What worked and Why in 2025

2025 should have been a good year for traders by and large. After all we’ve had periods of volatility and period of trending markets, over the last 12 months.

In fact you could argue that there has been “something for everyone” .

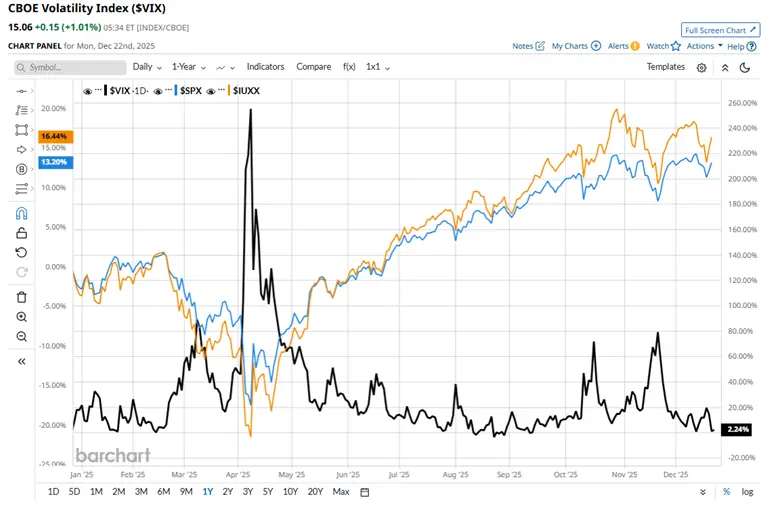

CBOE VIX index vs The S&P 500 and Nasdaq 100 Indices

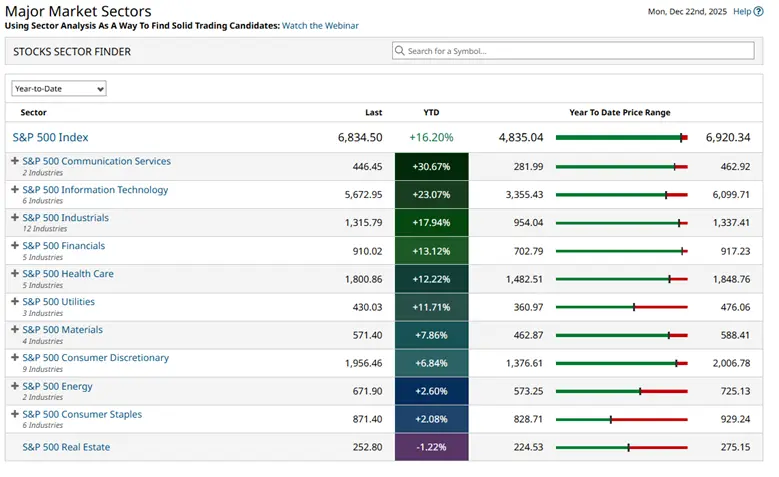

Looking at the US, all but one S&P 500 sector is in the green, over 2025, and that probably wouldn’t have been your expectation back in March/April. When President Trump’s tariff turmoil was at its peak.

US sector performance year to date (22-12-2025)

