case, in memory maker Sandisk SNDK US.

And no, your eyes aren’t deceiving you, the alerts start at a price of $44.00 and continue up to $137.60.

At that point, I briefly switched to new 1-month highs as the trigger.

Sandisk price alerts

I stopped setting alerts in SNDK after November 5th, not because I was no longer interested in the stock, but because it was just “one-way traffic” in the price action, after that point.

SNDK traded up to $284.76 on November 12th, generating a gain of more than +660.0% over the prior 6 months, and +580.0% since June.

A word of warning: the alert email count can build up rapidly.

I have almost 3100 email alerts, spread over numerous stocks, in my inbox right now.

I don't mind that, because I pay for storage, and I have a track record that I can look back on.

However, if I include emails that contain the results of the market screens I action daily, then that figure probably runs closer to 10,000. So it can get out of hand.

In both these stocks, there was no point in trying to oppose the prevailing trend

True, in Air France KLM, there was an attempt at a reversal between October 30th and November 3rd.

But in fact, that counter-trend rally failed, just below former resistance and the 50-day moving average.

Which, if anything, helped to confirm that the path of least resistance for Air France's stock price was downward.

The concept of the path of least resistance is an important one because that is what we are trying to establish when we assess any stock price move.

The less friction, or resistance, there is, the easier it is for the price to move, and that’s the direction it's most likely to go in.

Think about what it would be like to run on thick mud or loose, deep sand, compared to a flat tarmac road.

When price, which is always looking for directional cues, finds the “!tarmac”, then it can build momentum, which is exactly what happened with the examples above.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.