Weekly Outlook

What Happened This Week?

- Australia’s central bank unexpectedly kept its policy rate at 3.85%, awaiting further inflation data.

- The Bank of Korea kept its rate steady at 2.5%, opting to assess the effects of its recent measures designed to cool down the housing market in Seoul.

- A divide is brewing within the Federal Reserve over when to resume interest rate cuts, according to minutes from their June policy meeting. Although most officials expect to lower rates this year, only two were ready to cut them as soon as the upcoming meeting later in July.

- New Zealand's central bank kept interest rates steady at 3.25%, citing the need to watch for inflation risks that have increased recently.

- In a move to support its economy, Malaysia's central bank lowered interest rates to 2.75%—their first cut in half a decade. The bank stated that despite the economy's strength, the decision was driven by the economic risks from global uncertainties.

- While new unemployment filings in the US dipped to 227,000, the overall jobless population still grew in June.

- A Bank of Japan report indicates that growing anxiety over U.S. tariffs is dampening Japan's corporate outlook, even though the direct impact of these tariffs on businesses has been limited so far.

- In June, UK house buyer demand turned positive for the first time since December 2024, with new buyer inquiries rising 3% (from -22% in May), suggesting a market stabilization despite ongoing challenges for both buyers and sellers.

- German exports continued their slide in May, down 1.4% overall and a sharp 7.7% to the U.S., for the second month in a row. Germany's central bank expects the economy to stagnate this year, with tariffs alone potentially reducing growth by 0.75 percentage points.

- Donald Trump's announcement that the U.S. will impose 50% tariffs on copper imports sent copper prices soaring, with U.S. copper futures jumping 13% to a record high of $5.6450 per pound, marking their largest one-day increase since 1968.

- Bitcoin reached a new all-time high, climbing above $117,000.

This Week’s Market Movers

Forex

- The GBP/USD is trading downwards for the second week in a row.

- The USD/JPY is recording its highest weekly gain since mid December.

- The AUD/USD is trading higher for the 3rd week in a row.

- Bitcoin prices are trading at their highest level ever above $117,000.