Source: Barchart.com

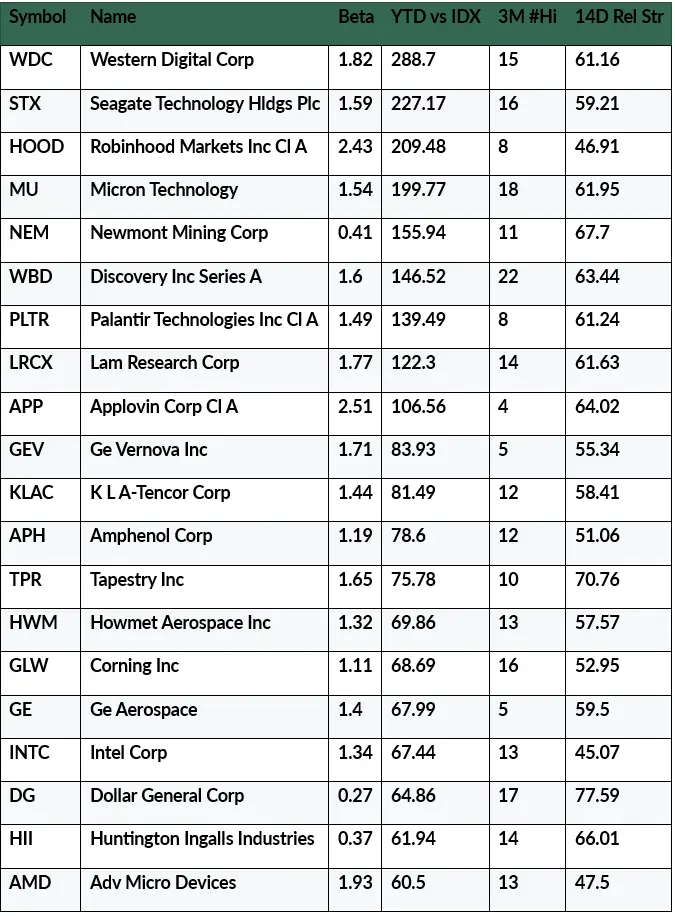

Stock pickers market

My sense is that it has been a stock pickers market this year.

Some 160 stocks have beaten the S&P 500 index, based on their year to date performance as of 22-12-2025

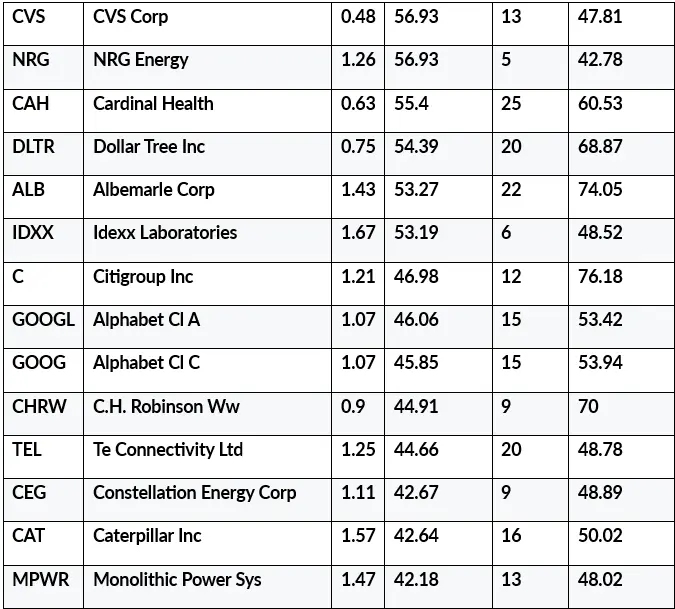

Below are those Stocks that outperformed the index YTD by +42.00% or more.

They are ranked by that outperformance, in the column YTD vs IDX.

Stocks that outperformed the S&P 500 index by +42.00% or more YTD

Source: Darren Sinden/ Barchart.com

Here are some of the stock picks and ideas that have worked out for me, over 2025, each with a brief look at what was behind the ideas and price moves.

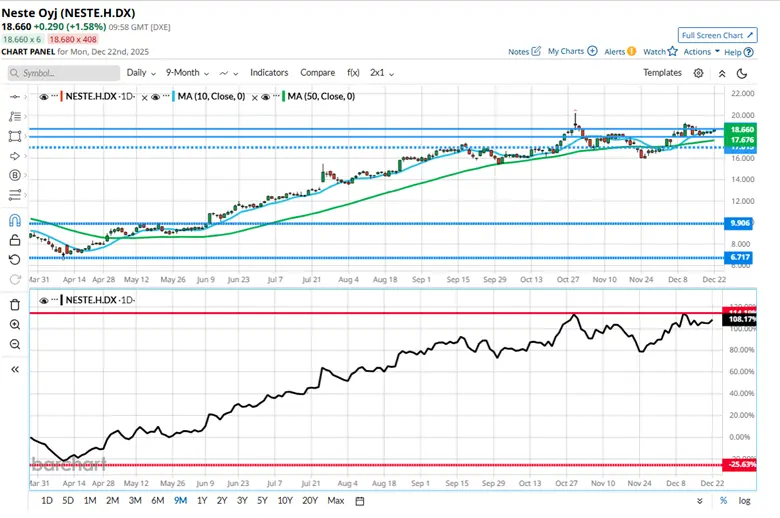

Trend following

Neste Oyj is a Finnish oil company that has been rising in price since April. It stood out, as it was going up in value, when oil prices weren’t.

