The US debt ceiling is a legislative limit on how much money the US federal government can borrow to pay for its obligations, those obligations include social security benefits, military salaries, and interest on the national debt.

The current debt ceiling is $31.4 trillion and was set by Congress on December 16, 2021.

The debt ceiling does not authorise new spending rather it allows the government to pay for spending that Congress has already approved.

However, if the debt ceiling is not raised or is suspended by Congress, then the Department of the Treasury will run out of money and potentially be unable to pay its bills on time.

A default is highly unlikely but not impossible

That could result in a default, which means the government would fail to meet its legal obligations to its creditors and other beneficiaries.

In the past when the US has reached the debt ceiling government departments have temporarily closed down, and some wages and benefits have gone unpaid.

An outright default would have serious and lasting consequences for the US economy and the financial system. Treasury Secretary Janet Yellen has said that a full-blown default would cause "irreparable harm" to the US economy and "global financial stability".

A default would damage the market's view of America's creditworthiness and its reputation as a reliable borrower, which would lead to higher interest rates and lower confidence in the dollar.

Moreover, a default could trigger a US recession, job losses, and disruptions to essential government services. That's not a situation that either party in Washington DC, should want to see.

The US has never defaulted on its debt, and it is unlikely to risk doing so now though we can't completely rule it out.

Political capital or monetary loss

The debt ceiling shouldn’t be a tool that’s used for political leverage/

However, the temptation for lawmakers to play hardball and get the chance to show the opposition in a poor light, as we approach a Presidential election in 2024, may be too hard to resist.

Donald Trump, who may run for office next year, has called for Republicans to allow the country to default to put a stop to what he sees as Democrat mismanagement of the country and the economy.

Meanwhile, the Democrats are trying to introduce a discharge petition legislation which circumvents the usual procedure for introducing new laws, with its various reviews and committee stages, and instead allows representatives to vote directly on a bill, and pass it into law.

This a very unusual move on the part of Democratic legislators however with the June 1st deadline fast approaching, some believe this is the only way that gridlocked talks between the two parties can be bypassed. The Democrats have a majority of votes in the US Congress.

What does the log jam in Washington meant for the markets?

Equity markets have largely taken the events in Washington DC in their stride reasoning that politicians will come to their senses ahead of the deadline and allow the debt ceiling to be raised, if only temporarily to allow negotiations over a longer-term solution to continue.

For its part, the US dollar has strengthened in the last month, with Dollar Index gaining 1.15% in that time frame.

Not a vote of confidence

However, the move higher in the dollar may not be a vote of confidence instead, it may reflect something more troubling namely the sharp rise in the yields on US 3- month bills.

Trading Economics

These short-term bonds reflect the cost of near-term US government borrowing.

Yields on one-month US bills have shot up even further than their 3-month cousins and currently yield 5.59 %.

Well above the Fed Funds rate (the US base rate) of 5.0 to 5.25%.

What’s at stake

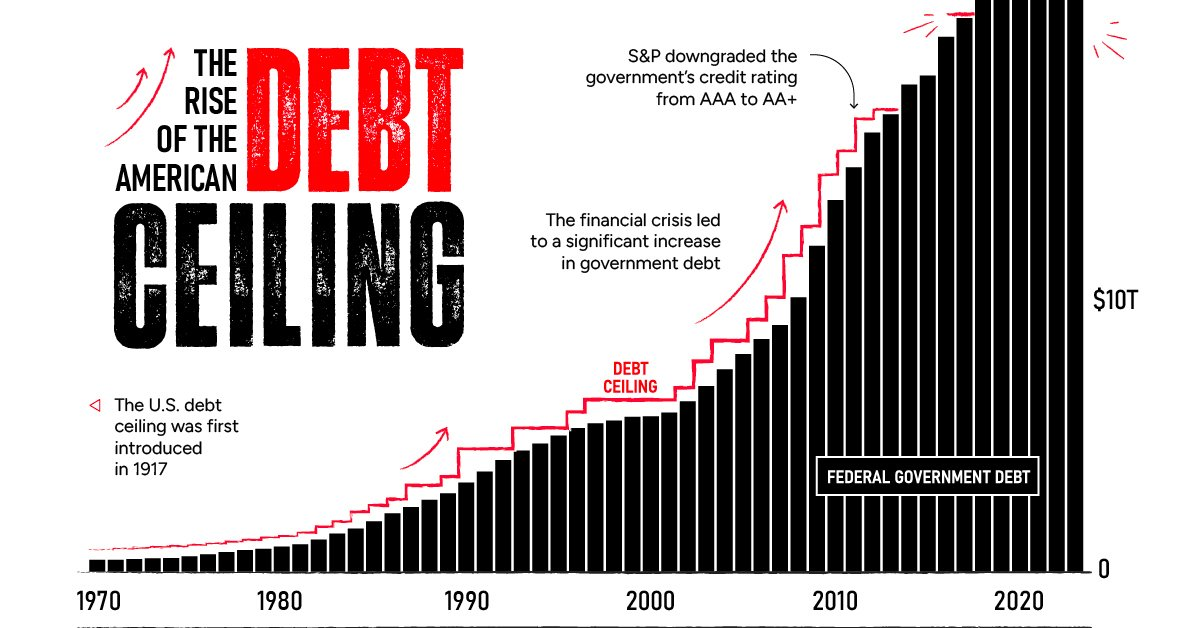

The graphic below from the Visual Capitalist blog shows just what's at stake and the parabolic growth of the US government debt.

Whilst the US government can service the interest on the debt it's not an issue.

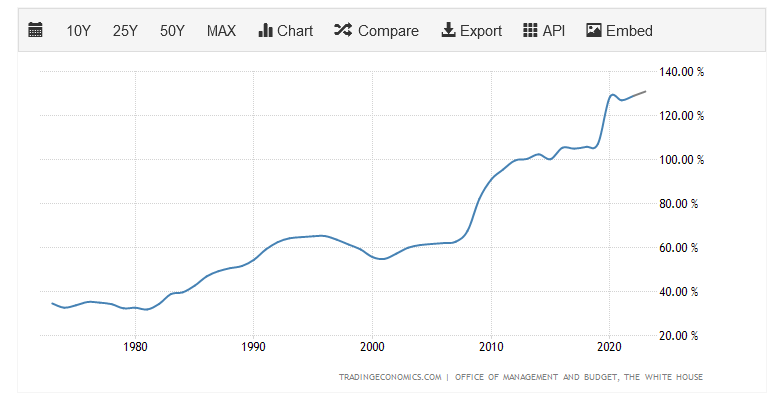

However, the fact that the debt now represents 129% of the country’s GDP and growing might soon start to make the bond markets (which finance US borrowing) feel jittery and less inclined to lend, or at least demand a much higher reward for doing so.

And at that point, the debt mountain could become a very big problem indeed.

US Govt debt as a percentage of US GDP

Trading Economics

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.