The UK’s benchmark equity index is flat on the year and the media is full of headlines about UK-listed companies considering moving those listings to the US.

Trading Economics

The chart above shows how far ahead, of the FTSE 100., US markets are.

In this case, we've plotted the FTSE, or UK 100, in green against the S&P 500 drawn in blue.

So are UK equity markets are write off?

The answer to that is no!

Whilst we can’t deny that the FTSE is well off the pace compared to gains in other global equity indices over the year to date that’s not the whole story.

Let’s not forget that the FTSE 100 was one of 2022’s top-performing indices and that much of the upside seen in US equities this year has been driven by just 7 mega-cap stocks rather than a broad-based rally. In fact, well over 190 S&P 500 stocks are still down over the year to date, as of the time of writing.

Looking under the hood

What this tells us is that we need to look below the hood and not just focus on the headlines and sound bytes, when it comes to working out what's really going on in the markets.

Let’s turn our attention back to the UK markets, and do some digging.

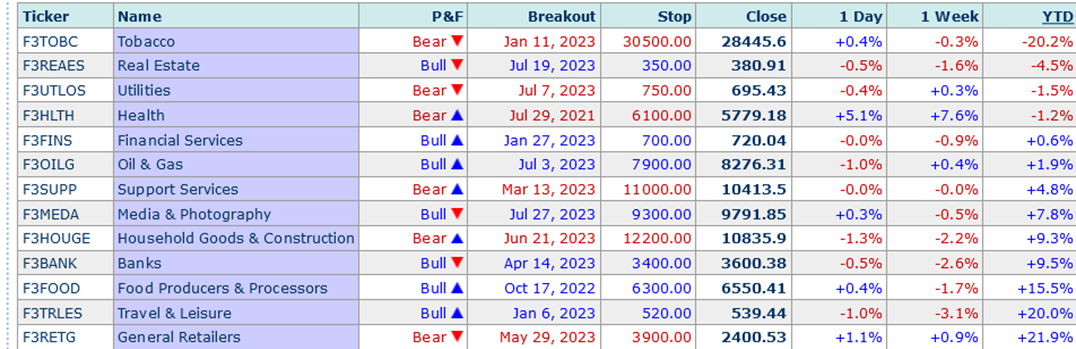

The table below shows the FTSE 350 sectors and their performance during 2023. I have ranked the table by YTD percentage change from lowest to highest.

What we can see straight away is that just four sectors are in the red over the last 8 months, the major loser being the Tobacco stocks.