And it continued to outperform US and European sector peers, as the year went on.

If we look at the percentage change chart in the lower window below, we can see that it added approximately +140.0% in that time frame, without any significant pull backs in the share price.

The phrase “the trend is your friend” could have been drafted with this stock in mind.

Summary: An outlier which caught my eye, and then continued to outperform.

Source: Barchart.com

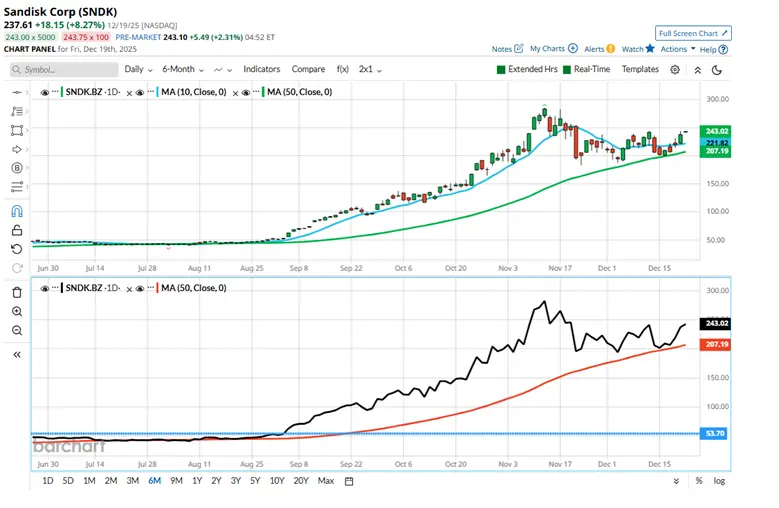

Local Knowledge

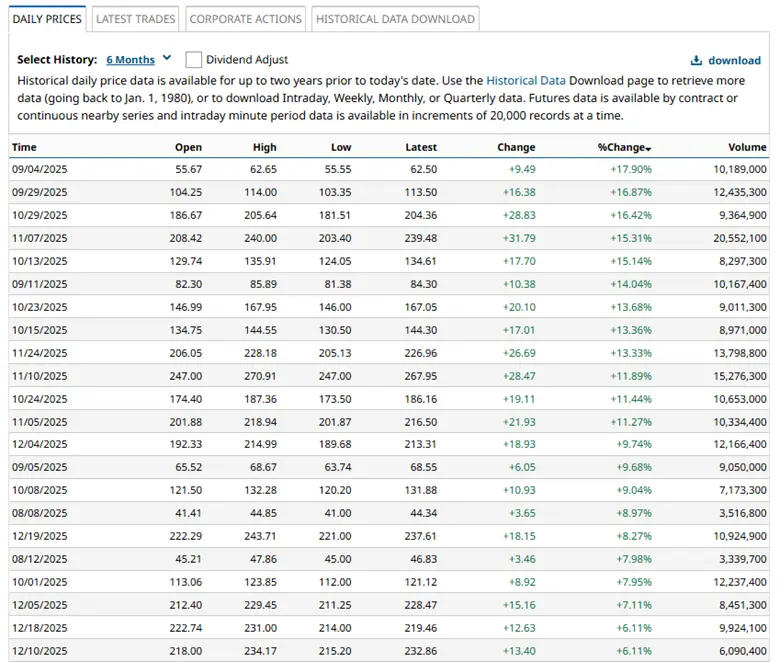

Sandisk SNDK US, which is a memory chip maker, has “ exploded” this year, since it was spun out of its former parent Western Digital. In the spring. At one point Sandisk stock was up by +687.0%.

Sandisk has been one I‘ve followed for almost a quarter of century, so I had some local knowledge about the name, and it went straight onto my alerts list once it was trading in its own right again.

Sandisk produced a dozen price alerts between June and November, and has posted 43 new highs over the last 6-months.

