GOLD

Gold prices edged lower early Wednesday as traders awaited the release of two crucial sets of data later in the day. The forthcoming GDP figures will provide a vital insight into the current state of the US economy, while data on the Fed's preferred inflation metric, personal expenditure, is also anticipated. However, market expectations suggest that neither dataset will offer any surprises. Consequently, their impact on the Federal Reserve's hawkish stance, which has been keeping gold prices in check, is likely to be minimal. Given this scenario, gold prices are expected to remain within a relatively narrow range. The Fed's hawkish stance is likely to act as a ceiling, with prices hovering around the $2,050 mark, while support is anticipated near the $2,000 level, as geopolitical tensions and economic uncertainty are expected to underpin demand for gold as a haven asset.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

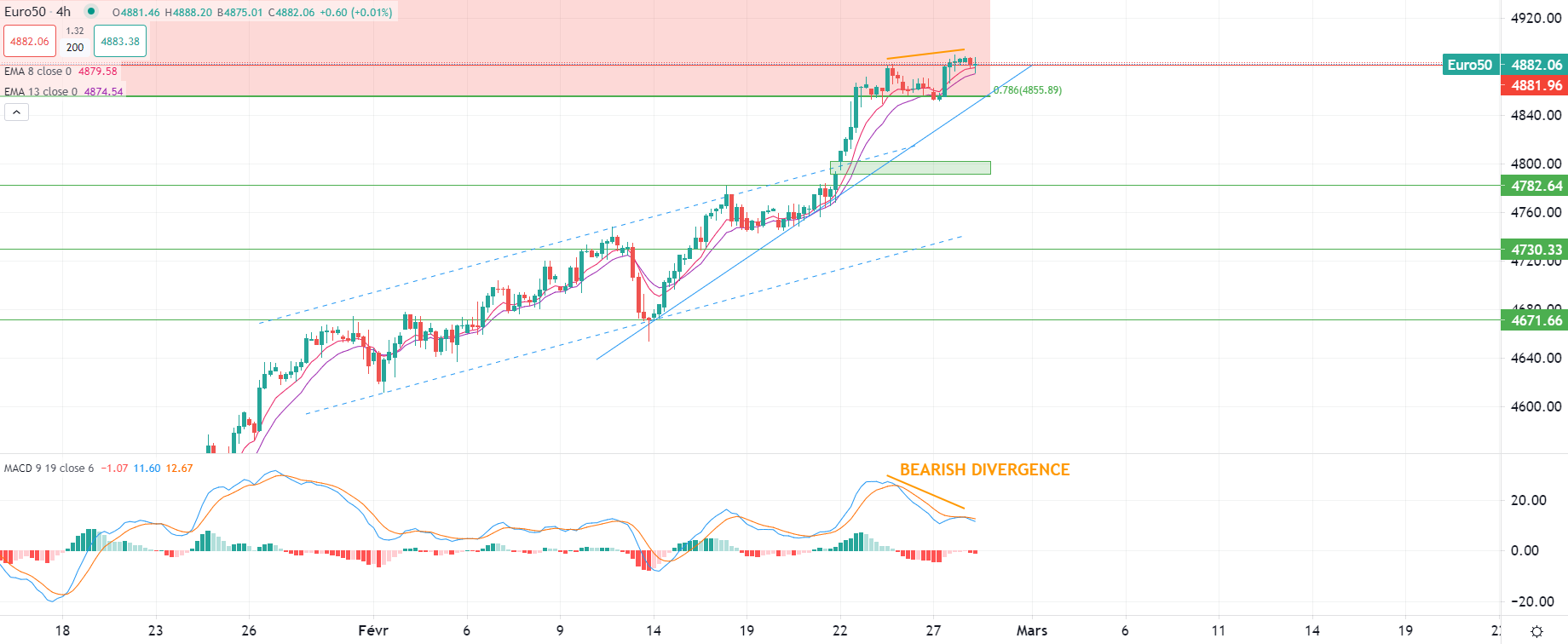

European shares opened mixed on Wednesday, with lower volatility than usual, as market sentiment takes a break ahead of the release of new economic data.

Market sentiment was clearly on hold this morning as the “wait and see” trading stance seemed to prevail everywhere while investors braced for the next big batch of economic developments.

With a slew of GDP and inflation data, alongside speeches from central bank officials from the EU and the US, investors will have a lot to digest in the second half of the week.

These data are seen as crucial as they will be used by many to assess the likely path for monetary policies in both regions, a key driver for both FX and equity markets.

We can expect a significant increase in market volatility towards riskier assets starting today with the release of GDP figures from the US.

So far, the STOXX-50 index trades slightly above 4,880.0pts, challenging a newly established support following the bullish break-out of its previous trading range.

However, although optimism has held on recently, the bearish divergence displayed by the MACD indicator may announce another correction leg in the very short term, with 4,855.0 pts as the first significant support level for the market.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.