GOLD

Gold prices dropped below the $2,000 mark during early Monday trading, falling below that significant level for the first time in over two weeks. The precious metal lost some of its shine as traders’ expectations shifted following the release of US labour data on Friday, which came up better than expected. Bullion prices had been supported by hopes that the Federal Reserve would pivot with a rate cut, which some saw coming as early as next March. However, with inflationary pressures still lingering, the resilience of the American labour market means that an earlier rate cut is unlikely. Against this background, the prospect of higher for longer rates is back, in a development that supports treasury yields and the dollar, and is bad news for the non-yielding gold.

Ricardo Evangelista – Senior Analyst, ActivTrades

Source: ActivTrader

EUROPEAN SHARES

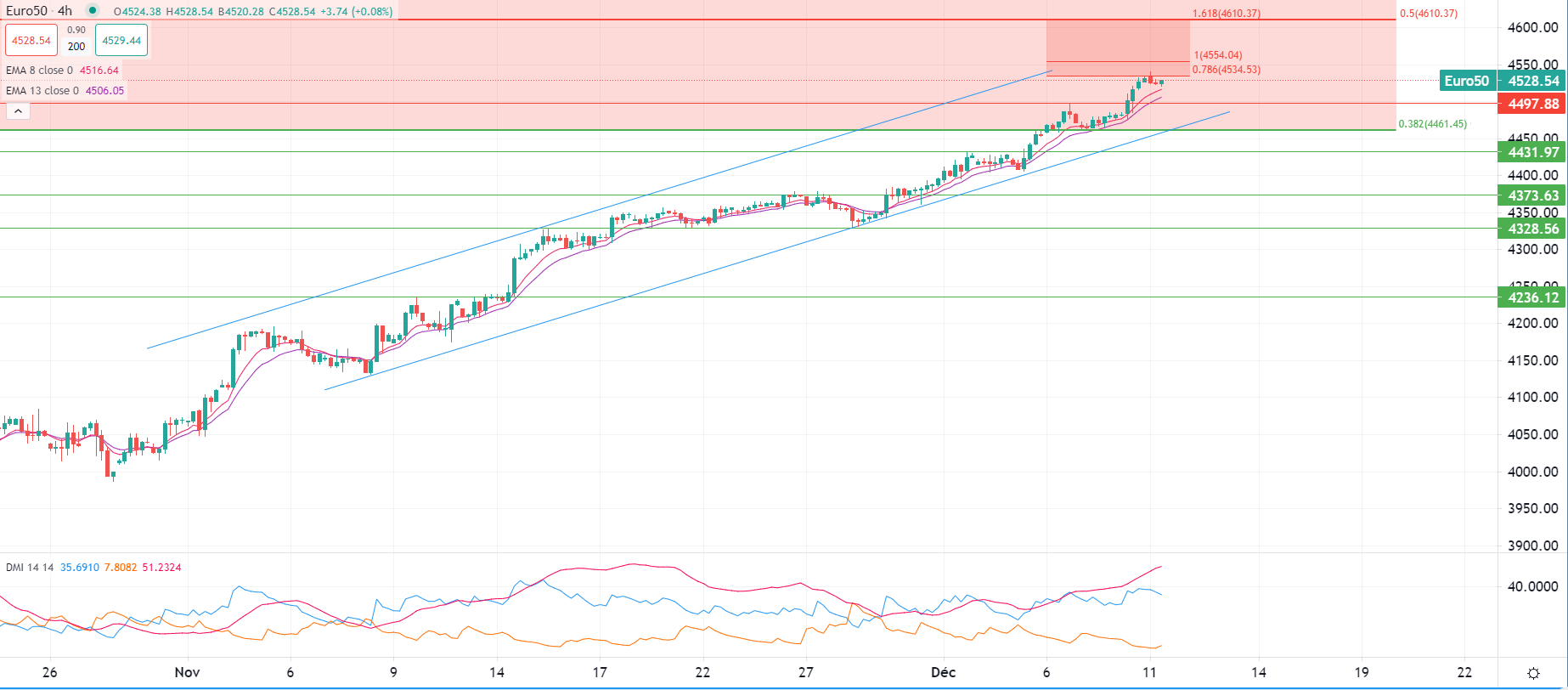

Following a patchy trading session in Asia, European stocks opened mixed on Monday as investors brace themselves for a risky week.

The STOXX-50 index still trades well above the 4,500.0pts mark despite its failure to clear the 4,535.0pts resistance, as gains in healthcare and industrial shares are offset by losses from the consumer non-cyclical, energy and basic materials sector.

The market lacks direction for the first exchanges of this new trading week, and investors are waiting for an extremely busy macro calendar in the next few days.

In addition to the new batch of key macro data such as PMIs and inflation rates, traders will pay close attention to the decision on rates from the US, EU and UK this week.

This week's challenge for investors will be to confirm their hopes of a monetary dovish turn to come. Many have already priced it in, and this sentiment still prevails even if the solid US employment data seen last Friday has slightly tempered the amplitude of rate cut expectations.

Volatility will likely increase significantly throughout the week, even though most benchmarks remain well-oriented.

The STOXX-50 index still trades inside its mid-term bullish channel, with both moving averages rising, while the DMI shows a directional price action inside a bull environment.

The 4,610.0pts zone should be seen as a strong resistance level if the market clears the 4,535.0pts and 4,55.0pts marks.

Pierre Veyret – Technical analyst, ActivTrades

Source: ActivTrader

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.