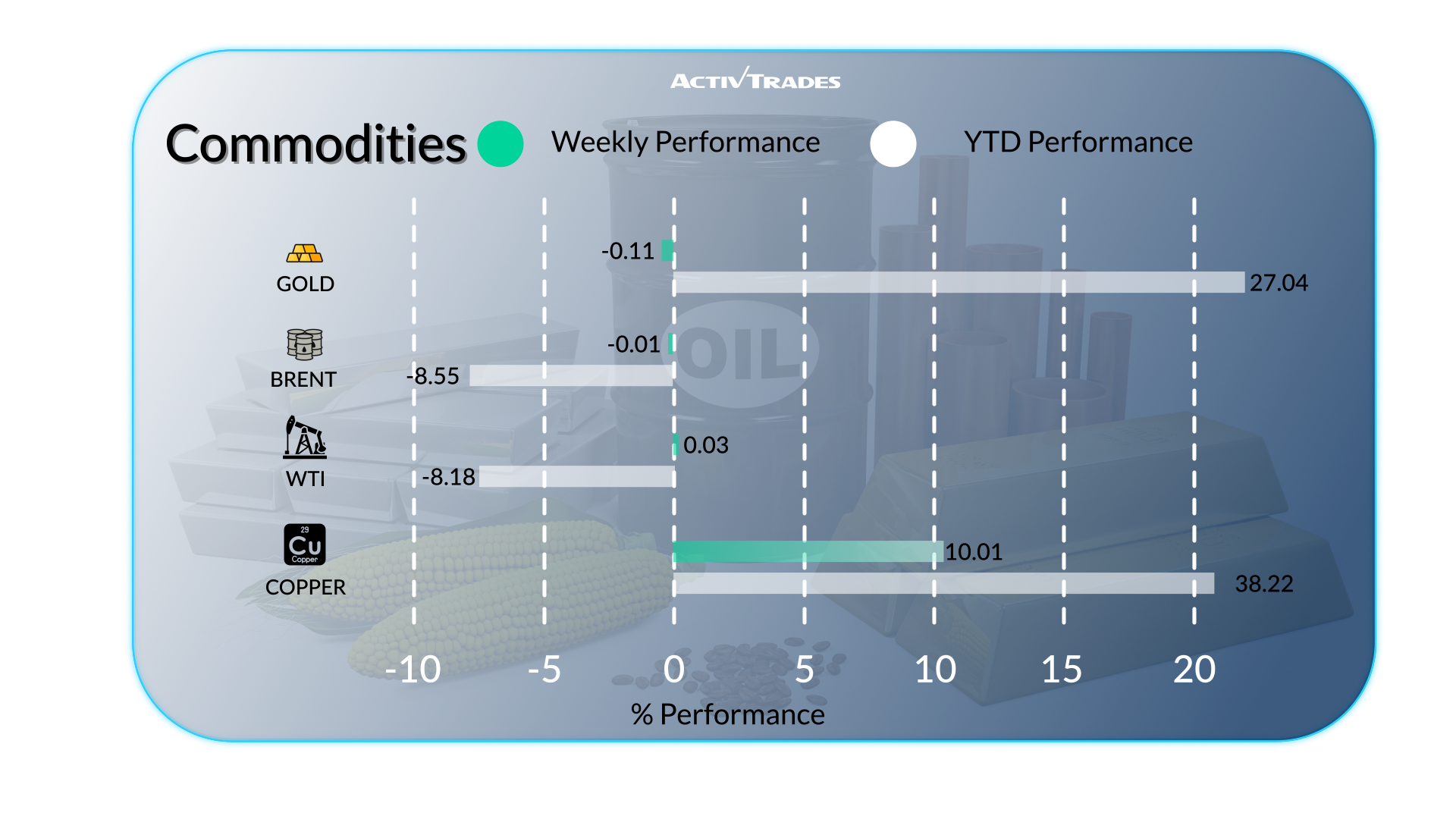

Commodities

- Copper prices are up almost 10% and reached their highest level on record above 5.8935.

- Silver prices are trading at their highest level since September 2011.

- Orange juice prices are up almost 20%, after 5 weeks down.

- Coffee prices are down almost 10% for the 11th week in a row.

Indices

- The Nasdaq Composite, the USA500 and the Uk100 hit a new record high.

- The Japan225 is down for the second week in a row.

- The Bra50 is down almost 4%, as Trump is set to implement a 50% tariff on Brazilian imports to the U.S.

- The Ger40 is up 2.35% and reached a new all-time high.

Shares

Tops

- BRF SA: +16.93%

- Delta Air Lines: +12.44%

- Moderna: +12.25%

- United Airlines: +12.18%

- PTC: +11.93%

- Tapestry: +11.68%

- Coinbase Global: + 11.02%

- Southwest Airlines: +9.85%

- Valero Energy: +9.34%

- The AES Corporation: +9.24%

Flops

- WPP: -18.32%

- Fair Isaac: -13.19%

- Magazine Luiza: -10.23%

- Engie Brazil: -9.17%

This Week’s News to Follow

Monday 14 July

- 03:00 AM - Chinese Balance of Trade (June)

- Previous: $103.22B

- Forecast: $ 100B

- 03:00 AM - Chinese Exports YoY (June)

- Previous: 4.8%

- Forecast: 5.5%

- 03:00 AM - Chinese Imports YoY (June)

- Previous: -3.4%

- Forecast: 2.5%

Tuesday 15 July

- 12:30 AM - Australian Westpac Consumer Confidence Change (July)

- Previous: 0.5%

- Forecast: 0.4%

- 02:00 AM - Chinese GDP Growth Rate YoY (Q2)

- Previous: 5.4%

- Forecast: 5.2%

- 02:00 AM - Chinese Industrial Production YoY (June)

- Previous: 5.8%

- Forecast: 5.6%

- 02:00 AM - Chinese Retail Sales YoY (June)

- Previous: 6.4%

- Forecast: 6.1%

- 09:00 AM - German ZEW Economic Sentiment Index (July)

- Previous: 47.5

- Forecast: 45.1

- 12:30 PM - Canadian Inflation Rate YoY (June)

- Previous: 1.7%

- Forecast: 1.5%

- 12:30 PM - American Core Inflation Rate YoY (June)

- Previous: 2.8%

- Forecast: 2.9%

- 12:30 PM - American Inflation Rate YoY (June)

- Previous: 2.4%

- Forecast: 2.5%

Wednesday 16 July

- 06:00 AM - UK Inflation Rate YoY (June)

- Previous: 3.4%

- Forecast: 3.7%

- 12:30 PM - American PPI MoM (June)

- Previous: 0.1%

- Forecast: 0.3%

- 11:50 PM - Japanese Balance of Trade (June)

- Previous: ¥-637.6B

- Forecast: ¥ -100B

Thursday 17 July

- 06:00 AM - UK Unemployment Rate (May)

- Previous: 4.6%

- Forecast: 4.6%

- 12:30 PM - American Retail Sales MoM (June)

- Previous: -0.9%

- Forecast: 0%

- 11:30 PM - Japanese Inflation Rate YoY (June)

- Previous: 3.5%

- Forecast: 3.5%

Friday 18 July

- 12:30 PM - American Building Permits Prel (June)

- Previous: 1.394M

- Forecast: 1.37M

- 12:30 PM - American Housing Starts (June)

- Previous: 1.256M

- Forecast: 1.30M

- 02:00 PM - American Michigan Consumer Sentiment Prel (July)

- Previous: 60.7

- Forecast: 61.5

Major Earnings Reports to Watch

Tuesday 15 July

- Bank of New York Mellon

- JPMORGAN CHASE

- Wells Fargo

- Citigroup

- Ericsson

- Blackrock

Wednesday 16 July

- Alcoa

- JOHNSON&JOHNSON

- GOLDMAN SACHS

- Bank of America

- ASML

- Morgan Stanley

- United Airlines

Thursday 17 July

- Pepsico

- Novartis

- Abbott Lab

- TSM

- NETFLIX

- GENERAL ELECTRIC

Friday 18 July

- 3M

- AMERICAN EXPRESS

Source: Trading Economics, TradingView, Yahoo Finance, and ActivTrades’ Data as of July 11 2025

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.