Source: Barchart.com

You can get a sense of the momentum within, and the demand for Sandisk, in the table below.

Standout momentum SNDK US biggest daily moves over 6-months descending.

Source: Barchart.com

Summary: Knowledge about the stock gave me an insight as to what could happen here - it became a momentum monster - driven by FOMO around the memory chip sector - because high-end memory is a key component in AI chipsets, and it is in short supply.

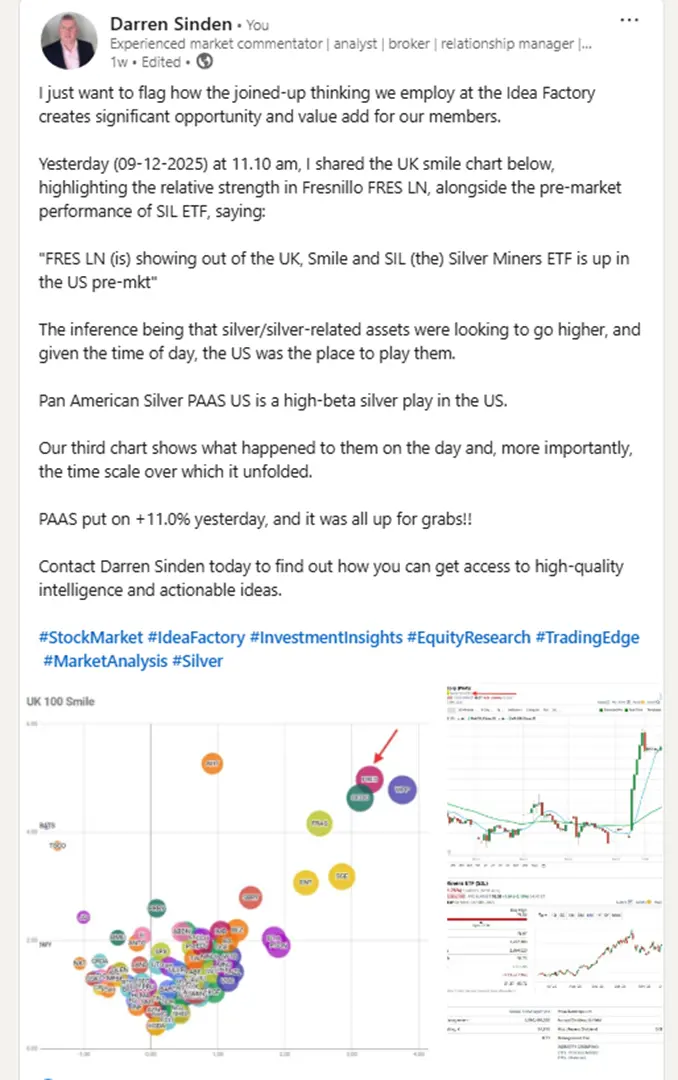

Joining the dots for a silver lining

Pan American Silver PAAS US was an example of joining the dots to create a trade idea.

I set out how this came about in recent LinkedIn post -see below.

Source: Darren Sinden -LinkedIn

Once again the concept of high beta comes to the fore - it’s no surprise, or coincidence that some of the best returns are generated in the most “sensitive stocks”.

High beta stocks can often move earlier, faster, and further than their low beta cousins.

Of course, that cuts both ways, but if you are directionally correct then your PnL should benefit.

Summary: High beta silver stock that hadn't moved pre-market despite moves higher in European silver miners and US silver ETFs that morning.