Investors Intelligence

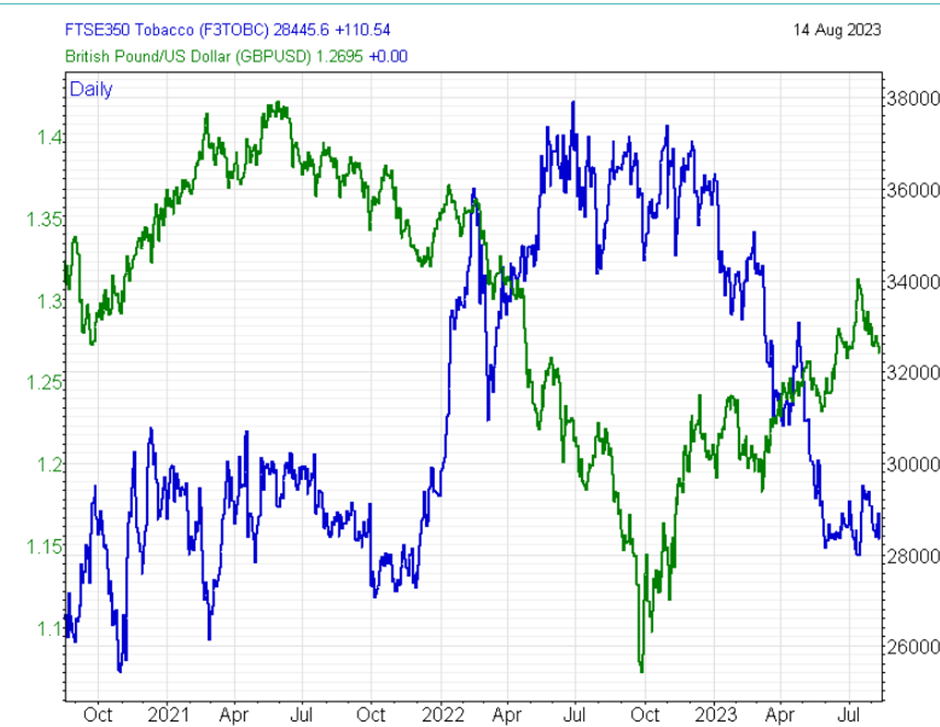

In this chart, we can see the dramatic divergence between the Tobacco sector and the FTSE 100 that has happened since April this year.

Investors Intelligence

Some of that weakness can probably be attributed to a stronger GBPUSD rate and we can see the performance of the FX pair compared to the Tobacco sector in the chart below.

Investors Intelligence

It's possible that the Tobaccos have now bottomed and could rally on future sterling weakness, but that’s another story.

Turning back to our sector performance table above one of the big winners year to date has been Travel and Leisure which is up 20.0% year to date.

Should that surprise us?

Perhaps that shouldn’t be so surprising as UK consumer spending in this sector refuses to lay down despite Bank of England interest rate rises, indeed the demand for travel and leisure is one of the reasons that inflation in the UK has remained stubbornly high.

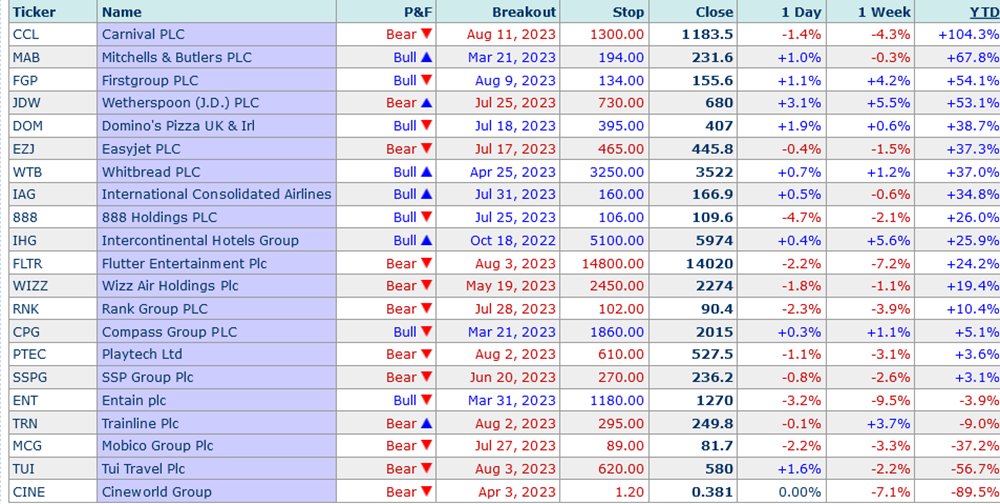

Not that the FTSE 350 Travel and Leisure sector has a completely domestic focus as we can see from the table below there are several internationally oriented stocks in the sector. Including Carnival, IAG, Whizz Air and Intercontinental Hotels.

Investors Intelligence

What stands out straight away is that the majority of stocks in the sector are up on the year and many of them by a decent margin.

Carnival, which of course is listed in both London and New York has achieved triple-digit gains, but there have also been impressive performances from UK-focused names in the sector, such as pub operators Mitchells and Butler and JD Wetherspoon.

Those gains might seem counter-intuitive given the ongoing problems faced by the UK hospitality industry right now, but the market is likely focusing on efforts to cut costs and rightsize pub portfolios.

