Position sizing is a key concept in trading discipline and risk management. We’ll be looking at the different position sizing trading models, such as fixed fractional and the Kelly Criterion. See how you can trade using these strategies as a way of managing risk.

What Is Position Sizing in Trading?

Position sizing is the process of working out how many units of the asset you’re going to trade. It can be calculated in terms of the number of shares, lots, or contracts that you buy or sell on a trade.

The purpose of position sizing in trading is to limit risk and preserve capital while maximising the potential return. By working out a strategy that includes sensible position sizing, you can take the emotional aspect out of trading by always making the size of trade that fits your profile and risk appetite.

Position Sizing Strategies – Key Methods Traders Should Know

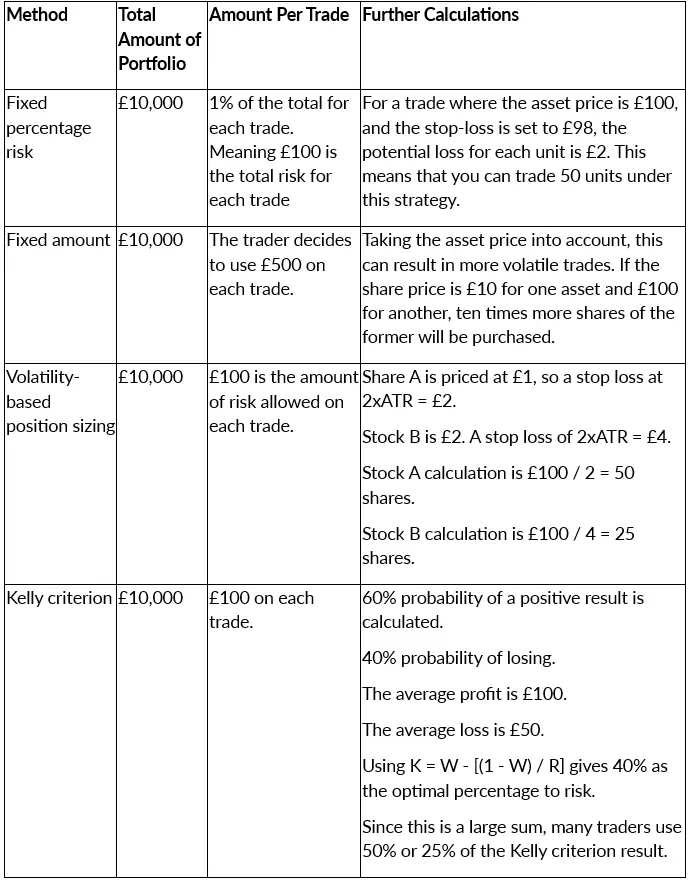

There are several options when it comes to the type of position sizing strategy you might want to use. The following are the main methods:

Fixed Fractional Position Sizing

Known as the fixed percentage method, this is a strategy in which you always use the same percentage of your trading capital. You do this by first calculating how much of your capital you’re happy to risk in each trade, with traders commonly setting this figure from 1 - 2%.

The next step is to work out the amount of potential loss on the trade. This is calculated by taking the stop-loss level away from the entry price. Now divide the amount you’re comfortable risking on each trade by the risk per unit. This tells you how many units to buy or sell.

Kelly Criterion Position Sizing

This position sizing strategy is also known as the Kelly formula. It’s designed to maximise your portfolio’s growth while keeping the risk under control.

You start by choosing a position sizing for each trade. While this is a percentage of your capital, it differs from other strategies by taking the probability of a positive result into account. It can be made less volatile by using a fraction of the figure calculated.

The trader calculates a figure based on their number of trades and how many of them have had a positive result. By seeing how large the profits or losses have been, an optimal position size for future trades is calculated.

The formula K = W - [(1 - W) / R] is used. K is the optimal bet size you're calculating. W is the win probability and R is the win/loss ratio. R is the win/loss ratio identified.

Other Common Position Sizing Models

Several other position-sizing strategies can be used to achieve the risk level you’re looking for.

- A fixed dollar or fixed capital strategy is the simplest to operate, as you just allocate the same amount to each trade. However, it may quickly become less proportional to your overall account size, meaning that the risk level would vary.

- An equal weighting strategy sees you allocate the same percentage to all your positions. It’s simple to operate, but it doesn’t take into account the risk level or volatility of each asset.

- Volatility-based position sizing using the average true range (ATR) as an indicator. An amount is then calculated for each position, based on the volatility of the asset. Less volatile assets get bigger positions.

The fixed percentage method of position sizing is widely regarded as the most robust approach. Yet, the fact that there are various other strategies to choose from means that everyone can choose the method that they feel most comfortable with.

Examples of How Position Sizing Works in Trading

Looking at a few examples helps us to more clearly see where the different types of position sizing can be used in a number of situations.

Position Sizing Calculator for Stocks, Forex and CFDs

A position sizing calculator is a risk management tool that quickly and accurately works out the amount to be traded. This is a simple tool that should be used before every trade.

Using a position sizing calculator for stocks and other assets allows you to make standardised sizing decisions for any type of asset.

How Position Sizing Supports Trading Risk Management

The role of position sizing in risk management is crucial. It’s one of the most important element of managing risk when trading, as it allows you to set the amount of each trade effectively and without emotional decisions.

By choosing the right kind of position sizing risk management trading strategy, you manage exposure, volatility and downside risk. Capital preservation is the main role of position sizing, as it’s designed to ensure that you avoid huge losses that wipe out your portfolio.

Position Sizing in Forex, Stocks and CFD Trading

The different variables between asset classes mean that position sizing differs. For example, a forex position sizing calculator will be based on the pip value.

You should also take into account the volatility differences. Stock trading often uses no leverage unless margin is specifically enabled; leverage is usually far lower than in forex or CFD trading. Contract sizes vary, with forex trading carried out in fixed lots, while stocks and CFDs are more flexible.

Position Sizing Trading FAQs

Can Position Sizing Strategies be Used with Any Asset?

Yes, the same basic principles can be used. However, differences like leverage and contract sizes need to be taken into account.

How Much Should I Risk in Position Sizing in Trading?

A general rule is to risk about 1% or 2% of your total portfolio in a single trade. Use your own attitude to risk and profile to calculate how much to use on each trade.

Does Position Sizing Remove the Need for Stop-Losses?

No, stop-losses need to be used on each trade to ensure that your position sizing strategy is effective.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.