We might be seeing the start of a new phase in the markets, one in which we can contemplate a world where inflation and interest rates stop rising.

That’s not guaranteed of course, and geopolitical risks mean that we can't take anything for granted.

After all, two major conflicts are happening right now and I am sure we all remember how external shocks, or if you prefer, rising energy prices, knocked European economies for six in the wake of Russia’s invasion of Ukraine. And an escalation of the conflict in Gaza could have similar consequences.

Markets look relatively unconcerned about that prospect

For now, at least that doesn't seem to be happening and with more Western politicians calling for a ceasefire and negotiations, hopefully, it won’t.

Markets seem happy to take that view, at least judging by the reaction of the oil price, which is typically a good gauge of geo-political tensions in the Middle East.

Source: Trading Economics

The next round of trading opportunities

If we have seen the peak in inflation and interest rates in this economic cycle, then it’s probably time to start thinking about where the next round of trading opportunities might be found.

We got some inkling into that from recent moves in both the bond equity markets over the last couple of weeks, as the market began to explore the upside once more.

The S&P 500 put a 7-day winning streak together and US government bonds which had been under pressure since early May started to poke their heads above the downtrend lines on their charts.

True, Fed chair Jay Powell poured cold water on some of those aspirations in the second of his speeches this week, but he hasn't extinguished the spark of a rally entirely.

Sharp rallies

US investment bank Goldman Sachs commented on recent moves in bond and equity markets saying that the market's name was “Bond - licensed to rally” adding that the recent moves in both bond and equity markets were some of the sharpest they had seen in the last 20 years.

The US bank also quantified the performance of a range of asset classes during the first week of November and found that high-yield corporate bonds and large-cap equities were the best performers, in both the US and Europe (including the UK).

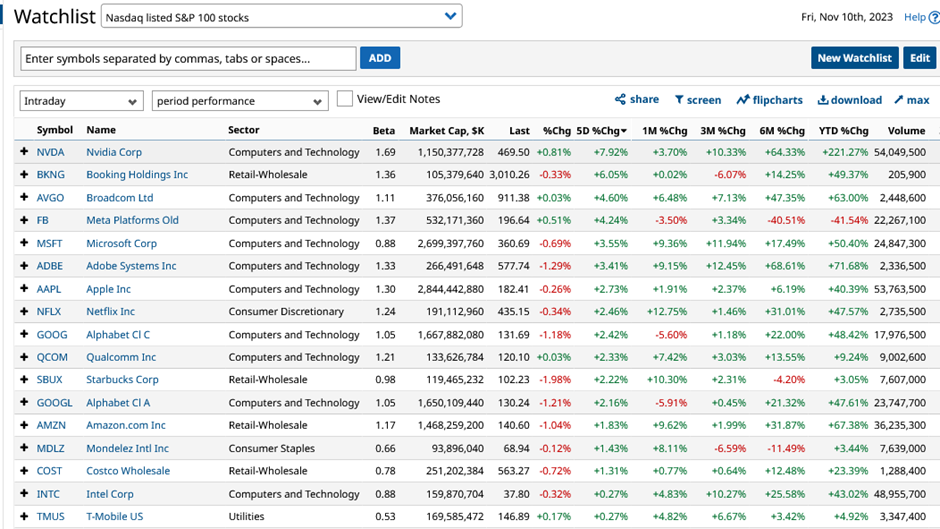

To my mind, high-yield bonds are synonymous with growth companies, so it's no surprise to see large-cap stocks in the Nasdaq 100 that are also S&P constituents posting some decent gains over the last week and the last month.

Source: Barchart.com

These gains haven’t been uniform or made across the board, and we wouldn’t expect them to be. After all 2023 has been a year for stock pickers rather than than one for buying the market as a whole, and we are just coming out of Q3 earnings season.

The data from which tends to impact the performance of individual companies, rather than sectors and indices.

Casting our net wider

Impressive as some of those gains are, they have been made in the stock prices of established companies, many of which one could argue don’t fit the “growth“ label anymore.

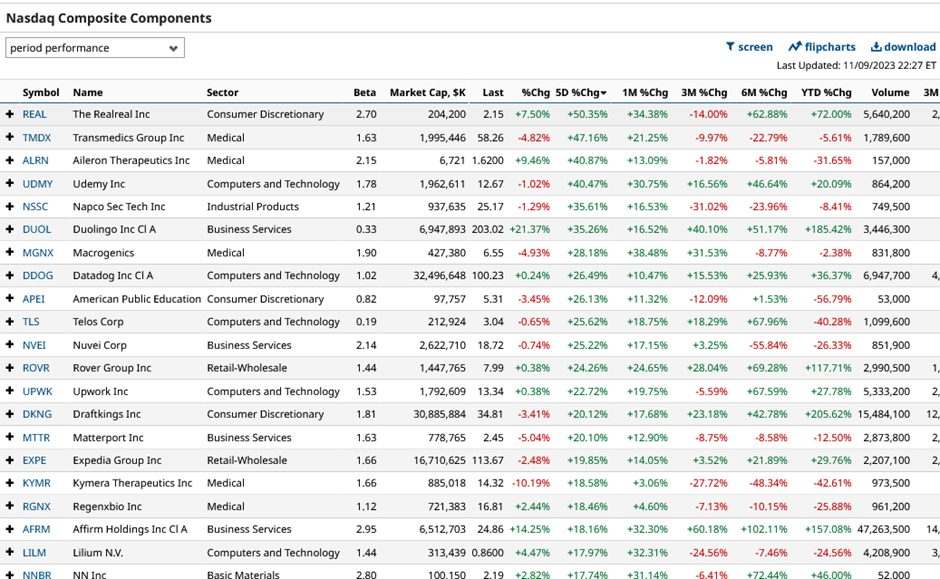

So perhaps we should look at a wider cross-section of growth and technology companies for inspiration. Such as the members of the Nasdaq Composite index.

Some of which can be seen below.

The table is ranked by 5-day % change, descending, and pretty impressive reading it makes too, with 15 stocks posting 5-day gains of +20.0% or more over the last week. As investors warmed to the idea of lower interest rates.

Source: Barchart.com

Tech and growth companies have been some of the hardest-hit stocks in the rising interest rate environment. There are several examples in the table above of stocks that have been beaten up over the year to date, or the last 6 months, which have now started to recover.

Closer to home

Of course, opportunities can be found in other places as well. For example, UK broker Shore Capital put out a strategy note this week, which highlighted the attraction of FTSE 100 and FTSE 250 stocks, which it believes are undervalued and vulnerable to bids from both overseas corporates and private equity buyers.

To back up its assertions the broker lists the number of transactions involving UK companies as targets made during 2023 to date.

There have been no less than 43 deals in 2023 with a combined value of £16.60 billion.

And the vast majority of those target companies were bought for cash.

Over the last six years the UK sectors that have seen the highest value deals have been, Other Financials, Food and Beverages, Electronics Equipment and Mining and Minerals.

Whilst the largest bid premiums were seen in deals made in the Aviation, Defence, Housing and Construction, Digital Services and Life Science sectors.

The market needs time to be comfortable again with the idea of lower rates and lower inflation.

However, if it can do that, particularly if macroeconomic data supports that assertion, then there is genuine scope for a rally into the year-end, or worst case a positive start to 2024 for equity markets.

That’s if all the UK stocks haven’t been taken over by then of course.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.