Topdown view

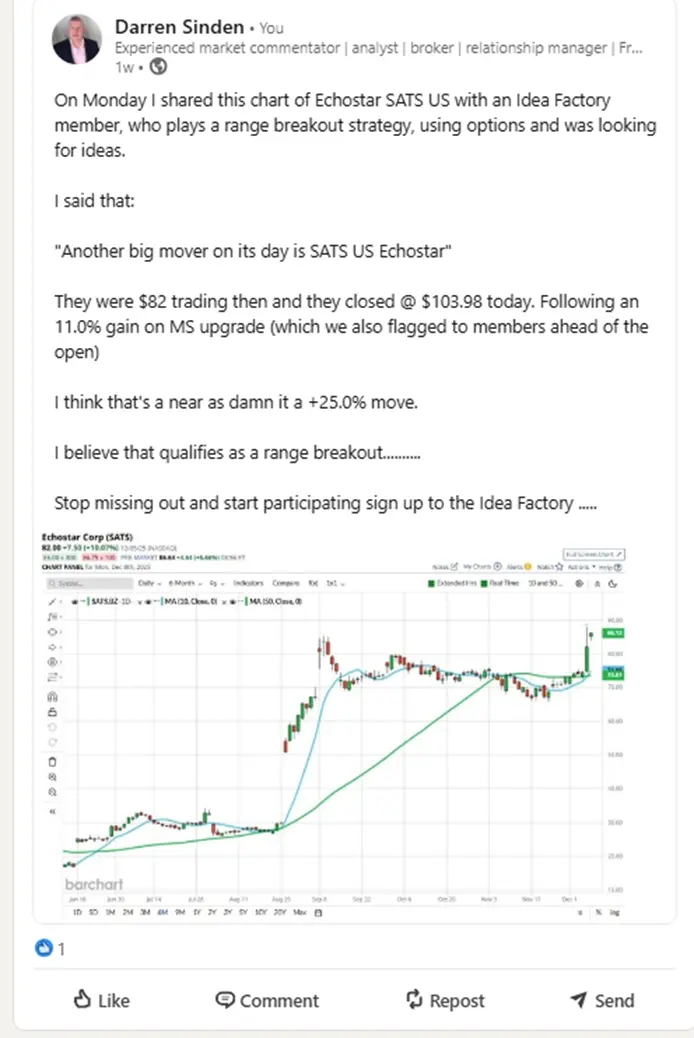

Once again I am referring back to a LinkedIn post to describe the trade idea/ opportunity in US satellite stock Echostar SATS US .

The firm owns a chunk of wireless telephone spectrum, a commodity that’s suddenly in demand.

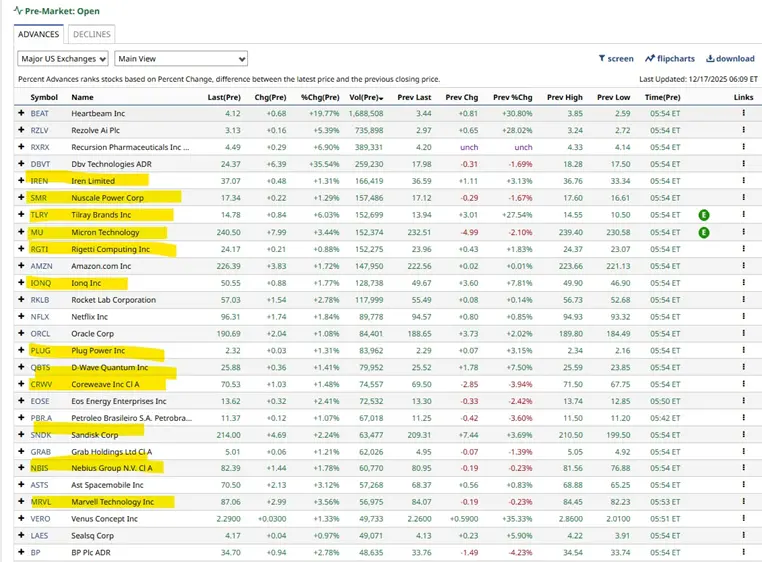

SATS is the kind of stock that appears in my pre-market movers with potential list.

That’s a list of stocks that are moving pre=market in the US, but which have the potential to make an even bigger mover in the regular session(see below).

Decent pre-market volume, and a track record of volatility are two of the factors I look out for, when I highlight these names, and distribute the list, and if there is news flow in a name, then so much the better.

A pre-market movers with potential list

Source: Barchart.com

Here’s how that kind of analysis turns into a trading opportunity.

Source: Darren Sinden -LinkedIn

I could have found lots more examples of my ideas that have played out well in 2025.

However,its not an exercise in me showing off - instead the idea is to get you thinking about how you can factor this type of analysis, into your idea generation.

You are most welcome to copy me. but it's probably better if you come up with your own ideas and strategies too.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.