Retail is detail

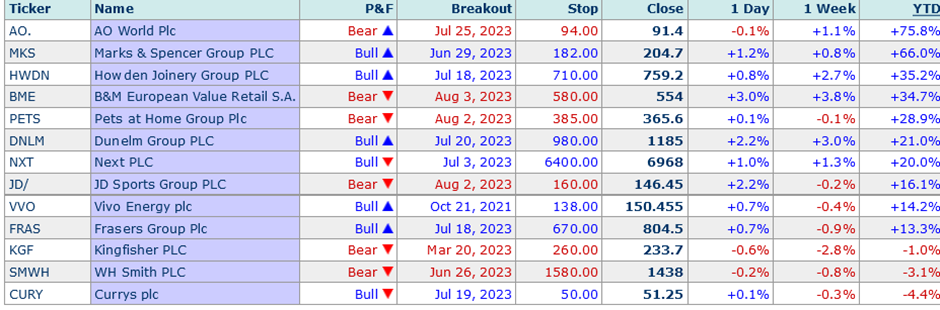

We find a similar story if we look at the FTSE 350 General Retail sector thjis sector does have a domestic focus. All but three of the stocks within the sector are up year to date and those that are have posted double-digit gains.

Investors Intelligence

What does all this tell us?

I said at the outset, that I thought 2023 was going to be a year for stock pickers rather than taking a broad brush to equity trading, as we saw in 2020, 2021 and 2022.

And I think we can say that has been the case. True some of that messaging has been lost in the US, where the outperformance of the mega-cap stocks has dragged equity indices and the ETFs that track them higher by default.

There’s an old market adage that says “A rising tide lifts all ships” and there has definitely been a degree of that in the US markets.

UK equity indices have looked rather, pedestrian in 2023, compared to both those across the Channel and the Atlantic.

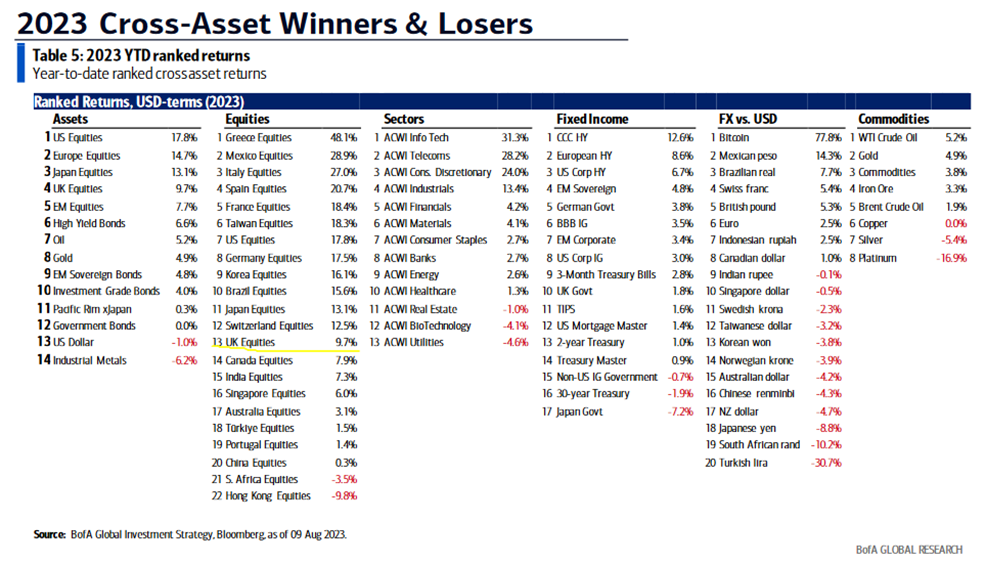

However, as this table of 2023 dollar-based returns, from Bank of America, shows UK equities have delivered +9.7% to dollar-based investors which puts them well above peers such as Canada and Australia.

That 9.70% is just over half of the returns delivered by US equities, which stand at 17.8% year to date. And is good enough to push the UK into 4th place on the list of asset classes on the left-hand side of the table.

None of this is to say that the UK equity markets and their participants don't have some cultural and structural issues that need addressing, because they do.

However, it does serve to show that things are rarely as bleak as they are painted and that as traders we shouldn’t take headlines at face value, but rather we should dig into a story to find out what's really going on because that’s where trading opportunities live.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.